My back to work morning train WFH reads:

• The economics of movie product placements Today’s films are brimming with products from big-name brands. How exactly do these partnerships work? Each year, hundreds of products — cars, computers, clothing, kitchen appliances, and lawn chairs — grace the silver screen. (The Hustle)

• David Swensen leaves a powerful legacy As head of the Yale University endowment he is widely credited with developing a new way to manage money for long-lived institutions like endowments, foundations, sovereign wealth and pension (The “Yale Model”). Swensen’s impact on the industry is undeniable, but more important are the many kind remembrances that his friends and colleagues had of him. Some items from the past week follow: (Abnormal Returns)

• Why Institutional Investors Should Double Down on VC Most institutional investors have some exposure to the venture capital asset class, but conventional wisdom has been that only a small handful of marquee VC managers are worthy of investment. A new NBER working paper contradicts that notion, showing that half of all VC fund managers outperform the public markets, and are therefore worthy of institutional investment. (Medium)

• 10 Things You Shouldn’t Care About as an Investor It’s never been easier to pay attention to everything that’s going on with the markets, economy, individual companies or your own portfolio. People used to get their paper statements in the mail on a monthly basis to know what was going on with their investments. Now we can watch the changes in market values instantaneously. (A Wealth of Common Sense)

• Suburban Homes and Retail Are the Budding New Office Hotspot Real-estate companies are transforming suburban residences and retail spaces into offices, betting that the pandemic will increase demand for workspaces in these neighborhoods. With many Americans working at home and planning to continue even after the pandemic, some startups and landlords believe these employees will want a place to work beyond their living room. They are offering these workers a nearby alternative: furnished office space, bookable by the day or month and within walking distance from home. (Wall Street Journal)

• The Great Fake: Digital advances have taken imitative technology on a miraculous trajectory—bringing new challenges but also new possibilities. (City Journal)

• How the Green Economy Will Be a Gold Mine for Copper Goldman Sachs note there is “no decarbonization without copper,” which they call “the new oil.” Copper will play a crucial role in the new green economy. Cables made of the metal are still the most cost-effective means of transmitting electricity from solar and wind sources, and it is a key material in charging stations and the electric vehicles that use them. (Barron’s)

• Why getting vaccinated for Covid-19 is more popular in the UK than in the US The UK has world-leading vaccine enthusiasm. What can the rest of the world learn? (Vox)

• Some SNL cast members aren’t happy about Elon Musk. He’s part of a long tradition of disliked hosts. Alas, Musk is part of a long tradition of the show’s stars and writers speaking up about hosts they can’t stand. It is a bit more unusual for this to happen before the episode airs, but not unprecedented. In 1990, when comedian Andrew Dice Clay was announced as host, cast member Nora Dunn boycotted the show because she was so disgusted by the “hateful” misogynistic jokes in his stand-up routine. (Washington Post)

• The Case Against the Eagles: Fifty years after their first release, the country-rock titans led by Don Henley and the late Glenn Frey still loom large in American music. Their hits still get play and their sound is a precursor to modern Nashville. But has this biggest of bands aged well? A panel of experts weigh the case. (The Ringer)

Be sure to check out our Masters in Business podcast with Michael Lewis, the poet laureate of finance. We discuss his latest book, The Premonition, A Pandemic Story. He is the author of The Undoing Project, Moneyball, Flashboys, Big Short, and so many others. The The Premonition describes how the United States was the best prepared nation in the world for a pandemic, yet allowed a variety of its institutions to fail.

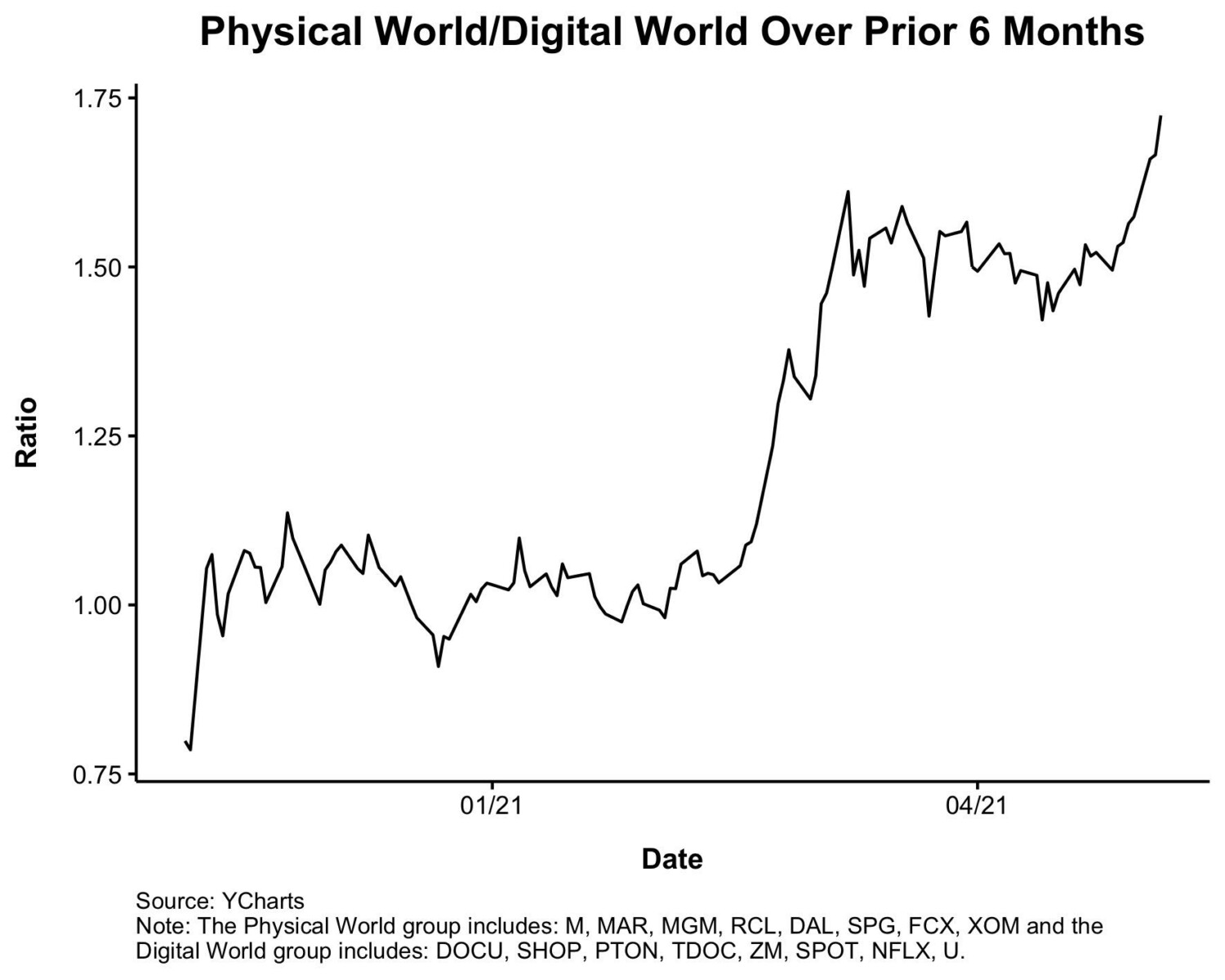

Physical World Stocks Outperforming Digital World Stocks

Source: Irrelevant Investor

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.