My end of week morning train WFH reads:

• No one knew secret behind Ford’s Mustang Mach-E, Bronco Sport — until now The Bronco Sport wasn’t in the original plan at Ford. The prototype that would become the Bronco Sport started out as a boxy, bland, nondescript, unmemorable small SUV. Definitely not part of a legendary Bronco family. And the project that became the Mustang Mach-E SUV was initially a cautious toe in the water for an automaker debuting its first dedicated all-new, all-electric vehicle. It was conceived to help meet fuel economy targets for the company. Now each SUV has a waiting list. (Detroit Free Press)

• Inflation Isn’t Happening, and It Likely Won’t. Here Are 7 Charts Showing This. Inflation may be on many investors’ minds, but it has yet to show up in the numbers. Moreover, a close reading of the data suggests that inflation won’t be a problem for some time, if ever. (Barron’s)

• Companies That Rode Pandemic Boom Get a Reality Check While the pandemic battered the economy, tech companies and consumer companies powered by digital technology stood out as islands of growth. But with coronavirus cases and deaths falling, more than two million Americans a day getting vaccinations and the overall economic outlook improving, investors are starting to turn elsewhere. (New York Times)

• Inside ‘The Firm’: How The Royal Family’s $28 Billion Money Machine Really Works “I don’t know how they could expect that after all of this time, we would still just be silent if there is an active role that The Firm is playing in perpetuating falsehoods about us.” The Firm—also known as “Monarchy PLC”—are the public faces of a $28 billion empire that pumps hundreds of millions of pounds into the United Kingdom’s economy every year. Here’s how it affects their 1,000-year-old business. (Forbes)

• Bitcoin As A Meme And A Future: Most people who ask the Bitcoin Question admit that they weren’t imagining any particular use for the currency. They don’t predict that the banking system is going to collapse, leaving only Bitcoin. Nor do they really think that the value of the U.S. dollar will crash so radically and permanently that Bitcoin becomes a more stable asset. But still, they ask, butstill? (Noema)

• How Lucky Are You? The highly unlikely happens surprisingly often. Nassim Taleb wrote “We tend to underestimate the role of luck in life in general (and) overestimate it in games of chance.” A special basketball randomness edition in honor of March Madness (Better Letter)

• Supplying Demand: The Chip Shortage in Macro Context The present semiconductor shortage is best understood as both an acute and long-gestating crisis. Given present capacity constraints in shipping and widespread economic disruption from the pandemic, the current shortage is not surprising. At the same time, semiconductor manufacturing has seen a generalized decay in capital expenditure over the past twenty years (Medium)

• Biden’s $4 Trillion Industrial Policy Faces Bigger Hurdles Than Politics The price tag for the infrastructure and manufacturing push could be too high for Republicans, but it’s economic forces that are the real obstacle. (Businessweek)

• Your Loved Ones, and Eerie Tom Cruise Videos, Reanimate Unease With Deepfakes A tool that allows old photographs to be animated, and viral videos of a Tom Cruise impersonation, shined new light on digital impersonations. (New York Times)

• Mehdi Hasan Thinks There’s One Thing Journalists Should Be Biased About The president who proved shamelessness is a political superpower also exposed real flaws in the traditional American model of journalism. Interviewers struggled to grapple with Trump or his lackeys, who would simply lie, deny, and attack in the face of a probing line of questioning. A bias for democracy is a bias “we should be proud about, open about, and not hide or run away from.” (Esquire)

Be sure to check out our Masters in Business interview this weekend with Jeff Immelt, former CEO of General Electric from 2001 to 2017. He joined GE in 1982, in its plastics, appliances, and healthcare division, and led GE’s Medical Systems division from 1997 to 2000. His new book is: Hot Seat: What I Learned Leading a Great American Company.

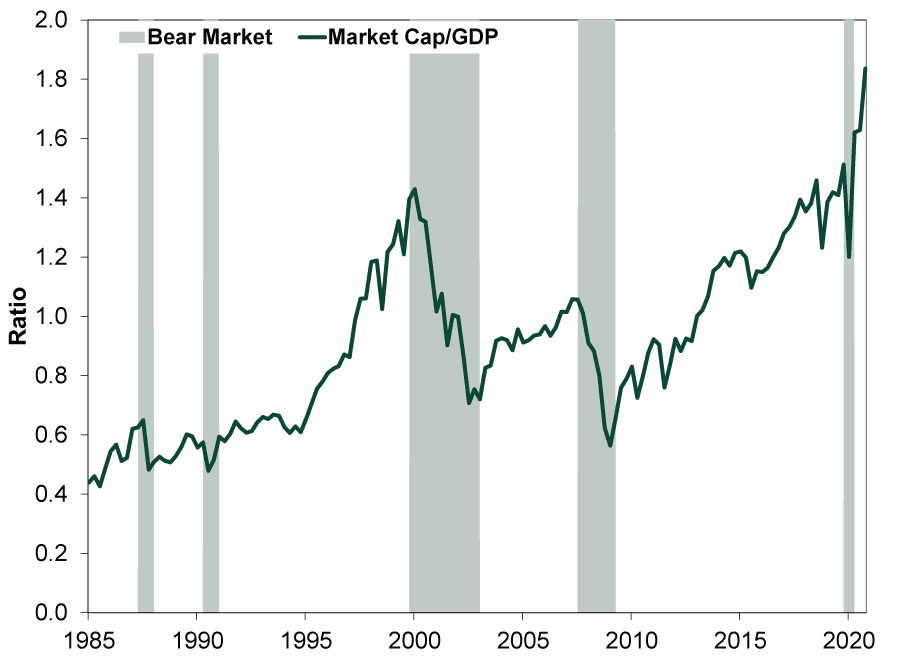

Dissecting the Buffett Indicator

Source: Fisher Investments

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.