My mid-week morning train WFH reads:

• Is Bitcoin Boom a ‘Better Gold’ or Just Another Bubble? Once seen as the province of nerds, libertarians and drug dealers, there’s little sign it will evolve into a useful form of currency. Yet the latest bout of roller-coaster volatility comes as more big investors are speculating that Bitcoin will gain wider acceptance and shake up the financial world, filling the role of gold as a hedge against inflation. (Bloomberg)

• Wall Street’s Most Reviled Investors Worry About Their Fate Short sellers — self-described financial detectives who make money when companies fail — were already worried about their success and safety. Then GameStop happened. (New York Times) see also Not Everyone Thinks Short Selling is Dead Bucking the trend of negativity, fund manager Chris Brown still thinks a huge market “blow-off” is in the offing. (Institutional Investor)

• A Lucid look at the SPAC-craziness: $CCIV deep dive It’s easy to say, “O that’s a speculative bubble,” but it can be hard to point to any one company or stock that actually exemplifies the bubble. Consider Churchill Capital Corp IV (CCIV). I don’t think there’s ever been a stock that so clearly exemplifies a bubble and people do not fully realize just how crazy it is for CCIV in particular to trade at this big a premium. (Yet Another Value Blog)

• Malls Spent Billions on Theme Parks to Woo Shoppers. It Made Matters Worse. For big operators who thought entertainment was a solution to a declining business, the bills are coming due (Wall Street Journal)

• How Did U.S. Consumers Use Their Stimulus Payments? How did the large one-time transfers to individuals from the CARES Act affect U.S. consumers’ consumption and saving decisions? Most primarily saved or paid down debts with their transfers; only 15% spent it. (NBER) but see Americans take to ‘buy now, pay later’ shopping during pandemic, but can they afford it? It is unclear how buy now, pay later fits into U.S. regulations – the companies that offer these services do not have bank charters, some do not charge interest and laws vary by state. Some experts expect the sector to come under more scrutiny during the new administration. (Reuters)

• How the Covid-19 pandemic broke Nextdoor Amid the pandemic, lots of people are turning to Nextdoor for help. That’s not always what they find. (Recode)

• Humans Are Pretty Lousy Lie Detectors Whenever we hear someone speak, we form an opinion about their believability. But our eyes and ears can lead us astray (Scientific American)

• Norway’s Electric Car Triumph Started With an ’80s Pop Star How a rule-breaking joyride by an MTV icon helped make Norway the world’s EV capital. (Reasons To Be Cheerful)

• Biden inherited a USPS crisis. Here’s how Democrats want to fix it. Party leaders have already begun discussions on major legislation — and trying to force out Louis DeJoy (Washington Post)

• It’s Not Every Day We Get a New Blue In 2009, a professor discovered a novel hue by accident in his university lab. Now, you can paint with it (New York Times)

Be sure to check out our Masters in Business interview this weekend with Ben Inker, head of Asset Allocation at GMO, which manages about $60 billion in assets. During Dotcom implosion, GMO’s US Aggressive Long/Short Strategy achieved 80+% cumulative net returns for their clients. Inker is widely regarded as founder Jeremy Grantham’s heir apparent.

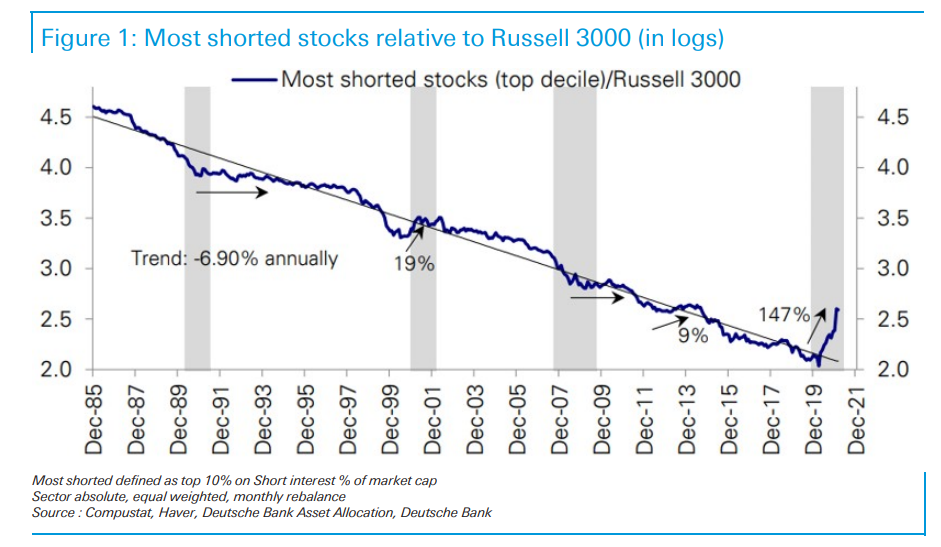

Between 1985-2019, a basket of the most shorted stocks out-performed Russell 3000 by 6.9%/year

Source: Deutsche Bank

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.