Update, April 29, 2021: This turned out to be more correct than I would have guessed, with a few of these assumptions confirmed in the recent POTUS speech. Note this was written and published prior to that 1st “100 days” speech and address to Congress being released.

Spoiler alert: Forget the 40% capital gains rate — its DOA, merely misdirection, designed to distract from the real show. My best deductive reasoning leads me to conclude the administration has decided that the 1% have amassed so much money and power, that they deserve their own (higher) tax bracket.

That is the philosophy behind the new cap gains proposal: Treat the top 1% as unique, and tax them accordingly.

Allow me to share my thinking about the proposed doubling of the capital gains tax rate to 40%. I am not going to weigh in on whether or not I support it — thats not especially relevant — but rather, how we got here, and what might be going on behind the scenes, and what is more likely to occur (if anytrhing). Contrary to some of the hyperbolic hysteria you may have seen on social media, there is a method to the madness.

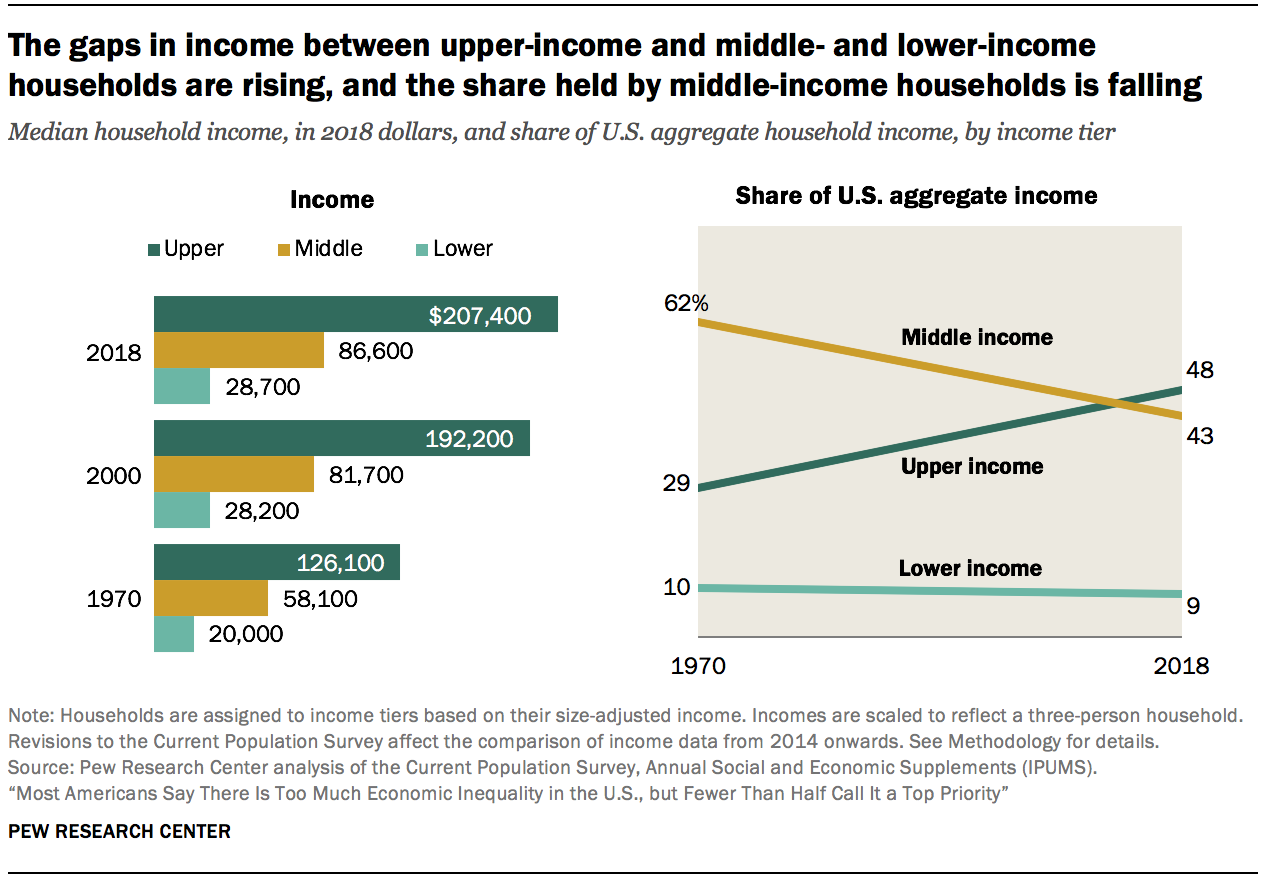

But first, my priors: Following World War Two, the United States enjoyed an unprecedented expansion of the middle class. Corporate CEOs earned about 25 times what the average worker made; jobs with good benefits were plentiful, wages rose regularly. Education and healthcare was affordable.

That began to change when Stagflation took root in the 1970s; change accelerated under President Reagan as tax rates were slashed. Not long after that, audits and enforcements at the IRS began to decrease. Capital began to outpace Labor – modestly at first, and then more significantly. In the 1990s, President Clinton introduced a tax change intended to limit executive pay – but it had the exact opposite effect, shifting more of their compensation from wages to stock options. This led to the creation of vast fortunes including an increased number of millionaires and billionaires. It was the law of unintended consequences writ large. That was before President Trump cut the Corporate tax rate in 2017.

Today, Corporate CEOs earned about 200+ times what the average worker makes (or 320x or whatever); good jobs with good wages and benefits are much less plentiful, Education and healthcare are unaffordable.

Hence, that is from whence my analysis begins. I believe that strategically, the proposed 40% is a misdirection, and a brilliant one at that. It is not at all what this is truly about.

Currently, there are three tiers of long-term capital gains taxes (plus the 3.8% ACA surcharge).

$0 – $40,400 = 0%

$40,401 to $445,850 = 15%

Over $445,850 =20%

If you make under $39,000 per year, your LT cap gains is zero. Nada, nothing, zero, zilch, you pay no capital gains taxes. Truth be told, you probably don’t own any equity or real estate and likely have no cap gains, but if you do, you get a pass.

If you are in the fat part of the income curve, making more than $39k all the way up to $425k, then you pay 15%. This covers a lot of folks you might think of as poor, middle class, upper middle class and not-quite-rich-but-very-comfortable.1

The top tier for long-term capital gains taxes for those making more than $425,000 is 20%. But that treats the top 1% as if they are a uniform group. 2 The simple mathematical reality is the income range of the bottom 99% is less than half a million dollars: Its 0 to about $500k. 3 The top 1% includes people making $500 thousand, $5 million $50 million, $500 million, $5 billion and more. Its incredibly wide, and the bottom of the top 1% has very little in common with the top 0.1% and even less with the top 0.01%.

What the Biden proposal does create a new 4th capital gains tax tier for the top 1%. This is driven by the simple calculus of who owns equities and other property subject to cap gains. For our purpose, let’s use stock holdings:

Richest 1% own >50% of the outstanding equity.

Next 9% own more >30%

Top 10% hold >88% of shares.

The Biden Administration wants a higher capital gains tax on the top 1% 4 for the same reason Willie Sutton robbed banks: Because that’s where the money is.

What about that bottom half (or 60 or 80%) whose incomes have failed to keep up with inflation, productivity, corporate profits and the C Suite? They suffer some of the world’s most neglected, and occasionally world’s worst, infrastructure. The Interstate Highway System was built in the 1950s, and for a few decades, it was glorious. But the gasoline tax that pays the Highway Trust Fund that does the maintenance has been frozen since the late 1993 – and it shows. Travel the world and you cannot help but see how antiquated and behind the times the USA is. It is not just roads and bridges and tunnels, its everything infrastructure from airports that are third world to crappy Mass Transit to a shaky Electrical Grid. Large swaths of the population do not have reliable access to Broadband. Harbors that remain vulnerable, a water supply system that has become increasingly dangerous. To say nothing of the worst Cell service is the Western world.

I interpret the proposal as being motivated as follows: This admin believes the top1% has enjoyed outsized benefits for decades, while the bottom 50, 75, even 90%? Have fallen behind. Hence, to pay for the badly needed upgrade, the top1% are going to have to pay for more capital gains taxes.

Sidenote: The Silicon Valley VCs have been screaming about this; my informal survey is that Hedge funds and private equity are just as – annoyed is probably the right word? – but they HF/PE tend to have lower profiles. VCs are more active on social media; these are many of the companies they have invested in that are generating all of those capital gains taxes. Its more than merely “talking their book,” they are literally talking “on their books.”

The complaining about killing the engines of economic growth are part of the mythology. As Tim O’Brien noted, “There is no evidence for any of the calamities that opponents argue would befall the economy and markets.”

My bit of game theory on the Carried Interest deduction: the prosed raise to 40% makes President Trump’s unfulfilled promise to eliminate this a non-issue by making cap gains and wages taxes similarly. But a lower number – say 25% – still creates a loophole. To be an effective rate, the unique carried interest deduction would need to be eliminated, too, for the new cap gains rate to be meaningful.

The secret misdirection in the proposed capital gains tax increase is the 40% – its DOA and never had a chance of passage. But 25% is viable, and 15 – 20 – 25 has a nice balanced rhythm to it. If any change does occur, I expect it would look something like that. 5

___________

1. This is due to how much the cost of living and salary changes by geography. $425k is not rich in New York or San Francisco or many other large cities, but it is pretty well off in most of the country

2. Specifically, if you make an annual income of $538,926 you are among the top 1% of all taxpayers. Among the approximately 1.4 million taxpayers who meet this threshold, the average annual income is about $1.7 million – about 20 times the average income of $82,535 among all taxpayers; see e.g. USA Today or Investopedia.

3. You will see a wide range of numbers quoted for the top1% of income. The reason for this is the denominator: Are we looking at all Americans, all taxpayers, or all workers? Each group has a slightly different top 1%.

4. If we really wanted to slice this finer, there should probably be tiers for top 10%, 1% and 0.01%, but the added complexity would not be worth the trouble.

5. If it proves successful, don’t be surprised if similar a top tier on income gets proposed eventually. I have no idea how likely that is or if its even desirable, but if some form of cap gains increase goes through, it would provide some data and an impetus to think that possible change through to its logical conclusion.