My Two-for-Tuesday morning train WFH reads:

• “Buy and Hold” No More: The Resurgence of Active Trading Conventional wisdom holds that passive trading is the rational investing strategy. Active traders are often portrayed as gambling rubes or lucky opportunists who will be handily beaten by index funds. But the steady growth of platforms like eToro and Robinhood has tipped the power from institutions back to individuals and created a renewed interest in active trading. (a16z.com) see also The Start-Up Enemies of Wall Street Are Booming Times are flush for young tech companies like Stripe and Coinbase, which are having a moment as they upend the financial establishment. (New York Times)

• “Asset price inflation” is not a thing American society — healthcare, childcare, and related goods really are becoming less affordable. But that’s not what inflation is. Also not inflation is the thing that some people, including major investment managers and venture capitalists, have taken to calling “asset price inflation.” (Slow Boring)

• Remote Work Is Here to Stay. Manhattan May Never Be the Same. New York City, long buoyed by the flow of commuters into its towering office buildings, faces a cataclysmic challenge, even when the pandemic ends. (New York Times) but see How City Office Centers, Written Off as Relics, Will Return, Post-Pandemic The urban workspaces of the future are going to see more personalization, more automation, and more focus on health and wellness. (CIO)

• Cathie Wood’s ARK Invest has an innovative, compelling content strategy Great content strategy understands that content is much more than words written into paragraphs or a person talking to a camera. It’s numbers and stories and emotion all intertwined to drive feedback loops and desired actions. It’s a compelling story that ends up occupying some amount of our collective thinking. (The Margins)

• JPMorgan, Salesforce Join Growing List of Firms Dumping Office Space Rise of remote work means demand for office space could be permanently lower for some companies (WSJ) see also Covid-19 Clobbered Manhattan. Lower Rents Could Seed Recovery. Shutdowns and other changes brought on by the pandemic have bruised Manhattan’s economy. But because rents for storefronts, apartments and workspaces have been pushed down to their lowest levels in years, new small businesses and residents have moved in. (WSJ)

• The US Is Real Close to Screwing Up Electric Vehicle Charging Forever There is no such thing as “the” EV charging network. It’s a complicated patchwork of plugs and proprietary software. And unless something changes, it’s only going to get worse. (Vice)

• Germany’s Climate Obstacle: Its Love Affair With Combustion Cars Automakers enjoy deeply embedded support from customers and have influence over government policy.(Bloomberg) but see With ID.4, Volkswagen Has Electric SUV That Whispers, Not Shouts Capable, well-equipped, and nice-looking, Volkswagen’s entry into the growing field of electrified utility vehicles will fit in with a lot of families. (Bloomberg)

• Asian Americans Are Ready for a Hero: After going from “model minority” to invisible minority to hunted minority, the community needs a generation of cultural and political leaders. (Businessweek)

• Who Helps Pay Amazon’s Low-Wage Workers? You Do. Taxpayers pick up the tab for employees at big companies whose paychecks won’t cover basic necessities. (Bloomberg) see also How McDonald’s and Wal-Mart Became Welfare Queens According to one study, American fast food workers receive more than $7 billion dollars in public assistance. (The Big Picture)

• The Time My Dad Locked Down Elgin Baylor His N.B.A. legacy will loom large in basketball history. But the time our columnist’s father managed to defend Baylor for a half became a cherished part of family lore. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Gary Chropuvka, President of World Quant. The firm was spun out of Millennium Management in 2007, and manages about $7 billion dollars. Previously, Chropuvka was co-head of the Quantitative Investment Strategies (QIS) team at Goldman Sachs Asset Management (GSAM).

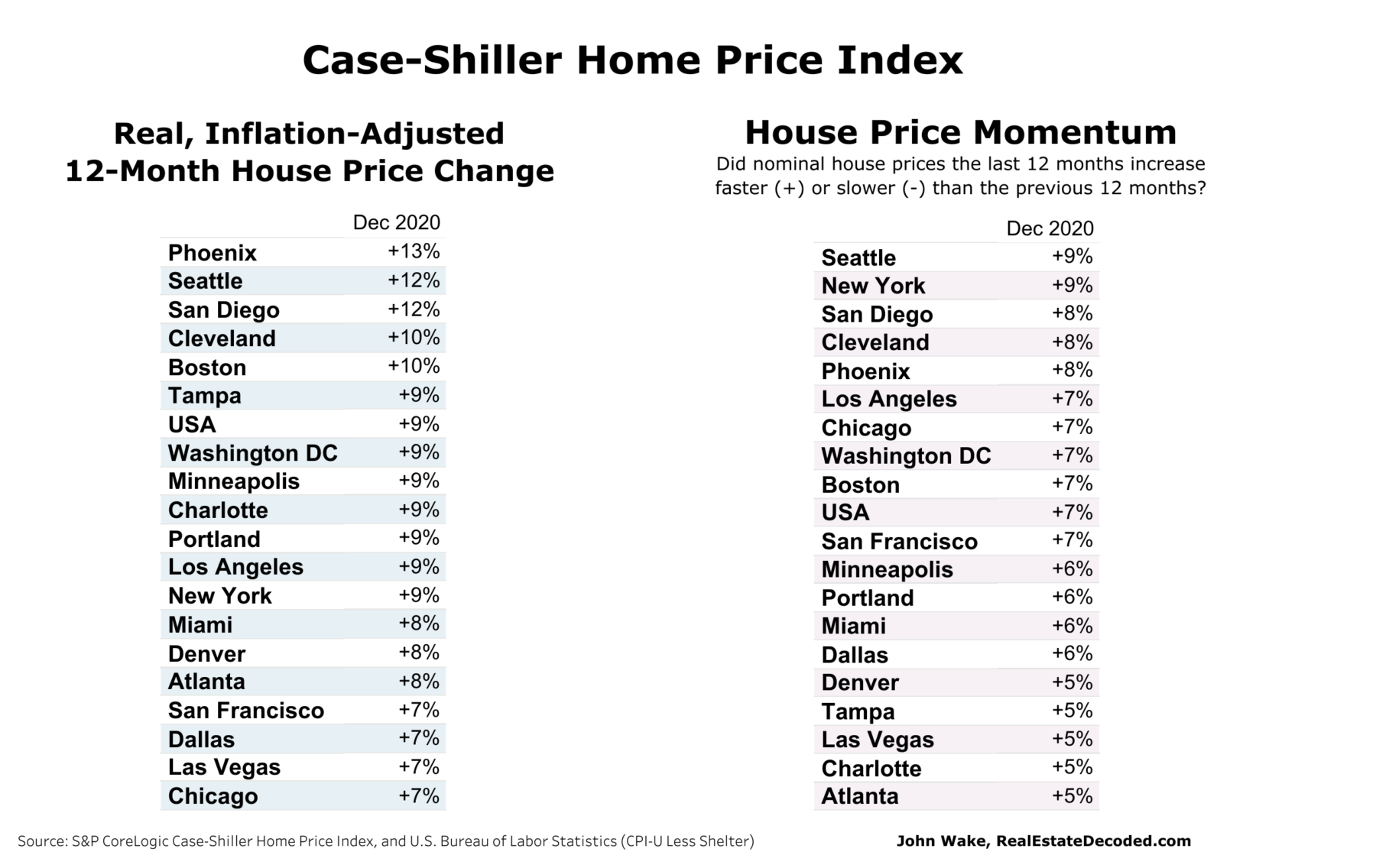

Real, inflation-adjusted house prices were up 9% from December 2019 to December 2020

Source: Real Estate Decoded

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.