My mid-week morning train WFH reads:

• The 2020s Will be the Decade of Customization For Financial Advisors In the 2020s, customization will be the next step in investing technology. The three biggest trends in this customization boom will be: (1) Direct indexing (2) ESG investing (3) Defined outcome investing (Wealth of Common Sense)

• How London grew into a financial powerhouse London is a hub for trading currencies and interest rate derivatives. Its location allows traders to catch the end of the Asian day and the opening on Wall Street. The good fortune of geography is underpinned by high-quality tech infrastructure. As a result, London accounts for 43% of the turnover in the $6.6tn-a-day foreign exchange market and half of the daily $6.5tn traded in interest rate derivatives. Brexit has not dented the UK capital’s dominance in these markets (Financial Times)

• It’s a Terrible Time for Small Businesses. Except When It’s Not. A counterintuitive silver lining to the pandemic is developing: While droves of small businesses across the United States have been crushed by Covid-19 and its restrictions, others have been pushed to lift off. The U.S. Census Bureau reports that business applications were up 43.3% in 2020 versus 2019. Its unclear if the increase is entrepreneurs finding opportunity in the crisis to form businesses or newly unemployed individuals starting their own firms. (New York Times)

• Netflix didn’t disrupt Hollywood, Hollywood disrupted Netflix Netflix is the lovechild of Hollywood and Tech, and in a deeper way than the one you might be thinking. As the story goes, in 1997 Netflix co-founders Reed Hastings and Marc Randolph were brainstorming startup ideas while the $700M acquisition of Reed’s company, Pure Atria, was in the process of closing. Favoring Amazon’s eCommerce model for books, they sought to replicate it in another category. (Nihaar)

• Institutional Investors’ BS — Decoded “Not for attribution,” the emails from big-name institutional CIOs always started. “But these are lines we have heard other LPs/colleagues use . . .” (Institutional Investor)

• Driving the Mustang Mach-E, Ford’s first real electric car Ford looks like it has an unqualified hit on its hands. Its next EV, the electric Ford F-150, is sure to be popular. But Ford needed to show everyone that it could make a powerful electric vehicle that was a blast to drive — and it did. (The Verge)

• Well-Employed in Pandemic Times: Landscaping Goats The animals are hired to clear land because of their insatiable hunger for weeds. And they don’t have to honor lockdowns. (Wall Street Journal)

• What If Covid-19 Measures Killed Flu Season? Masks and social distancing seem to have stopped a disease the tactics weren’t even targeting. Maybe we can learn from that. (Bloomberg)

• How Russian hackers infiltrated the US government for months without being spotted And why it could take months more to discover how many other governments and companies have been breached. (MIT Technology Review)

• John le Carré didn’t just invent the characters in the foreground of the spy world. He designed the entire set. It says something about the brilliance of John le Carré, and the craft of writing itself, that the very first chapter of his very first book is titled “A Brief History of George Smiley.” (Washington Post)

Be sure to check out our Masters in Business interview this past weekend with Mike Swell, head of Global Fixed Income at Goldman Sachs Asset Management (GSAM). Swell is responsible for co-leading the global team of portfolio managers that oversee more than $700 billion in multi-sector bond portfolios.

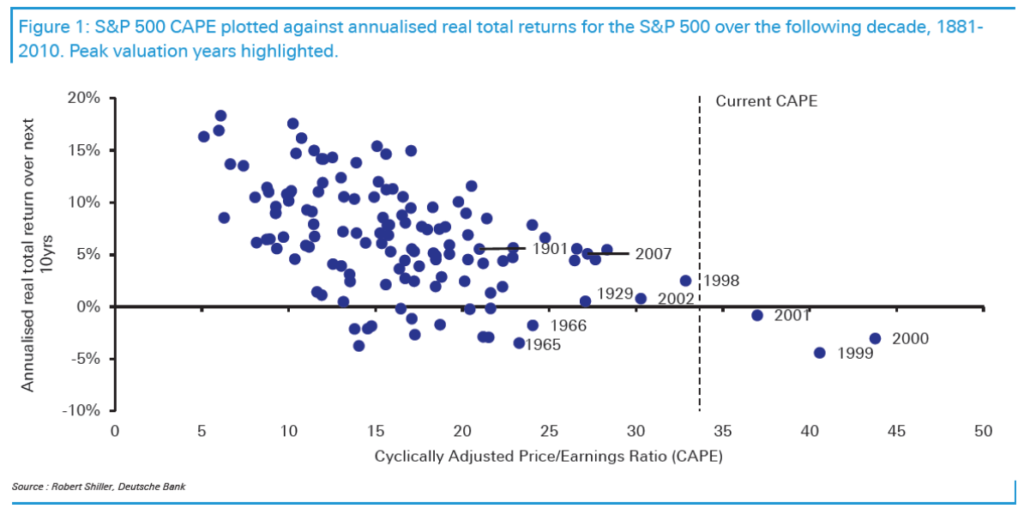

10-year Annualized REAL Returns Since 1881 (relative to starting CAPE)

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.