My morning train WFH reads:

• Post-COVID, What’s on the World Scene That Could Muck Things Up? Geopolitics will continue to roil the investment landscape for US investors, experts warn. COVID (Chief Investment Officer)

• How David Beats Goliath in Real Life The hedge fund industry manages $3 trillion. Private equity and real estate and venture money is even bigger than that. Funds are backed by banks and brokerages which are backed by the Federal Reserve. Get a grip on reality. This complex doesn’t lose an arms race. The money is infinite. You can’t squeeze it. It will crush you. The louder and more bellicose you are on the internet, the tighter it will squeeze back, until your head has literally popped off. On Wall Street, David doesn’t beat Goliath – especially in a battle of brute force and liquidity. (Reformed Broker) see also How The “Dumb” Money Won One of the most surprising outcomes of the cycle that’s been in place since the end of the Great Financial Crisis is the fact that retail investors seem to be winning more than ever over professional investors. (Wealth of Common Sense)

• In Epically Nerdy Interview, Elon Musk Discusses Build Quality Problems With Engineer Who Compared Model 3 To ‘A Kia In The ’90s’ Elon Musk is taking accountability for Tesla’s manufacturing failures. He recently sat down with one of Tesla’s biggest build-quality critics, manufacturing expert Sandy Munro, founder of the benchmarking consultancy Munro & Associates. Here’s what Musk had to say about large panel gaps and poorly designed body structures in what has to be one of the most epic technical interviews I’ve seen in a while. (Jalopnik)

• A Texas Maverick Is Trying to Save Endowments From the Next Stock- Market Crash. Will They Listen? An equally uncomfortable message for the tassel-loafered endowment managers at Harvard, Princeton, and MIT: “Hope is a bad strategy.” It’s a warning Abraham — hedge fund manager, commodities trader, and Texas rancher — has been delivering for years to investors who figure they will be lucky enough to dodge the next stock-market calamity. Endowments, foundations, and their ilk today naively believe that the pricey hedge funds they shovel their money into will provide safe haven in a selloff. (Institutional Investor)

• Booming Blank Check Companies Are the Talk of Reddit and TikTok The SPAC boom that seemed to come out of nowhere in 2020 is still going strong. Billionaires, celebrities, and money managers are lining up to start special-purpose acquisition companies and hedge funds are clamoring to buy an early piece of them. Retail investors are piling in, with Reddit boards and even a corner of TikTok lighting up with discussions about these unusual stocks. SPACs, also known as blank check companies, are empty corporate shells that raise money from investors and then aim to merge with a private business, essentially taking that company public through the back door. (Businessweek)

• The Relentless Jeff Bezos Jeff Bezos is arguably the greatest CEO in tech history, in large part because he created three massive businesses, all of which generate enormous consumer surplus and enjoy impregnable moats: Amazon.com, AWS, and the Amazon platform (this is a grab-all term for the Amazon Marketplace and Fulfillment offerings). These three businesses are the result of Bezos’ rare combination of strategic thinking, boldness, and drive, and the real world manifestations of Amazon’s three most important tactics: leverage the Internet, win with scale, and being your first best — but not only — customer. (Stratechery)

• The Downside to Life in a Supertall Tower: Leaks, Creaks, Breaks 432 Park, one of the wealthiest addresses in the world, faces some significant design problems, and other luxury high-rises may share its fate. (New York Times) see also Millennials Are Changing the Luxury Real Estate Market Tech-savvy and environmentally conscious, millennials’ preferences are poised to dramatically reshape the high-end housing market. (Bloomberg)

• The Chrome Update Is Bad for Advertisers but Good for Google Google Chrome is ditching third-party cookies for good. It may rewrite the rules of online advertising and make it far harder to track the web activity of billions of people. But what seems like a big win for privacy may only serve to tighten Google’s grip on the advertising industry and web as a whole. For most people, the change will be invisible but, behind the scenes, Google is planning to put Chrome in control of some of the advertising process. To do this it plans to use browser-based machine learning to log your browsing history and lump people into groups alongside others with similar interests. (Wired)

• How the Brain Responds to Beauty There is no shortage of theories about what makes an object aesthetically pleasing. Ideas about proportion, harmony, symmetry, order, complexity and balance have all been studied by psychologists in great depth. The theories go as far back as 1876—in the early days of experimental psychology—when German psychologist Gustav Fechner provided evidence that people prefer rectangles with sides in proportion to the golden ratio (if you’re curious, that ratio is about 1.6:1). Scientists are searching for the neural basis of an enigmatic experience (Scientific American)

• San Francisco Giants outfielder Drew Robinson’s remarkable second act He sat on his living room couch, poured himself a whiskey. He was alone, alone until the end. At about 8 p.m., in one uninterrupted motion, he leaned to the side, reached out to the coffee table, lifted the gun, pressed it against his right temple and pulled the trigger. That was supposed to be the end of Drew Robinson’s story. Over the next 20 hours, he would come to realize it was the beginning of another. (ESPN)

Be sure to check out our Masters in Business next week with Kevin Landis, Firsthand Funds. The firm’s Firsthand Technology Opportunities Fund (TEFQX) was created in 1999, and has gained 21.1% annually over the past 10 years vs 13.9% for the S&P500 and 18.5% for the Nasdaq Index. It gained 102% over the past 12 months.

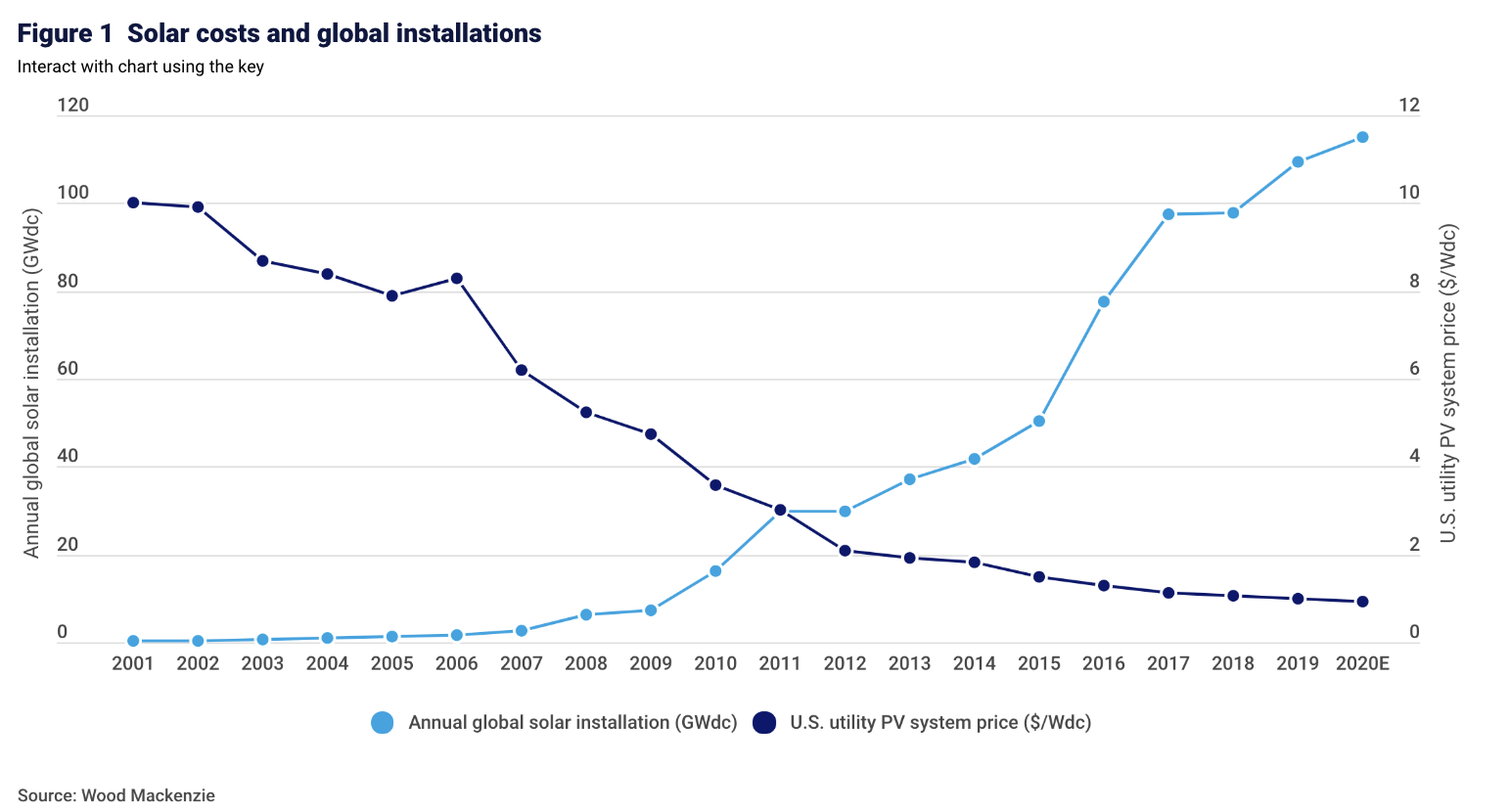

Total eclipse: How falling costs will secure solar’s dominance in power

Source: Wood Mackenzie

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.