My Two-for-Tuesday morning train WFH reads:

• This Bull Market Is Far From Over, Pros Say. One year ago, U.S. stocks were just beginning to recover from the swiftest and deepest selloff in modern memory. Today, after a vertiginous rally, they are trading near all-time highs. Yet, the nationwide rollout of Covid-19 vaccines, the persistence of ultralow interest rates, and expectations for torrid economic growth have convinced America’s money managers that the stock market still has more room to rise. (Barron’s) but see Now That Everyone Is Bullish, Be Cautious The economy and the stock market have churned out spectacular numbers, and investor optimism is high. But don’t forget to hedge your bets. (New York Times)

• What Wall Street Is Telling Us About the U.S. Economic Outlook Investors are betting that government stimulus and Covid-19 vaccines can return the economy to how it stood just before the pandemic (Wall Street Journal)

• The Most Important Number of the Week Is $329,100 The median price of an existing home in the U.S. rose to a record in March, but don’t call the housing market a bubble. (Bloomberg) see also U.S. Home Sales Are Surging. When Does the Music Stop? Nervous buyers and sellers are asking: ‘When is the housing market going to crash?’ Here’s what to expect this year. (New York Times)

• Yale endowment model architect Hunter Lewis calls time on it Co-founder of Wall Street gatekeeper Cambridge Associates says famed investment strategy is ‘backward looking, outdated and worn out’ (Financial Times)

• ‘Insanely cheap energy’: how solar power continues to shock the world Australian smarts and Chinese industrial might made solar power the cheapest power humanity has seen – and no one saw it coming (The Guardian) see also The One Question I Hate Getting About My Home’s Solar Roof Yes, it can power my home and two cars. No, that isn’t the point. (Slate)

• Rich Americans Face Biden Tax Hike With Anger, Denial and Grief Pressure has been building to raise levies on the wealthy after decades of tax cuts that disproportionately benefited the top 1%. Politicians at the national and state levels have recently proposed or passed higher rates, but the measures were largely focused on income taxes. (Bloomberg)

• Apple’s M1 Positioning Mocks the Entire x86 Business Model Apple is selling a single CPU across a wider range of products than any competing Intel or AMD CPU is ever sold. This speaks volumes as to what Apple believes it has its hands on, namely: 4+4 CPU architecture, with four high-performance CPU cores and four high-efficiency CPU cores; fast enough at the quad-core level while drawing so little power, it can also be sold in a laptop. (ExtremeTech) see also Thoughts and Observations on This Week’s ‘Spring Loaded’ Apple Event The Apple Card, paid subscriptions to Podcasts, iPhone 12 (now in purple), AirTags, A12-based Apple TV 4K, M1 iMac 24-inch, M1 iPad Pro, iOS 14.5 (Daring Fireball)

• The secretary who turned Liquid Paper into a multimillion-dollar business Bette Nesmith Graham invented one of the most popular office supplies of the 20th century. Today, she’s largely been forgotten (The Hustle)

• Pandemic Lessons From the Era of ‘Les Miserables’ Following disease outbreaks in the 19th century, Paris reimagined its streets, building the wide boulevards that the city is known for today. (Citylab) see also So Anthony Fauci Isn’t Perfect. He’s Closer Than Most of Us. Shocker of shockers: Fauci isn’t perfect. But he has been perfectly sincere, perfectly patient, a professional standing resolutely outside so many of the worst currents of American life. More than that, he has been essential. We owe him an immeasurable debt of gratitude, not the mind-boggling magnitude of grief that he gets. (New York Times Magazine)

• Posh French Winemakers Pounce on Big American Vineyard Selloff European vintners are finding toeholds in the U.S. just as some of America’s oldest wineries are ready to cash in. (Bloomberg)

Be sure to check out our Masters in Business next week with Jack Brennan, former CEO and Chairman of the Vanguard Group. When Vanguard founder and investment legend John Bogle decided to step down as CEO, Brennan was his hand-picked successor for the job, and ran the firm from 1996-2008.

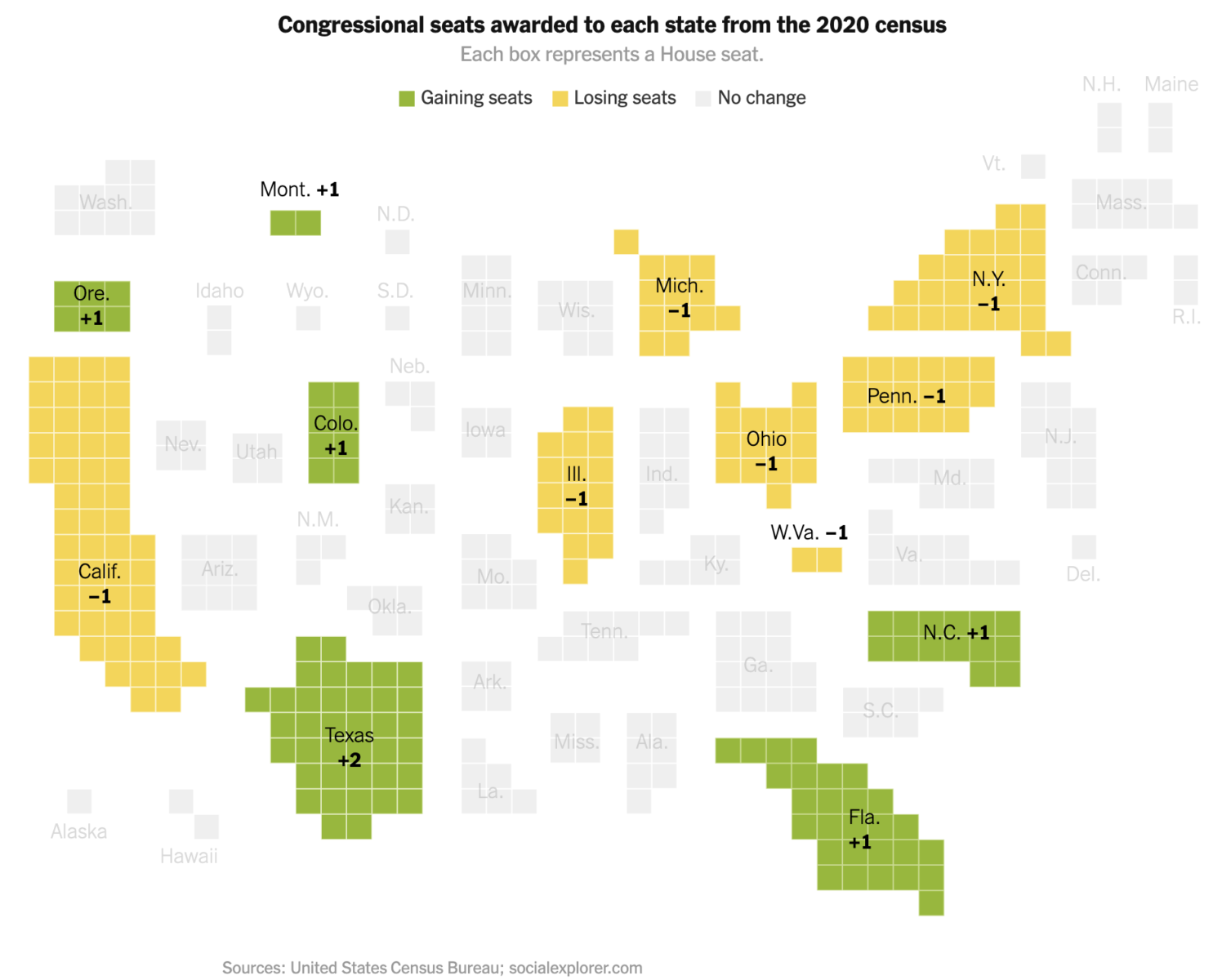

Which States Will Gain or Lose Seats in the Next Congress

Source: NYT

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.