My mid-week morning train WFH reads:

• How Not to Panic About Inflation Do you remember the great inflation scare of 2010-2011? It’s an episode worth revisiting, because there’s a good chance that we’ll see a replay over the next year or so. (New York Times)

• A Look Back at the Corona Crash One Year Later In the span of a month there were 8 days with losses of 3% or worse, 4 daily drops of 5% or worse, 7 daily gains of 3% or more, 5 daily gains in excess of 6%. Out of 21 trading sessions, there was only one that wasn’t a gain or loss of 1% or more. I never thought it would be possible to top what took place in 2008-09 but March 2020 did that for me. (A Wealth of Common Sense) see also Started From the Bottom We may never see a better 1-year rally: If you had bought the S&P 500 on March 23, 2020, you would now be up by 76% (excluding dividends): (Of Dollars And Data)

• Target-Date Funds Exploit Their Investors’ Long Time Horizons. Here’s How. Managers of long-term retirement funds face limited investor scrutiny — and potential conflicts of interest abound. (Institutional Investor)

• Is a Tweet the Next Mona Lisa? Dorsey’s $2.9 Million Sale Raises Questions of Value The Twitter founder’s first public message on the platform was bought by the head of a blockchain service. But what determines the worth of a digital scrawl? (Bloomberg)

• Were the Airline Bailouts Really Needed? Once again, we have socialized an industry’s losses and privatized its profits. The question isn’t whether airline employees should have been helped, it’s whether airline shareholders should have been. (DealBook)

• Covid-19 Vaccine Manufacturing in U.S. Races Ahead Vaccine makers are expected to produce 132 million doses this month, nearly tripling last month’s figure, boosting vaccination drive (Wall Street Journal)

• These Electric Motorcycles Are Set to Take Charge in 2021 After years of underpowered toys, the EV market for motorcycles is surging with exciting new possibilities. (Bloomberg) see also The Pandemic Is Creating a ‘Postwar Boom’ for Luxury Carmakers – Call it the Covid-19 carpe diem effect. “We began 2020 with the strongest order bank since 2003—and we started this January with 50% more orders than last January” (Pursuits)

• The uneasy intimacy of work in a pandemic year How capitalism and the pandemic destroyed our work-life balance. (Vox)

• Why Oumuamua, the Interstellar Visitor, Looks Eerily Familiar A piece of an extrasolar Pluto may have passed through our cosmic neighborhood, a new study suggests. (New York Times)

• Why Is Tower Records Coming Back Now, of All Times? Tower’s rise coincided with the rise of youth music culture. The store became a sort of church where young people would gather to talk about music, look at album covers, and, with any luck, buy something. And they did buy. (Slate)

Be sure to check out our Masters in Business interview this weekend with Gary Chropuvka, President of World Quant. The firm was spun out of Millennium Management in 2007, and manages about $7 billion dollars. Previously, Chropuvka was co-head of the Quantitative Investment Strategies (QIS) team at Goldman Sachs Asset Management (GSAM).

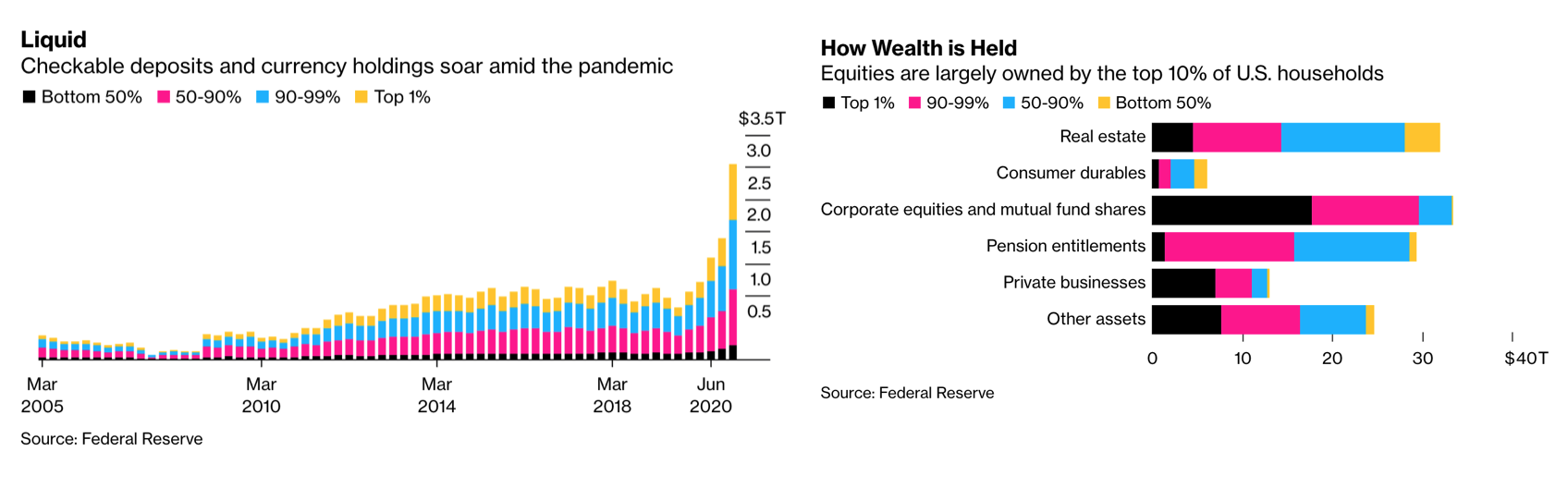

The Wealth Gains That Made 2020 a Banner Year for the Richest 1%

Source: Bloomberg

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.