Succinct Summations for the week ending February 26th, 2021

Positives:

1. Covid infection rate plummets 72%; USA is closer to herd immunity.

2. FHFA House Price Index rose 1.1% m/o/m, above expectations.

3. Jobless claims fell 111k w/o/w from 841k to 730k.

4. New home sales came in at 923k for January, above expectations.

5. Personal income rose 10.0% m/o/m, above previous increase of 0.6%.

6. Leading economic indicators index rose 0.5% m/o/m, above expectations.

7. Durable goods orders rose 3.4% m/o/m, above expectations.

8. Consumer confidence came in at 91.3 for February, above expectations.

Negatives:

1. Markets anticipating higher inflation and interest rates, whacks Bond market.

2. Pending home sales fell 2.8% m/o/m, below the previous increase.

3. Home mortgage apps fell 12.0% w/o/w, below the previous decrease.

4. Home refinance apps fell 11.0% w/o/w, below the previous decrease.

5. Chicago PMI came in at 59.5 for February, below expectations.

6. Retail inventories fell 0.6% m/o/m, below the previous increase.

7. State Street Investor confidence index came in at 91.9 for February.

Thanks, Matt.

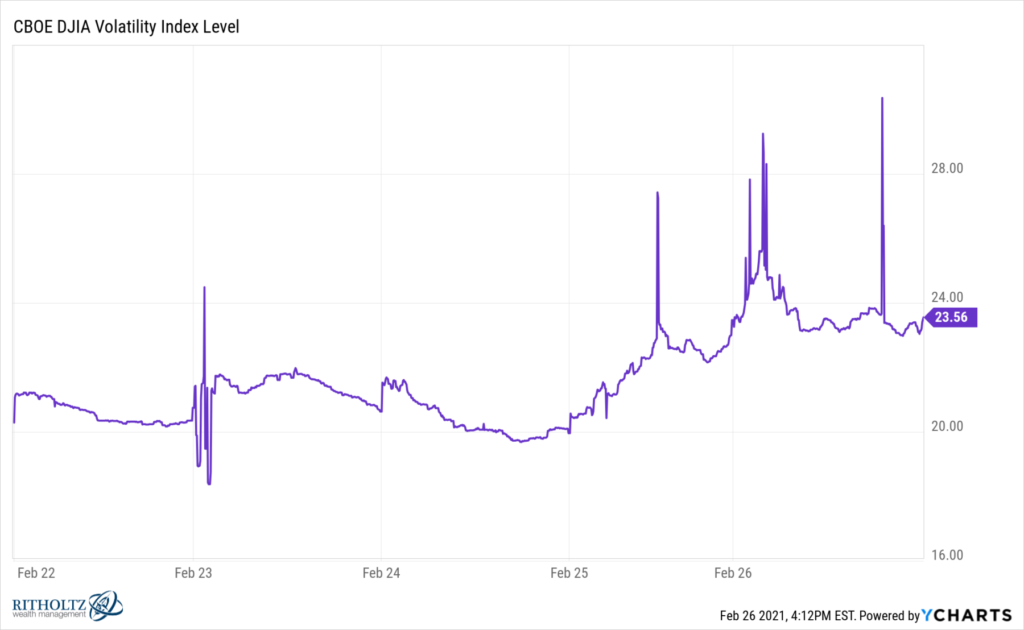

This week in Volatility: CBOE DJIA Volatility Index

Source: YCharts