My morning train WFH reads:

• WallStreetBets Founder Reckons With Legacy Amid Memes, ‘Loss Porn’ and Online Threats The man who created Reddit’s WallStreetBets isn’t who you think he is. He’s 39 years old, lives in Mexico City with his wife, a physician, and spends his weeks chasing after their 3-year-old twins and tending to his day job as a consultant—hardly the sort of character one might associate with the roiling investing forum. He never imagined the Reddit community he created in 2012 would morph into a force so powerful that it would topple hedge funds and leave professional money managers around the country staring at Twitter with their mouths agape. (WSJ)

• Investing in a Bubble: Spotting Bubbles is Easier than Investing through Them The S&P 500 index soared 38% in 1995. This sharp increase, following four years of steady gains, made some of the smartest investors on Wall Street begin to grow wary of a bubble in the making. We found that the investors we studied almost all perceived the market to be in a bubble, but almost all of them were too early in making the call. It’s easier to predict what will happen, it turns out, than when it will happen. (Verdad)

• Hedge Fund “Idea Dinner” with 2 Million Guests Wall St Bets is the cloud-based version of the hedge fund idea dinner. None of the glamour but 1000x the buying power. And these informal gatherings have been going on in Manhattan since before the average Wall St Bets poster was born. (Reformed Broker)

• Tesla’s Model S Plaid Is Fastest-Accelerating Production Car 0-60 in less than 2 seconds, claiming in the earnings presentation that it’s the fastest-accelerating production car in the world. It will cost $112,990, including potential incentives. That will get you 390 miles of range and a top speed of 200 miles per hour. Deliveries will start around March, according to the company’s website. (Bloomberg)

• The Triumph of Dumb Money: It may be a “digital boiler room,” but Robinhood mostly won 2020. Does a reckoning await? (Institutional Investor) see also Arthur Levitt: History Has a Warning for GameStop Traders The SEC can take steps right now to curb the day-trading frenzy and help safeguard the investing public. (Bloomberg)

• Is a vaccine trade war brewing? The breakdown of supply chains and squabbles over jab efficacy proves a dangerous combination (Unherd)

• Superforecasting: The Art & Science of Prediction In a landmark study undertaken between 1984 and 2004, Wharton Professor Philip Tetlock showed that the average expert’s ability to make accurate predictions about the future was only slightly better than a layperson using random guesswork. His latest project, which began in 2011, has since shown that there are some people with real, demonstrable predicting foresight. These are often ordinary people who have an extraordinary ability to make predictions with a degree of accuracy significantly greater than the average. (Richard Hughes Jones)

• What All Those GOP Retirements Mean For The 2022 Senate Map The 2022 Senate map doesn’t force Democrats to compete on red turf nearly as much as the 2020 map or killer 2018 map did. In fact, no Democratic senators are running for reelection in states won by former President Donald Trump in 2020, while Republicans are defending two seats in states won by President Biden (FiveThirtyEight)

• Biden Team Rushes to Take Over Government, and Oust Trump Loyalists President Biden named nearly all of his cabinet secretaries and their immediate deputies before he took office, but his real grasp on the levers of power has come several layers down. (New York Times)

• Was early Mars wet and warm, or dry and cold? Yes. If you want to see copious liquid water on the surface of Mars then you need to time travel 3 billion years. Back then there was quite a bit of surface water, the evidence of which is still around today. River channels, lake beds, even hints of ocean shorelines… all these imply that back then Mars had a thicker atmosphere and plentiful water. (SyFy)

Be sure to check out our Masters in Business interview this weekend with the legendary fund manager Ron Baron of Baron Funds. Founded in 1982, the firm is known for long-term, fundamental, active approach to growth investing, and has $49 billion in AUM. 16 of 17 Baron Funds, representing 98.3% of assets outperformed their passive benchmark since inception; the Baron Partners Fund was up +148% in 2020.

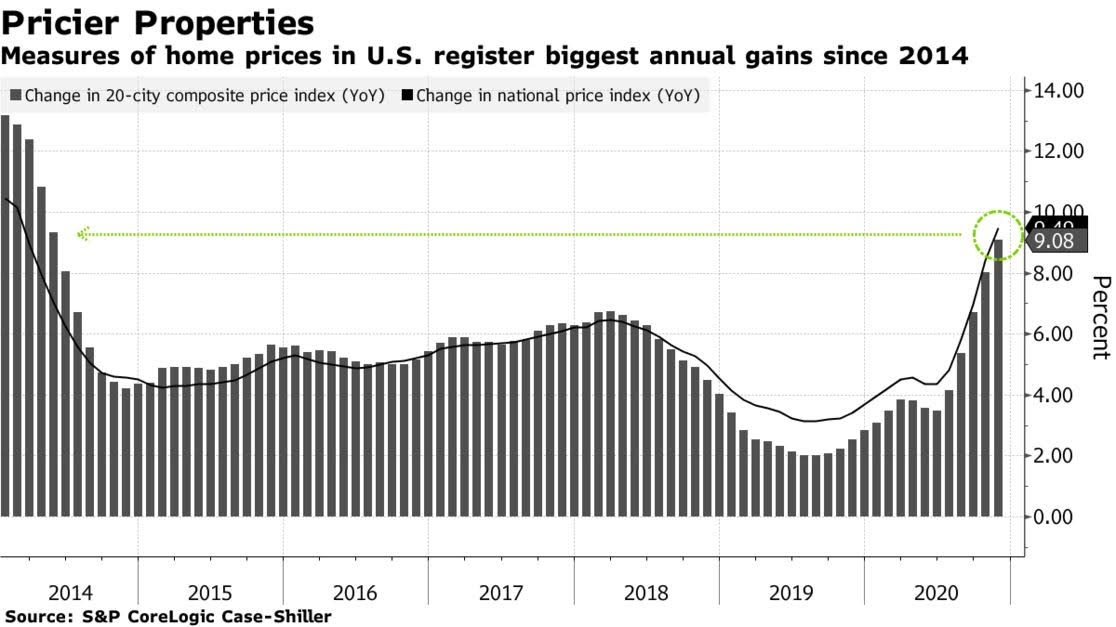

Home Prices in U.S. Cities Rise at Fastest Pace Since 2014

Source: Bloomberg

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.