My Two-for-Tuesday morning train WFH reads:

• Investment Advice From Psychologist and Poker Star Maria Konnikova: Poker, much like investing, is a balance between skill and chance, says Maria Konnikova, a writer who has parlayed her doctorate in psychology into a career chronicling human behavior and decision making. The big takeaway: Focus on the decision-making process, rather than dwelling on losses or missed opportunities. (Barron’s) see also My 2020 Investing Lessons You’re never as dumb as you feel during a bear market nor as smart as you feel during a bull market. Unfortunately, sometimes it takes a nasty bear to remind investors of this fact7. (A Wealth of Common Sense)

• The People Who Actually Had a Pretty Great Year It’s not just the filthy rich. Much of America’s professional class has quietly, if a bit guiltily, been doing just fine, despite 2020. (New York Times)

• A Sober Look at SPACs Costs built into the SPAC structure are subtle, opaque, and far higher than has been previously recognized. Although SPACs raise $10 per share from investors in their IPOs, by the time the median SPAC merges with a target, it holds just $6.67 in cash for each outstanding share. (SSRN) see also When Stocks Moon Not a broad-based one, but a significant bubble nonetheless. Where is it? The most obvious pocket is in EV (electric vehicle)-related SPACs (blank check companies that, historically, have had a tendency to acquire third-rate businesses at inflated prices. (Upslope)

• Stockpicking legend Warren Buffett and index champion John Bogle both knew the other was right about investing Active vs. passive is polarized but in fact they each have unique and valuable qualities (Marketwatch)

• Toyota’s game-changing solid-state battery en route for 2021 debut A trip of 500 km on one charge. A recharge from zero to full in 10 minutes. All with minimal safety concerns. The solid-state battery being introduced by Toyota promises to be a game changer not just for electric vehicles but for an entire industry. The technology is a potential cure-all for the drawbacks facing electric vehicles that run on conventional lithium-ion batteries (Nikkei) but see We’re Still Only Halfway to Electric Cars Sales of hybrids are rising, reflecting the reality that interim solutions can often last a long time. (Bloomberg)

• This is The Year Celebrities Lost Their Shine Like most of the learnings gleaned from the pandemic — prevention is better than cure, you probably didn’t wash your hands as thoroughly as you could have — the revelation that inequality is rife and celebrities are dreadful isn’t remotely new. While some celebrities feigned empathy, others showed Dickensian levels of indifference toward the world’s COVID quarantines. (Vice)

• How the Facebook Case Could Revitalize Our Broken Antitrust Law Until now, the government had abandoned some of the most important tools for stopping monopolies. (Slate) see also Why the US government wants Facebook to sell off Instagram and WhatsApp Experts told Recode it’s possible that Facebook will be forced to sell both apps, but not anytime soon. (Recode)

• Bloomberg Businessweek 2020 Jealousy List Swallow your pride and acknowledge a job well done, begrudgingly if need be, by someone else. So, congratulations to those on this year’s list. You managed to make 2020 even worse for us. (Businessweek)

• What’s in the Box? The Role of Box Sets in a Streaming-Music World Once upon a time, the box set was the luxury item of the music-listening experience. It could confer importance, cement legacies, and revitalize careers. But what is a box set when all the world’s a playlist? (The Ringer) see also No, I Am Not Getting Rid of My Thousands of CDs Our chief classical music critic writes in praise of going to a shelf, pulling out a recording and sitting down to listen. (New York Times)

• Jerry Seinfeld Rarely Laughs While He’s Reading “It’s pretty hard to laugh when you’re reading — the written word is tough,” says the comedian and author of “Is This Anything?” But he makes an exception for John Updike: “You know, describing the circles of water under someone’s toes when they get out of the pool. That makes me laugh more than anything, that he would zero in on that.” (New York Times)

Be sure to check out our Masters in Business interview this weekend with Mike Swell, head of Global Fixed Income at Goldman Sachs Asset Management (GSAM). Swell is responsible for co-leading the global team of portfolio managers that oversee more than $700 billion in multi-sector bond portfolios.

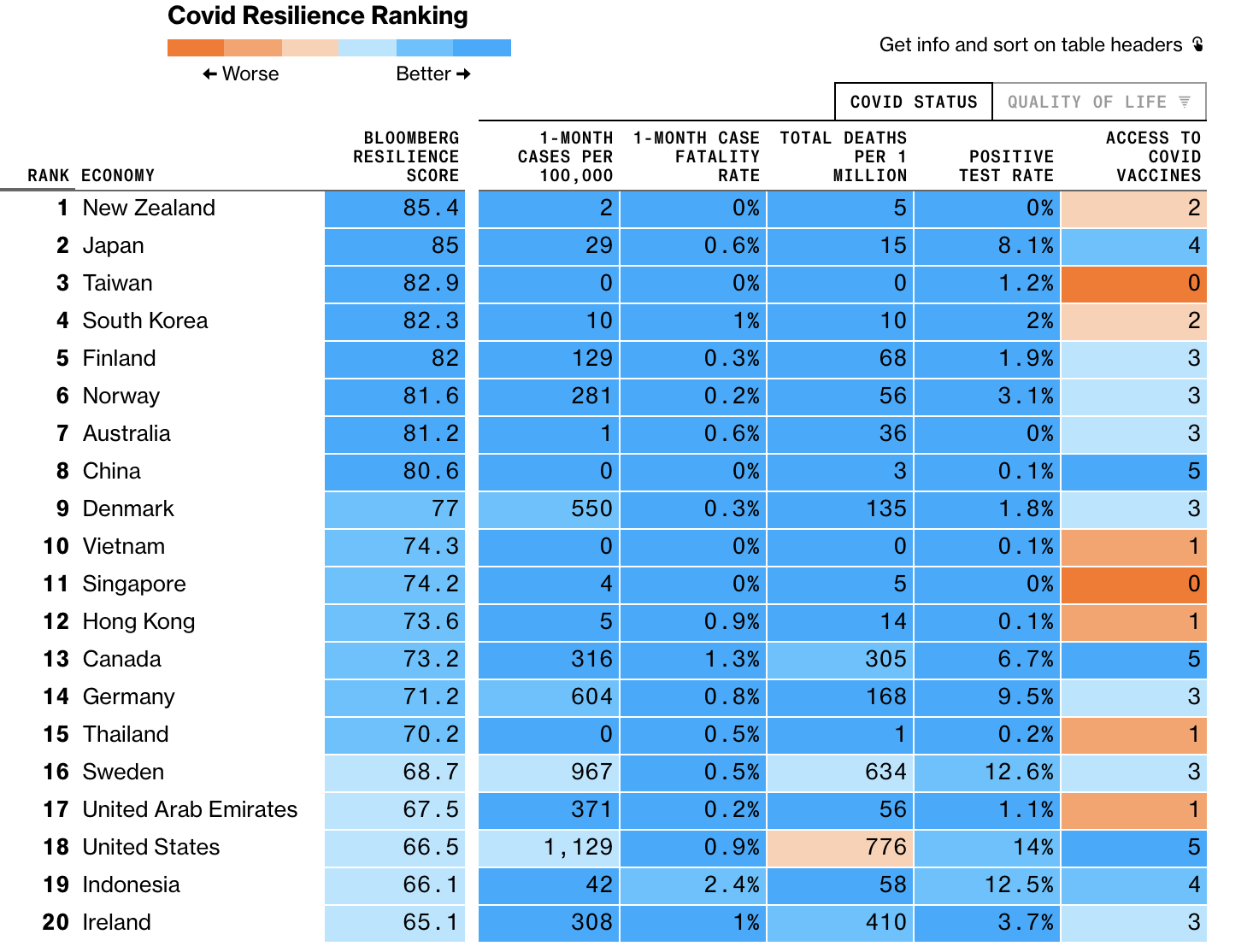

The Best and Worst Places to Be in the Coronavirus Era

Source: Bloomberg