The weekend is here! Pour yourself a mug of Portland Organic French Roast coffee, grab a seat by the window and get ready for our longer form weekend reads:

• Sneakerheads Have Turned Jordans and Yeezys Into a Bona Fide Asset Class When the pandemic presented a buy-low opportunity, one college dropout hit the road and filled his truck with $200,000 worth of kicks. The sneaker boom has created opportunities for a new generation of speculator. Young resellers are the first to treat footwear as a bona fide asset class, products as worthy of informed valuation and investment as any other commodity. The sneaker market, for them, is a lot like playing the market. (Businessweek)

• Sex Tapes, Hush Money, and Hollywood’s Economy of Secrets Meet Kevin Blatt, the celebrity fixer who’s a master at shepherding compromising material off the internet—or into the hands of the highest bidder. A Movie Star’s agent will never take a call from a stranger, but Kevin Blatt reads every message and follows up on every tip. You never know who might have the goods. Over the past two decades, Blatt has become a one-man clearinghouse for everything seedy in Hollywood—the fixer you call when you want to see whether the thing you have that could humiliate a famous person is worth anything. (Wired)

• Ultra-fast Fashion Is Eating the World: Even a pandemic can’t stop people from buying clothes they don’t need. In times of crisis, consumers don’t stop shopping—they just limit their purchases to affordable pleasures. Fast fashion had expanded its market share during the 2008 global financial crisis; now this new cohort of companies—known as ultra-fast fashion—was poised to do the same. (The Atlantic)

• Utilities Offer Yield and a Way to Play Green Energy. And Their Stocks Are Cheap. By the next decade, clean power sources such as wind and solar are projected to provide 39% of the U.S. utility industry’s generating capacity versus 13% today. Coal is forecast to account for 3%, versus 19% now. Natural gas, now the dominant source of electricity generation, could fall to 28% by 2030 from 40%. As a result, the industry’s carbon emissions could decline by 60% from 2020 to 2030.(Barron’s)

• Elon Musk moved to Texas and embraced celebrity. Can Tesla run on Autopilot? Investors fear a world where Musk no longer leads the company. But his attention is already going elsewhere. (Washington Post) but see It looks like the Batmobile, works on solar energy, and could be the future of cars Aptera Motors, a California company whose name comes from the ancient Greek for “wingless,” is rolling out the first mass-produced solar car this year. It’s a three-wheel, ultra-aerodynamic electric vehicle covered in 34 square feet of solar cells. (Washington Post)

• How to Remember a Disaster Without Being Shattered by It Margaret McKinnon survived a midair catastrophe, then became a major researcher of memory and trauma. Now she’s studying how the pandemic will haunt us. (Wired)

• The Activists Who Embrace Nuclear Power On December 8, 1953, President Dwight Eisenhower delivered his “Atoms for Peace” speech at the United Nations General Assembly. He described the dangers of atomic weapons, but also declared that “this greatest of destructive forces can be developed into a great boon, for the benefit of all mankind.” Stockpiles of uranium and fissionable materials could be used “to provide abundant electrical energy in the power-starved areas of the world.” (New Yorker)

• How vulnerable is the world? Sooner or later a technology capable of wiping out human civilisation might be invented. How far would we go to stop it? (Aeon)

• This Rural Liberal Set Out to Talk to His Pro-Trump Neighbors It didn’t go well — until it did. For rural liberals like me, Joe Biden’s win certainly didn’t usher in a new era of sweetness and light. All 18 of the politicians we just sent to New Hampshire’s very large state legislature are Republican, and before you call them New England moderates, consider that when the delegation met in December, in a small room, it made protective face coverings optional, in defiance of a statewide mask mandate. (Washington Post)

• Close Encounters of the Worst Kind: A brutal, bloody hunt. A ghastly, devastating attack. And a state left divided on what to do about its 2,500 black bears, with whom New Jerseyans cross paths hundreds of times per year. (Sports Illustrated)

Be sure to check out our Masters in Business interview this weekend with Jean Hynes, incoming CEO of Wellington Management. The firm has over $1 trillion client assets under management. Hynes also runs the $51B Vanguard Healthcare Fund – the country’s largest health care fund.

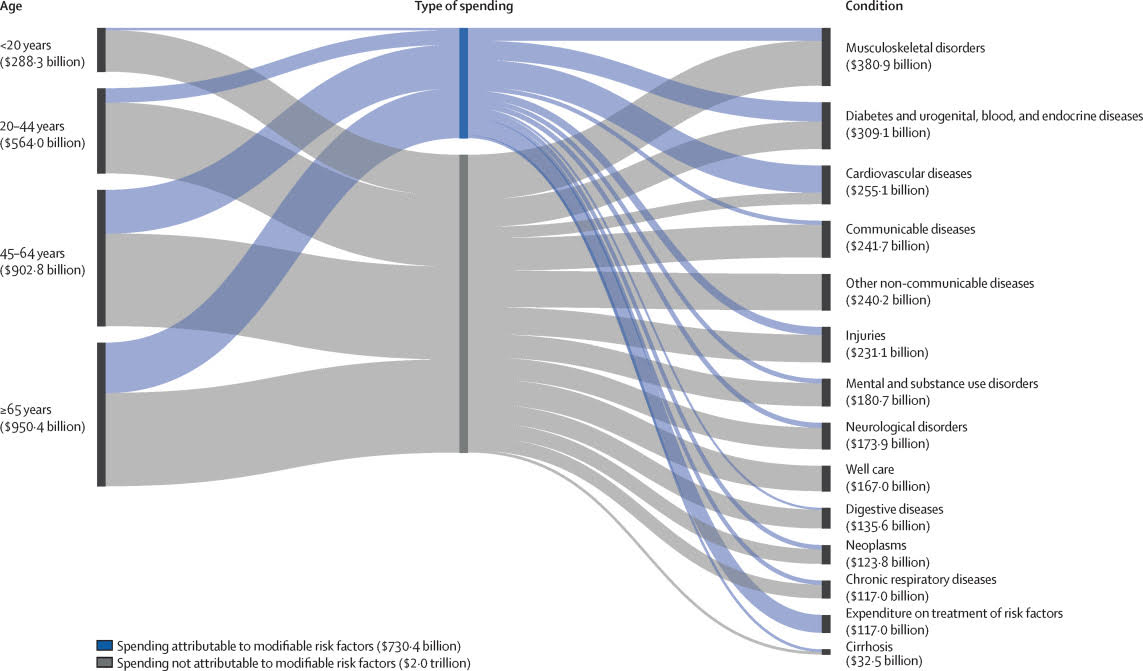

Modifiable Health-care risk factors in the USA

Source: The Lancet

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.