My Two-for-Tuesday morning train WFH reads:

• A Record Number of New Retail Investors Signed Up in 2020 They’re younger, more diverse, and they go to their friends and family for investment advice, a new report confirms. (CIO) see also How to Win at the Stock Market by Being Lazy The drama of GameStop is misleading; the surer path to wealth is extremely boring (New York Times)

• More Than Two Dozen Funds Returned More Than 100% Last Year. Here’s Why That’s Not Good News. The top performers of 2020 are mostly concentrated growth funds from a handful of firms. While doubling your money is a win for current investors, these outsize gains pose problems for potential investors trying to evaluate these funds. (Barron’s)

• Some Friendly Reminders About Day Trading There will always be winners and losers in the stock market, even for those who aren’t day-trading. This is simply the zero-sum nature of transacting in a market like this. For every buyer, there has to be a seller and vice versa. But day-traders face a much higher hurdle rate than long-term investors for a couple of reasons: (A Wealth of Common Sense) see also Hedge Funds Always Win And as GameStop shows, individual investors competing against well-capitalized professional investors (almost) always lose. (Institutional Investor)

• OpenLux: the secrets of Luxembourg, a tax haven at the heart of Europe Multinationals, billionaires, artists, sportsmen, criminals : an investigation by Le Monde reveals for the first time exhaustively what the Grand Duchy’s financial centre conceals, thanks to its tax advantages (Le Monde)

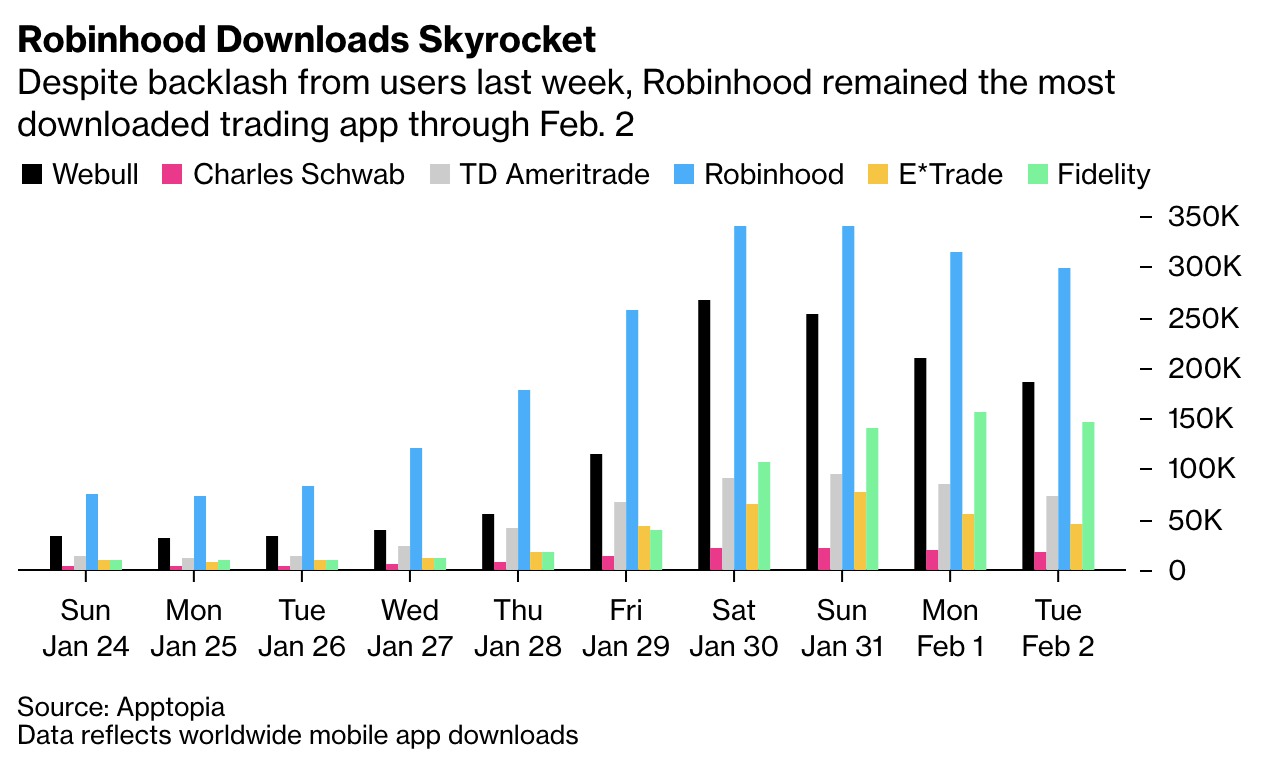

• Why people love to hate Robinhood Robinhood is loved not only by the trading newbies who are downloading the app at a record pace, but also by Wall Street investors who have recently sunk $3.4 billion into the company. The online brokerage has also been relentlessly attacked, however, by everybody from Alexandria Ocasio-Cortez to Ted Cruz and Mark Cuban. (Axios) see also Robinhood’s Reckoning: Can It Survive the GameStop Bubble? The firm that set out to bring investing to the masses has run into the reality of Wall Street regulations (Wall Street Journal)

• Who Really Created the Marvel Universe? Stan Lee presided over a world of superheroes, but his collaborators and readers sustained his vision—and his characters outlasted it. (New Yorker)

• Silicon Valley Won’t Last Forever, and Texas Knows It The birthplace of Dell and TI has been quietly building its tech industry since the 1930s. Now it has the chance to move into the spotlight. (Bloomberg) see also See Just How Big DoorDash, Airbnb and Snowflake Have Gotten The largest IPOs of 2020 have market caps that dwarf established companies in their sectors—yet profit remains elusive (Wall Street Journal)

• Facebook is finally banning vaccine misinformation Nearly a year into the pandemic, Facebook now aims to take down misinformation on vaccines overall — not just Covid-19 vaccines. (Recode)

• The Republican Party Is Radicalizing Against Democracy The GOP is moderating on policy questions, even as it grows more dangerous on core questions of democracy and the rule of law. (The Atlantic) see also In America’s ‘Uncivil War,’ Republicans Are The Aggressors Extremism, domestic terrorism and white supremacy is largely coming from one side of the uncivil war. But that’s the reality. In America’s uncivil war, both sides may hate the other, but one side — conservatives and Republicans — is more hostile and aggressive, increasingly willing to engage in anti-democratic and even violent attacks on their perceived enemies. (FiveThirtyEight)

• The Brain Within the Brain of a Rising Tennis Queen Iga Swiatek of Poland came out of nowhere to win the French Open in October. A sports psychologist was with her all the way. (New York Times)

Be sure to check out our Masters in Business this week with Kevin Landis, Firsthand Funds. The firm’s Firsthand Technology Opportunities Fund (TEFQX) was created in 1999, and has gained 21.1% annually over the past 10 years vs 13.9% for the S&P500 and 18.5% for the Nasdaq Index. It gained 102% over the past 12 months.

Robinhood Traders Bash the App But Just Can’t Leave It

Source: Bloomberg

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.