My morning train WFH reads:

• At 93, She Waged War on JPMorgan—and Her Own Grandsons Beverley Schottenstein said two grandsons who managed her money at JPMorgan forged documents, ran up commissions with inappropriate trading and made her miss tens of millions of dollars in gains. So she decided to teach them all a lesson. (Bloomberg) see also Advice for Rich Uncles and Others… Never give money to relatives to manage, instead, buy them a new Rolex. This sounds like a quite odd bit of advice, but follow my logic (The Big Picture)

• The Most Powerful Artificial Intelligence Knows Nothing About Investing. That’s Perfectly Okay. Indeed, that’s the point. The power of advanced AI is rooted in its ability to find patterns in data directly, making predictions independent of human intelligence or expertise. While investment managers readily concede that these algorithms will solve incredibly complex problems in medicine, autonomous driving, engineering, robotics, and other verticals, they staunchly deny they will solve investment problems and build autonomous investment strategies. That denial will be their downfall (Institutional Investor)

• Payment for Order Flow: An Explanation of the Practice and the Debate The trick is to understand PFOF in context. You can’t really have an informed opinion as to whether it is good, bad or neutral unless you understand it within the broader context of how the stock market works. Before looking at the arguments for and against PFOF, there are six concepts you need to understand. (Forefront)

• Covid Housing Boom Is Even Bigger Than Imagined The latest Fed data on household finances shows the extent to which record-low mortgage rates and surging home prices turbocharged the economic recovery. (Bloomberg)

• Bond yields are not good predictors of inflation Bond market complacence should not be taken as strong evidence against the risk of overheating. The postwar history of US and foreign bond markets shows that bond yields are not good predictors of inflation. Yields largely reflect the behavior of inflation over many years in the past, not the future. It is far from clear whether inflation will rise significantly, but if it does, bond markets are not likely to have predicted it. (Peterson Institute for International Economics)

• Posing as Amazon seller, consumer group investigates fake-review industry Fake Amazon reviews still sold in bulk—it costs $10,900 for 1,000 reviews. (Ars Technica)

• Clubhouse, a Tiny Audio Chat App, Breaks Through The 11-month-old app has exploded in popularity, even as it grapples with harassment, misinformation and privacy issues. (New York Times)

• The Texas grid got crushed because its operators didn’t see the need to prepare for cold weather What has sent Texas reeling is not an engineering problem, nor is it the frozen wind turbines blamed by prominent Republicans. It is a financial structure for power generation that offers no incentives to power plant operators to prepare for winter. In the name of deregulation and free markets, Texas has created an electric grid that puts an emphasis on cheap prices over reliable service. (Washington Post)

• The coronavirus is here to stay — here’s what that means A Nature survey shows many scientists expect the virus that causes COVID-19 to become endemic, but it could pose less danger over time. (Nature)

• Why Do We Even Have Dogs? A new Proceedings of the National Academy of Sciences paper which locates the origin of some of the very first dogs in the last Ice Age, about 23,000 years ago. (Slate)

Be sure to check out our Masters in Business interview this weekend with Doug Braunstein, former Chief Financial Officer at JPMorgan Chase. Braunstein is founder and managing partner at Hudson Executive Capital, which has underwritten several successful SPAC offerings, with $1.6B in AUM. Braunstein worked directly with Jamie Dimon as CFO and a member of JPMorgan’s Executive Committee. He served as head of JPMorgan’s Americas Investment Banking and Global M&A.

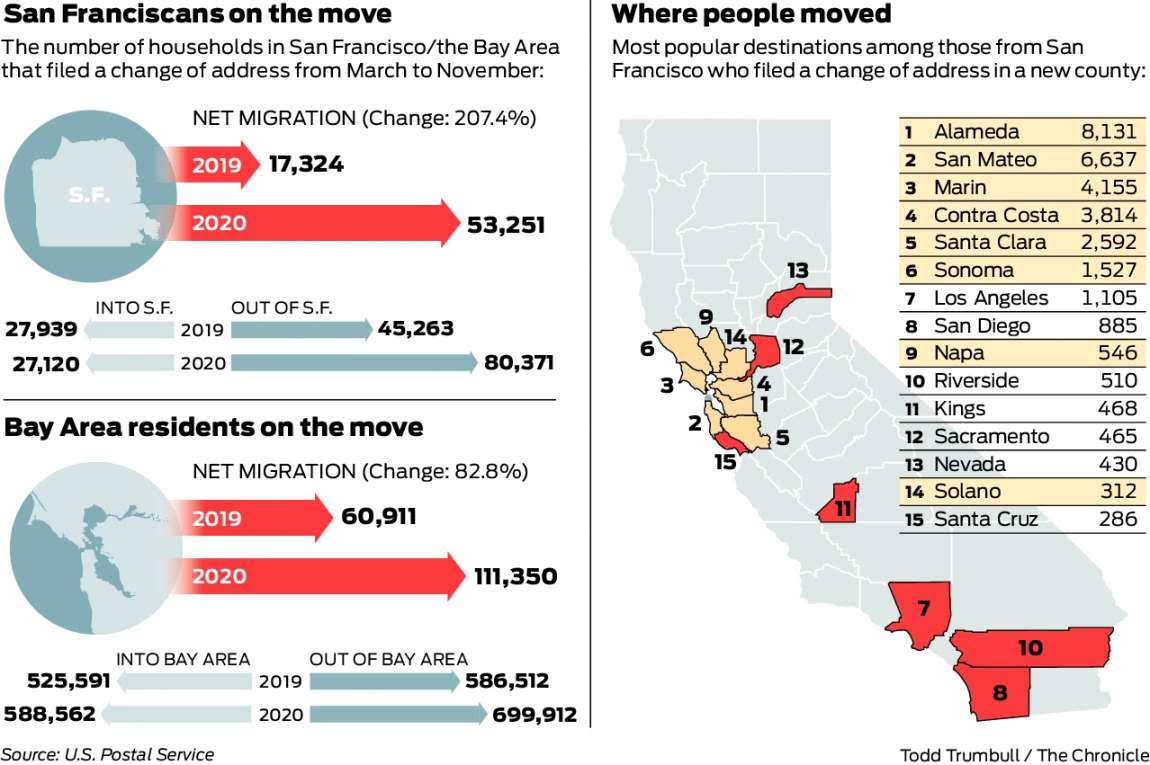

People are leaving S.F., but not for Austin or Miami. USPS data shows where they went

Source: San Francisco Chronicle

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.