The weekend is here! Pour yourself a mug of French Roast coffee, grab a seat by the fire, and get ready for our longer form weekend reads:

• Elon Musk Loves China, and China Loves Him Back—for Now Tesla and its chief executive officer have done all the right things as far as Beijing is concerned. Musk, who didn’t respond to requests to be interviewed for this story, has effusively endorsed China’s talent pool and its ambitious plans for EVs, remarks that go a long way in a country whose leaders are intensely sensitive to foreign judgments. Tesla’s local unit has also aligned itself explicitly with President Xi Jinping’s economic policy goals and forced China’s vast array of EV manufacturers to up their game, a crucial step in the government’s efforts to dominate the age of electric mobility.(Businessweek)

• Why People Believe in Conspiracy Theories (They’re not stupid). Conspiracy theories arise in the context of fear, anxiety, mistrust, uncertainty, and feelings of powerlessness. For many Americans, recent years have provided many sources for these feelings. There’s been employment insecurity, stagnating wages, and thwarted social mobility. (Slate)

• Business travel: ‘We don’t know how many people will choose to fly’ The sector lost an estimated $710bn year-on-year loss of revenue to the industry. The question now is whether those travellers will return once the pandemic ends. And, if they don’t, what that means for a sector which directly and indirectly supports one in seven jobs worldwide according to the Global Business Travel Association, subsidizes mass tourism and had annual revenues of $1.4tn in 2019. (Financial Times)

• Why ESG Funds Fail to Scale You’ve seen the headlines about the growth in environmental, social, and governance funds. Many investment professionals might read these and believe that launching a new ESG investment firm or ESG offering will be an automatic success. Our analysis of the data shows that this is far from the truth: Most of these efforts fail. (Institutional Investor) see also How Lemonade Hijacked the “ESG Movement” to Pull Off the #1 Stock Promotion of 2020 Lemonade is an egregious stock promotion disguised as a social impact company – the company is making a complete farce of the ESG investment movement (The Friendly Bear)

• The joys of being an absolute beginner – for life. The phrase ‘adult beginner’ can sound patronizing. It implies you are learning something you should have mastered as a child. But learning is not just for the young (The Guardian)

• Coronapolitics from the Reichstag to the Capitol Defying conventional political labels and capitalizing on widespread distrust, a range of new movements share the conviction that all power is conspiracy. (Boston Review)

• The Lasting Lessons of John Conway’s Game of Life Fifty years on, the mathematician’s best known (and, to him, least favorite) creation confirms that “uncertainty is the only certainty.” (New York Times)

• QAnon reshaped Trump’s party and radicalized believers. The Capitol siege may just be the start. The online conspiracy theory, which depicts Trump as a messianic warrior battling ‘deep state’ Satanists, has helped fuel a real-world militant extremism that could haunt the Biden era: It’s ‘a threat to our democracy, and we’re not nearly done’ (Washington Post)

• The Unsettling Truth About the ‘Mostly Harmless’ Hiker The body of a hiker had been found in a tent in Florida in the summer of 2018, but scores of amateur detectives, and a few professional ones too, couldn’t figure out who he was. Everyone knew that he had started walking south on the Appalachian Trail from New York a year and a half before. He met hundreds of people on the trail, and seemed to charm them all. He told people he was from Baton Rouge, Louisiana, and that he worked in tech in New York. They all knew his trail name, but no one could figure out his real one. (Wired)

• Why So Many Pop Stars Are Trying to Be Working-Class Heroes Now Artists including Justin Bieber, Drake, and Travis Scott are making clumsy plays at humble relatability during an era of deepening economic inequality. (Pitchfork)

Be sure to check out our Masters in Business interview this weekend with Adam Karr, portfolio manager at Orbis Investments and head of the US division. The firm, which manages $37B in assets, has a unique fee approach, where they only pay if they outperform, and refund fees when they underperform.

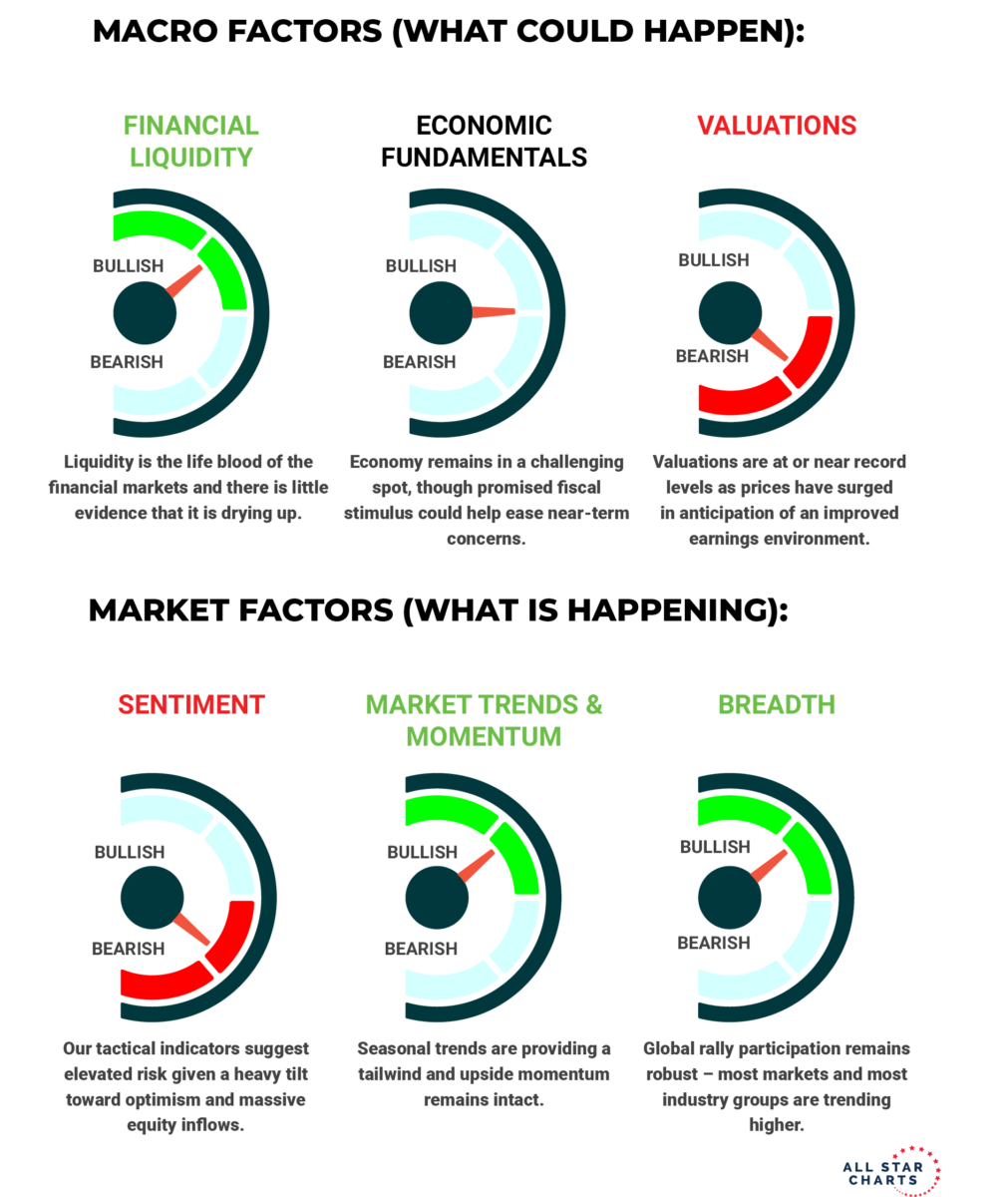

Stocks Are Historically Expensive. So What?

Source: All Star Charts

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.