The weekend is here! Pour yourself a mug of French Roast coffee, grab a seat by the fire, and get ready for our longer form weekend reads:

• The Unbeatable Ed Hyman For four decades Ed Hyman has been unrivaled among Wall Street economists. It is a truth universally acknowledged that Edward S. Hyman Jr. is Wall Street’s greatest living economist. And a nice guy too. The former has been documented every October since 1976 in Institutional Investor. The latter, most recently by everyone interviewed for this article. Is his reign nearing its end? (Institutional Investor)

• No, Austin Won’t Become Silicon Valley 2.0 Appalled by the sky-high rents and wealth inequality of today’s San Francisco region, the other tale is that the tech industry itself is the real villain. Having eaten the Bay Area alive, and now in the process of spitting out the bones of a once-dynamic city, it looks for its next meal. The same rapacious billionaires are moving on to fresh prey in still-groovy Central Texas, which is destined to turn into another smoking cultural wasteland (Texas Monthly)

• Make Way for the ‘One-Minute City’ While the “15-minute city” model promotes neighborhood-level urban planning, Sweden is pursuing a hyper-local twist: a scheme to redesign every street in the nation. (Citylab)

• How the Insurgent and MAGA Right are Being Welded Together on the Streets of D.C. A vast constellation of American right-wing groups converged on Washington D.C. to protest what they falsely believe to be a stolen US Presidential election. The organizations include numerous violent extremist groups like the Proud Boys. Its the result of the merger between run of the mill MAGA supporters, white supremacists, and neo-Nazis. (Belling Cat)

• The Sanity List: The Discoveries That Have Been Getting Us Through: The best thing about 2020 may be that it’s over. The second-best (and maybe third-, fourth-, and fifth-best) is up for debate. The pandemic forced us to rethink our daily routines and find some level of sanity amid the chaos, so Bloomberg Pursuits polled the newsroom to root out the best pandemic discoveries: new services and products and activities that brought us joy, that improved the day-to-day-to-what-day-is-it-again of our lives. (Bloomberg)

• The Man Who Turned Credit-Card Points Into an Empire Brian Kelly, The Points Guy, has created an empire dedicated to maximizing credit-card rewards and airline miles. What are they worth in a global pandemic — and why are they worth anything at all?(New York Times)

• Now It Can Be Told: How Neil Sheehan Got the Pentagon Papers It was a story he had chosen not to tell — until 2015, when he sat for a four-hour interview, promised that this account would not be published while he was alive. (New York Times)

• A 25-Year-Old Bet Comes Due: Has Tech Destroyed Society? In 1995, a WIRED cofounder challenged a Luddite-loving doomsayer to a prescient wager on tech and civilization’s fate. Now their judge weighs in. (Wired)

• Does Time Really Flow? New Clues Come From a Century-Old Approach to Math. The laws of physics imply that the passage of time is an illusion. To avoid this conclusion, we might have to rethink the reality of infinitely precise numbers. (Quanta Magazine)

• A Brief History of Nachos In the 1940s, Ignacio “Nacho” Anaya was working at Club Victoria in the border town of Piedras Negras, Mexico, when a group from the neighboring Texas town of Eagle Pass came in looking for something to eat. As the restaurant’s maître d, Anaya’s job was normally limited to attending to guests, but on this particular occasion, the cook was nowhere to be found. Instead of turning the customers away, Anaya ducked into the kitchen to whip up a quick dish using the few ingredients he could find. The resulting plate of tortilla chips topped with grated cheese and sliced jalapeños was a hit. It needed a name, and Nachos Especiales—an homage to its creator—stuck. Or at least the first half of it did. (Mental Floss)

Be sure to check out our Masters in Business interview this weekend with Sébastien Page, head of T. Rowe Price’s Multi-Asset Division, which manages $363.5 billion. T. Rowe Price’s total AUM was $1.31 trillion.

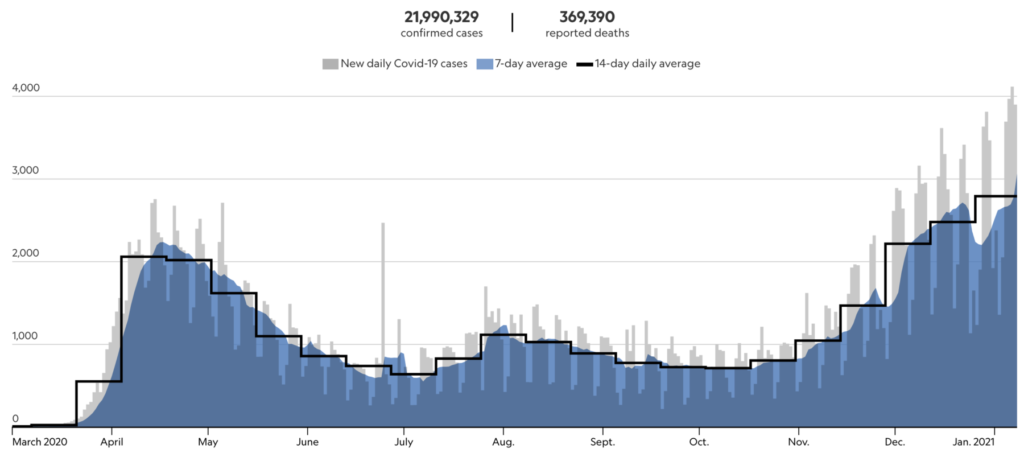

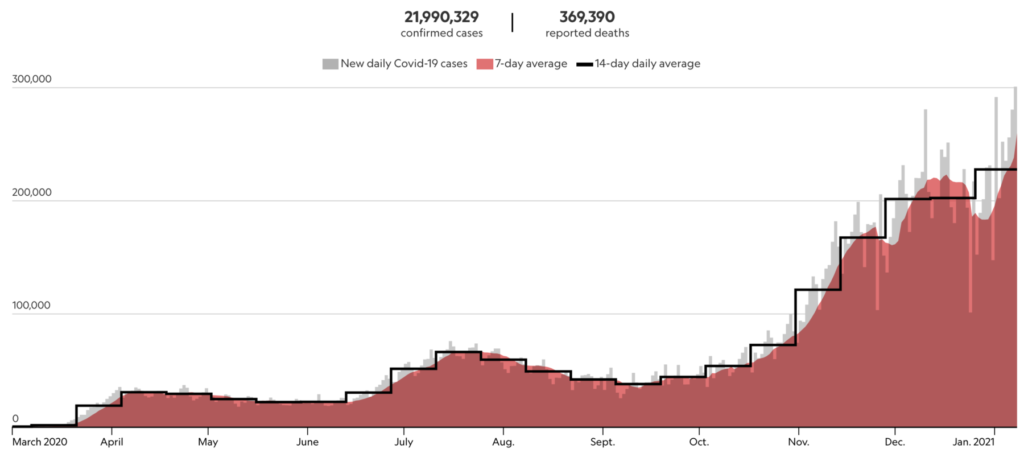

Deaths, hospitalizations, and new cases reach record highs in the new year

Source: Nat Geo