My morning train WFH reads:

• Will Markets Defy Gravity in 2021? 10 charts examining if 2020’s trends will be your 2021 friend Financial assets, from stocks to bonds to Bitcoin, have responded by rallying to record highs. Hopes that vaccinations can replace lockdowns as the best defense against the coronavirus are feeding expectations that the trend — mostly — is likely to continue in 2021. (Bloomberg)

• The 5 Phases of a Bubble Bubbles should be viewed through the lens of every asset bubble in history, because human nature is the constant. The problem for investors is you never know how long each phase lasts in real-time. There is no iPhone alert to let you know when the period of euphoria is coming to an end. (A Wealth of Common Sense) but see also There Is No Stock Market Bubble Are stock markets, especially the US market, in a bubble that is sure to pop? The answer depends on prospects for corporate earnings and interest rates. Provided the former are strong and the latter ultra-low, stock prices look reasonable. (Financial Times)

• Guggenheim’s Scott Minerd Says Bitcoin Should Be Worth $400,000 Makes you wonder if he is long. Bitcoin’s scarcity combined with “rampant money printing” by the Federal Reserve mean the digital token should eventually climb to about $400,000, according to MinerdBitcoin breached $20,000 for the first time, bringing its 2020 gain to 190%. (Bloomberg)

• Supercharging Your Financial Bullshit Detector financial success depends on knowing what to include as well as what to exclude; being able to separate good advice from bad advice; telling the truth from the bullshit. A good bullshit detector can go a long way in making better financial decisions. (Incognito Money Scribe)

• Keeping tax low for the rich does not boost economy Our research shows that the economic case for keeping taxes on the rich low is weak. Based on data from 18 OECD countries over the last five decades, we estimate the causal effect of major tax cuts for the rich on income inequality, economic growth, and unemployment. We find that major reforms reducing taxes on the rich lead to higher income inequality as measured by the top 1% share of pre-tax national income. In contrast, such reforms do not have any significant effect on economic growth and unemployment. (London School of Economics and Political Science) + (PDF)

• High-Frequency Traders Push Closer to Light Speed With Cutting-Edge Cables Firms aim to gain nanoseconds of advantage over rivals by using hollow-core fiber to convey data (Wall Street Journal)

• Time’s Up on Corporate America’s 2020 Climate Goals. Here’s How They Did Bloomberg Green analyzed 187 different climate pledges meant to be voluntarily fulfilled by 2020 or earlier. 138 of these pledges have already been met their modest goals. But many businesses do not provide data on their progress, and 1,000s of the biggest global companies still don’t publish data on climate risks or targets to reduce them (Bloomberg)

• Amazon-Owned Self-Driving Taxi Zoox Reveals Its Secret Vehicle Long-time stealth startup Zoox, a company founded by a radical Australian designer and a Stanford roboticist finally unveiled their new design that they feel is not merely the car of the future, but the thing that comes after the car. Zoox took on the challenge of designing a vehicle from scratch, aiming at the future of mobility (Forbes)

• COVID-19 and the Failure of Swedish Exceptionalism The Swedish policy of herd immunity, had no lockdowns. Schools, restaurants, night clubs, and non-essential shops have all stayed open. There been no mandates regarding facemasks. Sweden’s death numbers stand in stark negative contrast to our Scandinavian neighbors who introduced lockdown measures: Per capita, 5X as many deaths as Denmark, 9X as many as Finland, and more than 10X as many as Norway. (The Dispatch)

• What’s in the Box? The Role of Box Sets in a Streaming-Music World Once upon a time, the box set was the luxury item of the music-listening experience. It could confer importance, cement legacies, and revitalize careers. But what is a box set when all the world’s a playlist? (The Ringer)

Be sure to check out our Masters in Business interview this weekend with Tom Slater, head of the US equities team at Baillie Gifford, with over $370 billion in assets under management. He serves as a decision-maker on Long Term Global Growth portfolios, and the U.S. Equity Growth Fund which is up +113% year to date. He also co-manages the Scottish Mortgage Investment Trust, which Baillie Gifford has been managing since 1908.

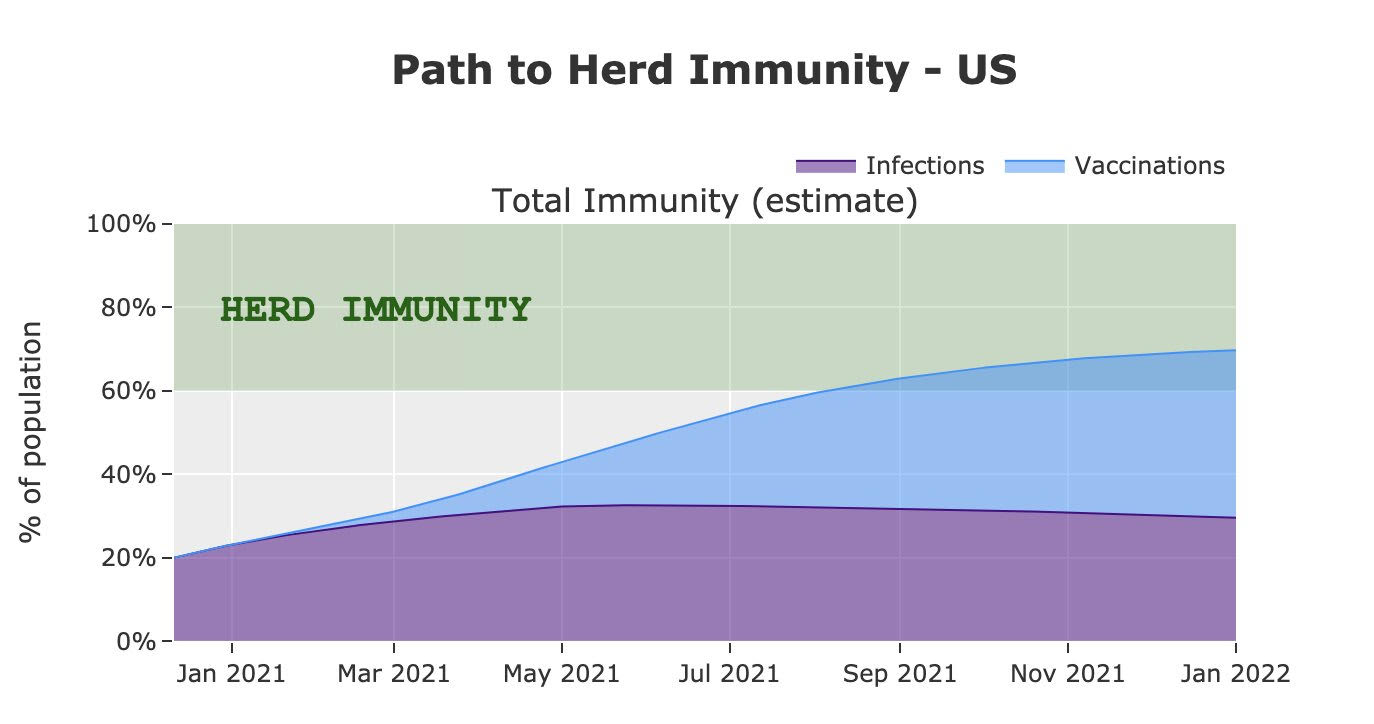

TL;DR version: I estimate a “return to normal” by June/July 2021.

Source: @youyanggu

Sign up for our reads-only mailing list here.