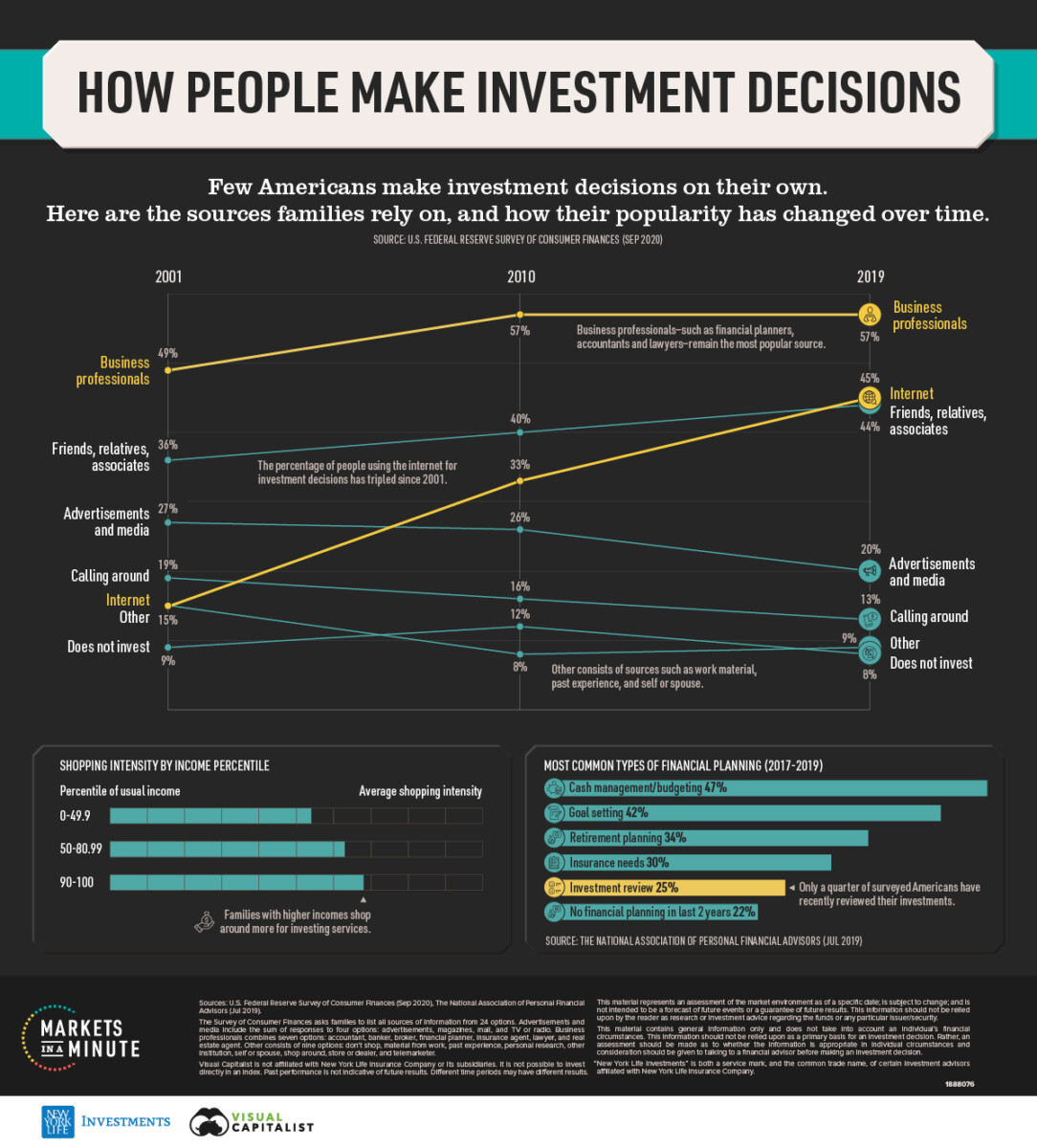

Top Sources Americans Use to Make Investment Decisions (2001-2019)

Source: Visual Capitalist

Nice visualization (based on a study by the Brunswick Group) looking at the sources of information were investors rely upon, and how that has changed over the past 20 years.

There were two especially noteworthy changes: More investors were relying on professional advice in 2019 versus 2001 — 57% vs 49%. I suspect those numbers really changed in the 2010s post-GFC, as retail found it difficult to sidestep the crash and even more challenging to get back into equities.

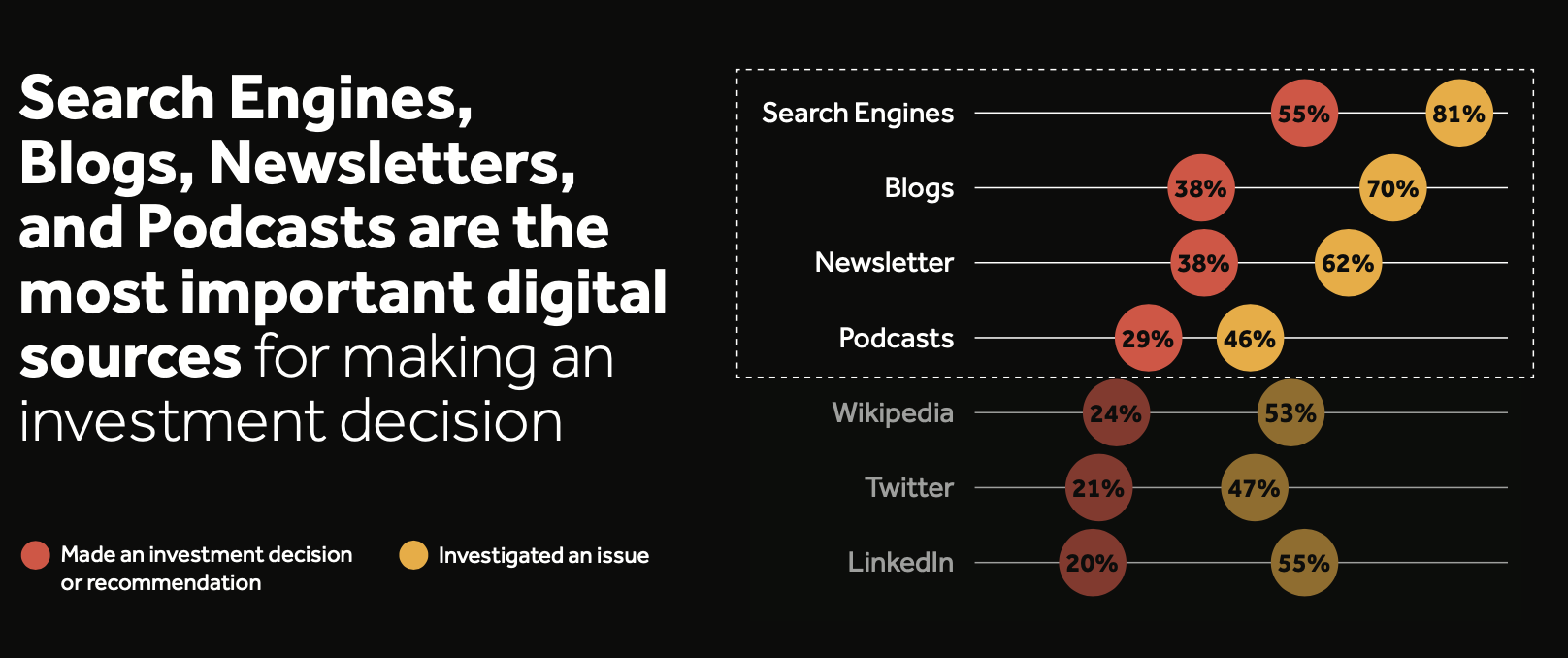

The biggest change is the ongoing rise of the internet as a resource for basing investing decisions. The big increases are blogs, now called the most important information source (after search engines) for making an investment decisions at 70%, up from only 38% 20 years ago; and podcasts, which were 29% and are now 46%.

I am also curious as to how social media specifically breaks out from the broader internet. Not just FinTwit, but r/WallStreetBets, Facebook, TikTok Stocks, and LinkedIn.

I recently did a Bloomberg radio hit with Sinan Aral, professor of Management, Marketing, IT, and Data Science at MIT, where he is also the director of the MIT Initiative on the Digital Economy and head of MIT’s Social Analytics Lab. His book The Hype Machine: How Social Media Disrupts Our Elections, Our Economy, and Our Health addresses some of these issues more directly.

All of this is very interesting, and it falls under the rubric of “Its not your father’s internet, anymore.”

~~~

More on this soon . . .

Source: Brunswick