Last month, I reviewed Ray Dalio’ s take on whether or not we were in a full blown bubble. (Dalio’s take was closer to a bubble than 1 year ago, but still less of a bubble than 1999-2000).

The latest hot take on bubbles comes to us via GS. While not as quantitative as the Bridgewater approach, I like their checklist of 9 characteristics of a bubble:

Common Characteristics

1. Excessive price appreciation and extreme valuations 2. New valuation approaches justified

3. Increased market concentration

4. Frantic speculation and investor flows

5. Easy credit, low rates and rising leverage

6. Booming corporate activity

7. ‘New era’ narrative and technology innovations

8. Late-cycle economic boom

9. The emergence of accounting scandals and irregularities

Their conclusion: Sure, there are pockets of excessive valuations in equities, but it is not remotely close to a full blown bubble.

I agree with the conclusion that while there is some froth, we are not in a bubble.

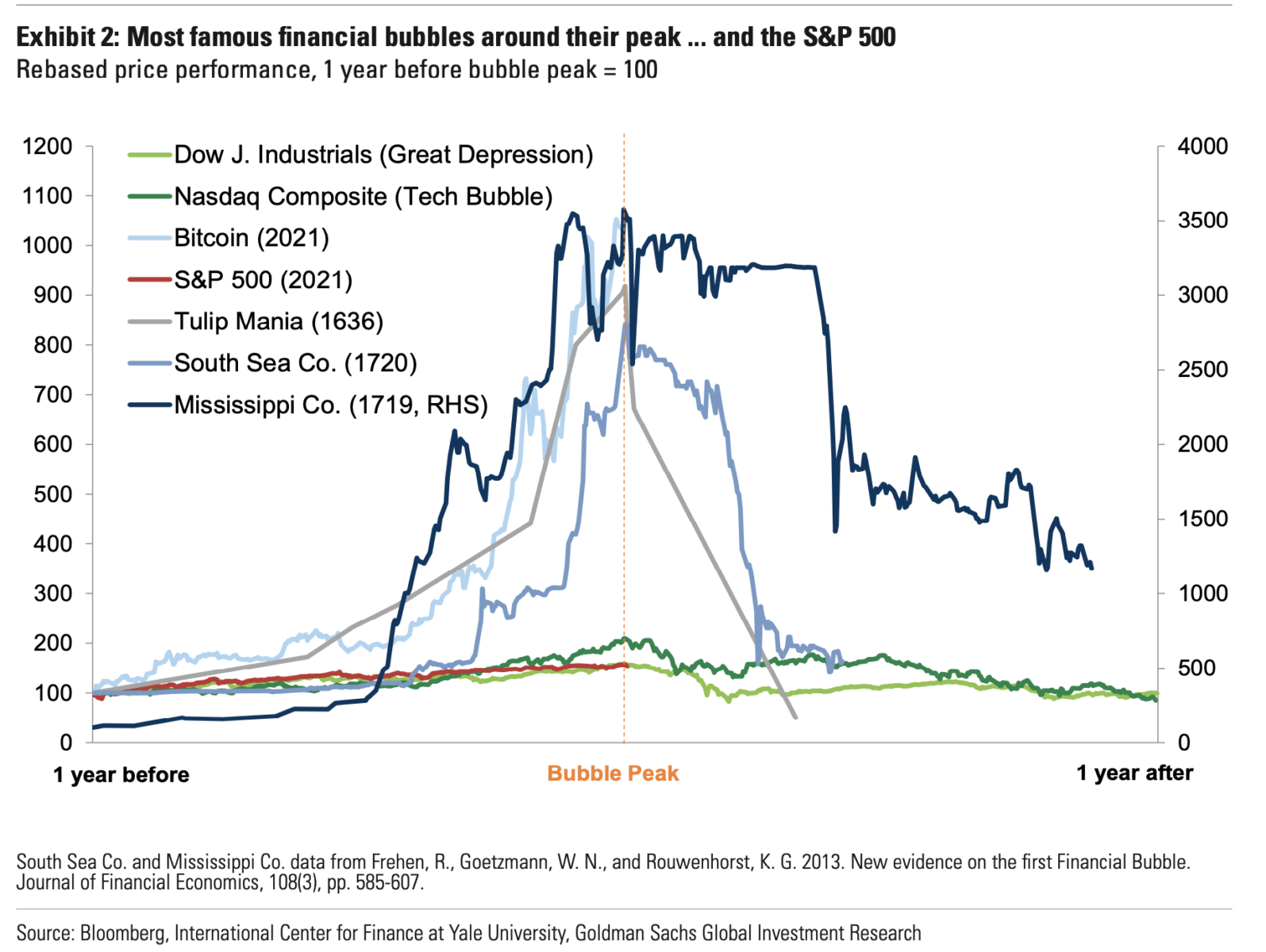

But the chart above is noteworthy for another reason: It shows Bitcoin more or less a bubble comparable to the South Sea Bubble (1720), the Mississippi Company Bubble (1719), and Tulipmania (1636).

Previously:

Dalio: How to Spot a Bubble (February 23, 2021)

Bottoms Are Easier to Spot than Tops (February 17, 2021)

No, It Is Not a Bubble (Yet) (February 27, 2020)

Trump: The Economy is in a Bubble (No, its not) (December 21, 2015)

Checklist: How to Spot a Bubble in Real Time (June 9th, 2011)

Bubbles (TBP)