The weekend is here! Pour yourself a mug of Vienna Mexican coffee, grab a seat by the fire, and get ready for our longer form weekend reads:

• The Secret History of the Shadow Campaign That Saved the 2020 Election A weird thing happened right after the Nov. 3 election: nothing. The nation was braced for chaos. Liberal groups had vowed to take to the streets, planning hundreds of protests across the country. Right-wing militias were girding for battle. In a poll before Election Day, 75% of Americans voiced concern about violence. Instead, an eerie quiet descended… (Time)

• Rise and fall of the house of Bitcoin A Buenos Aires hacker haven produced some of Argentina’s most valuable crypto companies. Then it suddenly disappeared. (Rest of World) see also The Rise and Fall of Bitcoin Billionaire Arthur Hayes The BitMEX cofounder created a cryptocurrency exchange that has traded trillions. Now he’s wanted by U.S. authorities, and insiders wonder whether he and his partners are villains—or victims of a two-tiered justice system that favors big banks over brash outsiders. (Vanity Fair)

• Apple Is the $2.3 Trillion Fortress That Tim Cook Built Trade war? Pfft. Trump? Please. Antitrust? Zuck’s prob. (Ditto privacy.) Revenue? Endless. Tim Cook has been counterpunching, broadening his influence over the mobile phone industry while marketing Apple’s commitment to privacy as the antidote to the practices of social media companies. (Businessweek)

• Mistakes and Memes Mistake: I was looking to the real world as a guide to understanding the Internet, when it was in fact inevitable that the Internet would, over time, come to impact the real world. Some of that impact will be fleeting; some will have short term effects, particularly in places, like Wall Street, that easily translate sentiment into prices. The most intriguing people are those that leverage memes to build something new. (Stratechery)

• Michael Hintze explains himself: Famed Hedge Fund Firm CQS Is Surviving — But Not Because of Its Hedge Funds A near-forensic appraisal of the entire firm’s operations meticulously combing through individual positions in every portfolio and reexamining all aspects of day-to-day decision-making. Ultimately, CQS reorganized teams, revamped portfolios, and put in place a new board executive committee and a senior partners’ group. (Institutional Investor)

• Covid Brought Booze to Your Door—and Made Delivery Worth Billions Prohibition-era regulations stifled liquor e-commerce in the U.S. for decades. Pandemic lockdowns sparked demand almost overnight. (Businessweek)

• The Thirty Tyrants: The deal that the American elite chose to make with China has a precedent in the history of Athens and Sparta The poisoned embrace between American elites and China began nearly 50 years ago when Henry Kissinger saw that opening relations between the two then-enemies would expose the growing rift between China and the more threatening Soviet Union. At the heart of the fallout between the two communist giants was the Soviet leadership’s rejection of Stalin, which the Chinese would see as the beginning of the end of the Soviet communist system—and thus it was a mistake they wouldn’t make. (Tablet)

• From Tech Critique to Ways of Living Neil Postman was right, but so what? The proper response to Technopoly is not to shun technology itself, for human beings are intrinsically and necessarily users of tools. Rather, it is to find and use technologies that, instead of manipulating us, serve sound human ends and the focal practices that embody those ends (The New Atlantis)

• Is Spacetime Real? “What exactly is spacetime? Is it a real thing like an atom, or just a mathematical construct that is used to describe how mass ‘generates’ gravity?” (Forbes)

• Once Upon a Time in Central Florida: Inside Give Kids the World Village, where the ice cream is unlimited, nightly tuck-ins from six-foot bunny rabbits are complimentary, and Santa Claus visits every Thursday. (Afar)

Be sure to check out our Masters in Business interview this weekend with Ben Inker, head of Asset Allocation at GMO, which manages about $60 billion in assets. During Dotcom implosion, GMO’s US Aggressive Long/Short Strategy achieved 80+% cumulative net returns for their clients. Inker is widely regarded as founder Jeremy Grantham’s heir apparent.

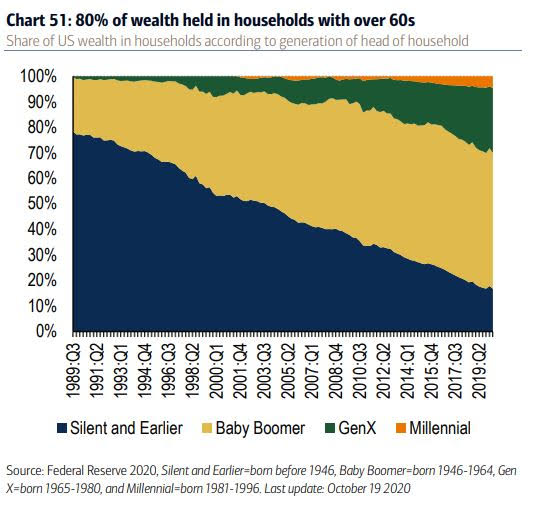

80% of U.S. wealth is held by people 60 and over

Source: @MichaelBatnick

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.