To hear an audio spoken word version of this post, click here.

I wrote a column yesterday (out tomorrow) on how to manage your investments when it is late in the market cycle. When writing 800-ish words to a specific topic, lots of other ideas and distractions come along. Given the relative youth of the average RobinHood/Tiktok/Reddit trader, perhaps a few of these digressions, tangents and perspectives are worth sharing:

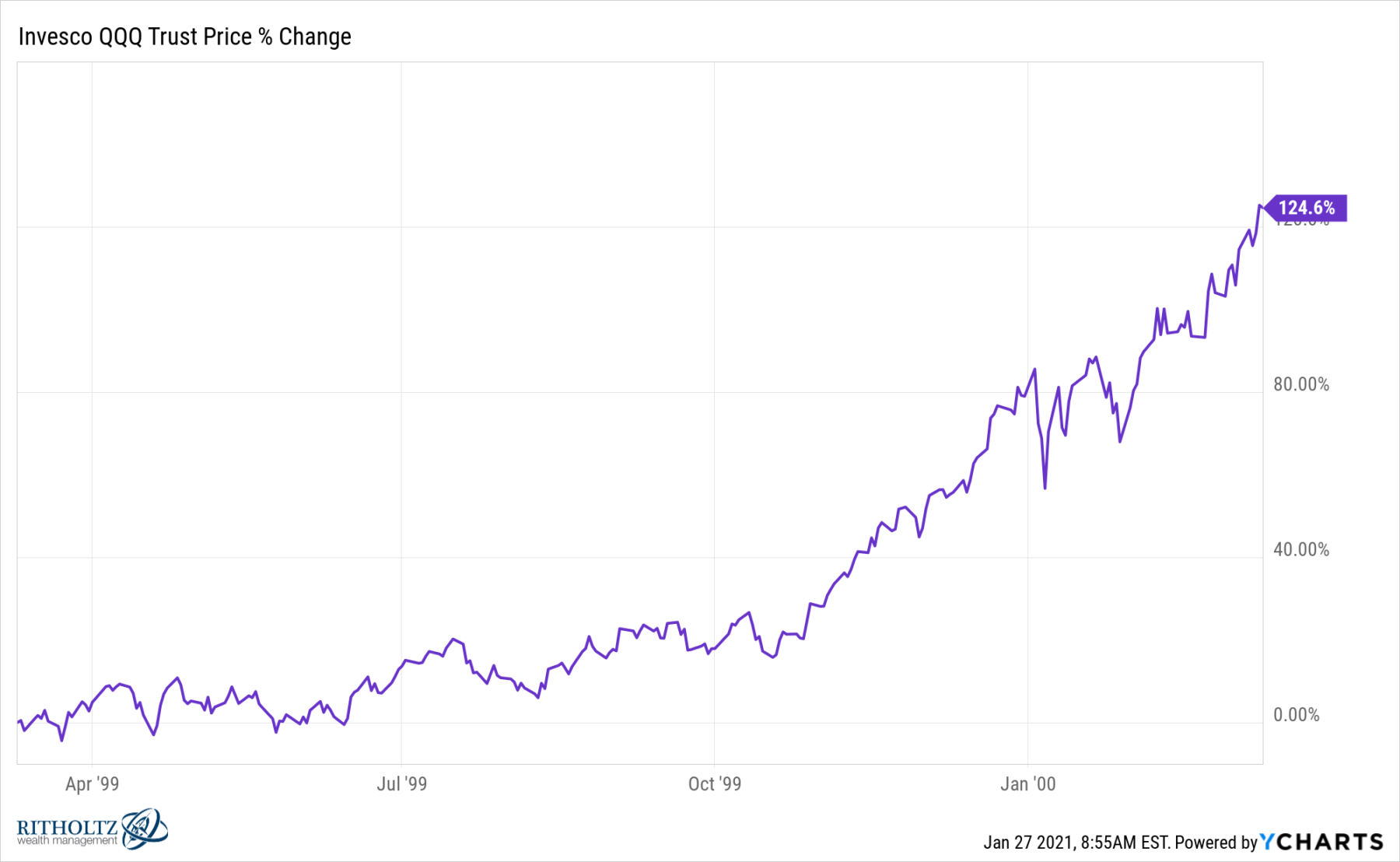

• Bull Markets Run Much Further Than Anyone Expects: One of the major tenets of famed Merrill Lynch technician Bob Farrell is that “Rapidly rising or falling markets usually go further than you think.” This is true, and sometimes, to a shocking degree.

There are lots of comparisons between the present era and the 1990s dotcom implosion. Recall then Fed Chairman Alan Greenspan’s Irrational Exuberance speech. Had you sold your tech stocks the following market day after his now infamous 1996 speech, you would have left a lot of money on the table: The Nasdaq QQQs rose another 124.6% post-Greenspan speech; some individual names went up even higher.

• FOMO YOLO COVID STONKS: Finding historical parallels to the pandemic groundhog day circumstances is all but impossible: Stuck at home, the usual in-person socializing non-existent, much of our favored live entertainments unavailable.

What might be driving some of the behaviors we witness are very clever, potentially destructive algorithms “designed to funnel you into the most extreme, most dopamine-driving financial ideas.” Whether it is Facebook or TikTok, Reddit or Robinhood, the Gamma algo is different this time.

• Speculation versus Systemic Risk: We should pay attention to two important but very different kinds of risks: The pockets of speculation that send otherwise overlooked or undervalued or even worthless stocks soaring higher, and the risks that threaten the entire economy. You must distinguish between the two when you are engaging in market commentary; especially pay attention when putting on broad macro trades.

When literally worthless stubs of bankrupt companies — see Hertz Global Holdings (HTZGQ) — soar due to day traders, the risk is that those people may lose some or most or all of their money. The same is true for a turnaround story like Gamestop (GME) or AMC Entertainment Holdings (AMC) or whatever the Stonk of the day is. That would be ☹️😢😫 for them, but meaningless to the economy or the market.

On the other hand, when through the miracle of securitization, the entire financial system becomes festooned with defaulted junk mortgages that grinds the credit markets to a halt, thereby freezing up the real economy, you have a serious problem.

• What Don’t We Know: Consider the universe of things we do not currently know about this market & economy, but will likely understand with great clarity 10 years from now. Is this a bubble? When will the market crash? How will the pandemic end? Will there be another US insurrection? What other surprises await us?

We are incapable of answering those questions today (with any degree of confidence), but they will look obvious in the future. Worse, our hindsight bias will allow us to convince ourselves that we knew the answers all along.

• And in the End . . . How does this spasm of speculation conclude? I have a high degree of confidence in my answer: The same way it always does.

There will be tears, massive losses by some and big gains by others. There will be lives ruined and lessons learned among the claims of a rigged market, insider trading, and fraud. Maybe even people go to jail (JK maybe not). As Wall Street runs red with proverbial blood, a few clever bastards will notice the “generational buying opportunity” — the fourth such rare entry point over the past 20 years.

And, we won’t have any idea when that will be — it could be starting today, or just as likely, in 5 years.

Your goal throughout this is to survive with enough capital intact to take advantage whenever that opportunity when it presents itself . . .

Previously:

What Does the Longest Bull Market Mean? A Debate (August 29, 2018)

Bob Farrell’s 10 Rules for Investing (August 17, 2008)

See also:

Semantic Density, Algos & Gamestop: This Time It’s Different (Dave Nadig January 26, 2021)

For Better of For Worse, This is a Young Person’s Market Right Now (Ben Carlson, January 26, 2021)

Timeless Lessons From Today’s Mania (Michael Batnick, January 26, 2021)

Semantic Density, Algos & Gamestop: This Time It’s Different (ETF Trends, January 26, 2021)

~~~

The End: Perhaps the finest two minutes and twenty-one seconds to ever officially* end an album.

______

* The hardcore fans know why I say “officially.”