Mediocre SPAC Returns Shouldn’t Be a Surprise

The latest Wall Street craze puts Sturgeon’s Law to the test.

Bloomberg, October 22, 2020

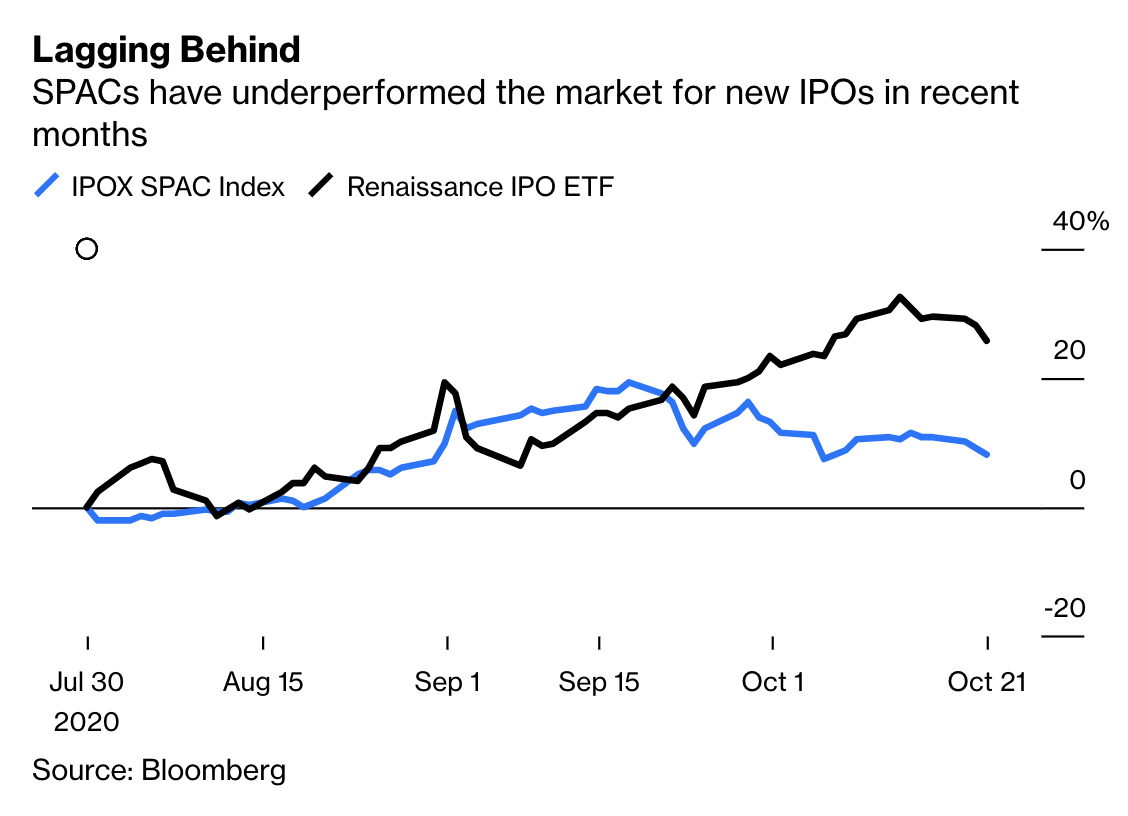

This week’s column is on why most SPACs do poorly. The short answer: most investment products do poorly.

The vast majority of “products” that can be stuck in a portfolio are mostly not worth the cost relative to the performance they provide.1 Main Street investors have come to this realization, as evidenced by money flows since the financial crisis, with cash moving away from expensive, complicated, under-performing products toward inexpensive, simple, market-performing ones.

It used to be difficult to discern how expensive and underperforming most products2 were. Finance was opaque, with full costs usually hidden from view. Information asymmetry, combined with a – mostly – rising stock market, effectively hid this fact from investors until the scandals and crises of the first decade of this century caused many investors to rethink their approach.

The investing world is as much a victim of Sturgeon’s Law as anything else. Dating back to 1953, this maxim was coined by the science fiction writer Theodore Sturgeon, who, in response to a critique of his genre made the insightful observation that “90 percent of everything is crap.” The simple reality is that most human attempts at creation fail, many quite spectacularly.3 This not as a curmudgeonly observation, but rather, the joyful celebration of how rare true success is.

~~~

I originally published this at Bloomberg, October 22, 2020. All of my Bloomberg columns can be found here and here.