My mid-week morning train WFH reads:

• How People Get Rich Now In 1982 the most common source of wealth was inheritance. Of the 100 richest people, 60 inherited from an ancestor. By 2020 the number of heirs had been cut in half, accounting for only 27 of the biggest 100 fortunes. How are people making these new fortunes? Roughly 3/4 by starting companies and 1/4 by investing (Paul Graham)

• Why Delaware is the sexiest place in America to incorporate a company Nearly 1.5m companies are incorporated in Delaware. How did this tiny state become a mecca for corporate activity? (The Hustle)

• “I Just Like the Stock” versus “Fear and Loathing on Main Street”: The Role of Reddit Sentiment in the GameStop Short Squeeze The tone and number of comments influence GME intraday returns. Sentiments extracted from longer threads have a greater influence. Fear is the dominant sentiment in all comments, while comments that express a Sad sentiment show the most significant impact. While investors may just like the stock, it appears that fear and loathing also are important. (SSRN)

• Why Coinbase’s stellar earnings are not what they seem It’s easy to be profitable if your real unique selling point is being a beneficiary of regulatory arbitrage. (Financial Times)

• 6 boomtowns: What’s driving LI’s rising home prices Long Island’s real estate market has gone wild during the pandemic, with luxury homes that once languished on the market suddenly sparking bidding wars, and some first-time homebuyers scrambling to make offers of $30,000 or more over asking prices. (Newsday) see also That Suburban Home Buyer Could Be a Foreign Government Big foreign investment firms that buy office buildings, hotels and shopping centers around the world have a new favorite real-estate play: single-family homes in American suburbs. (Wall Street Journal)

• The Consumer Price Index Is Not Economic Reality The nation’s leading indicator of inflation has always existed as a creature of politics and power, revised and updated in ways that betray its image. (Bloomberg)

• How long can the Substack party last? A moat could be a tricky thing to maintain once everyone realises that fees can add up to more than 20 per cent. (Financial Times)

• Over 3 Million People Took This Course on Happiness. Here’s What Some Learned. It may seem simple, but it bears repeating: sleep, gratitude and helping other people. (New York Times)

• US suicides dropped last year, defying pandemic expectations The number of U.S. suicides fell nearly 6% last year amid the coronavirus pandemic — the largest annual decline in at least four decades. Death certificates are still coming in and the count could rise. But officials expect a substantial decline will endure, despite worries that COVID-19 could lead to more suicides. (Associated Press)

• Non-Fungible Taylor Swift It’s not just Fearless, it’s Fearless (Taylor’s Version); which version do you think that Swift fans will choose to stream (which, after all, is where most of the residual value of Fearless lies)? That’s the part that Logan forgot: when it comes to a world of abundance the power that matters is demand, and demand is driven by fans of Swift, not lawyers for Big Machine or Scooter Braun or anyone else. (Stratechery)

Be sure to check out our Masters in Business interview this weekend with Rob Arnott, founder and chairman of Research Affiliates. The firm created & patented a methodology for basing indexes on fundamental metrics instead of market cap weighting, and its strategies runs over $160 billion in assets. Arnott is the author of over 100 academic papers, and is the co-author of the book “The Fundamental Index: A Better Way to Invest.”

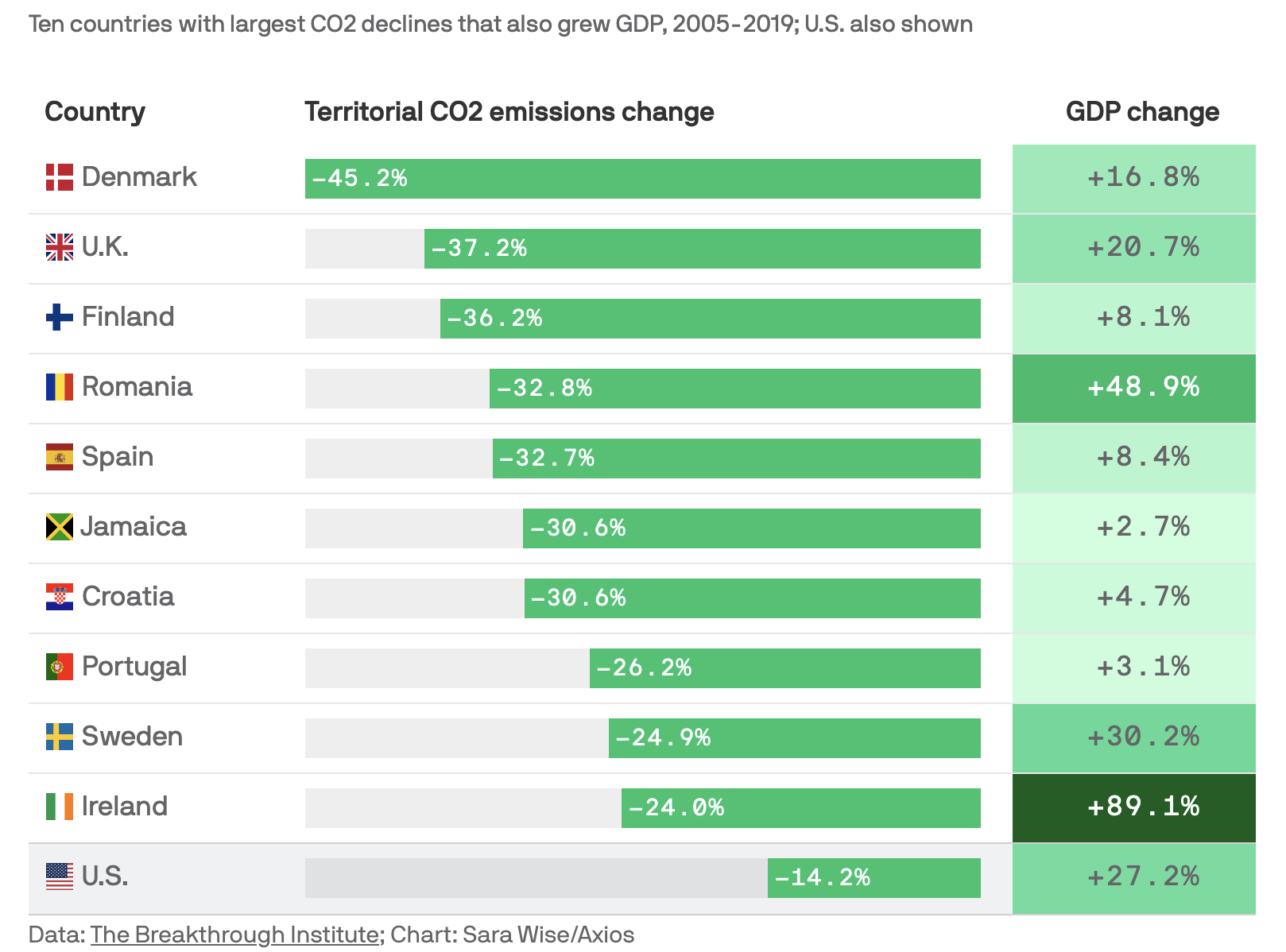

Decoupling of emissions and economic growth

Source: Axios

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.