Every now and again, several different ideas and stories collide in a grand moment of serendipitous good fortune, resulting in keen insights into a complex and little understood issue. Today is one of those days — the resulting mixtape is part (sing it) Obvious!, with a smidge of confirmation bias on my part. But it explains quite a bit about a few terrible hot takes about inflation, lazy workers on unemployment, and the state of the economic recovery.

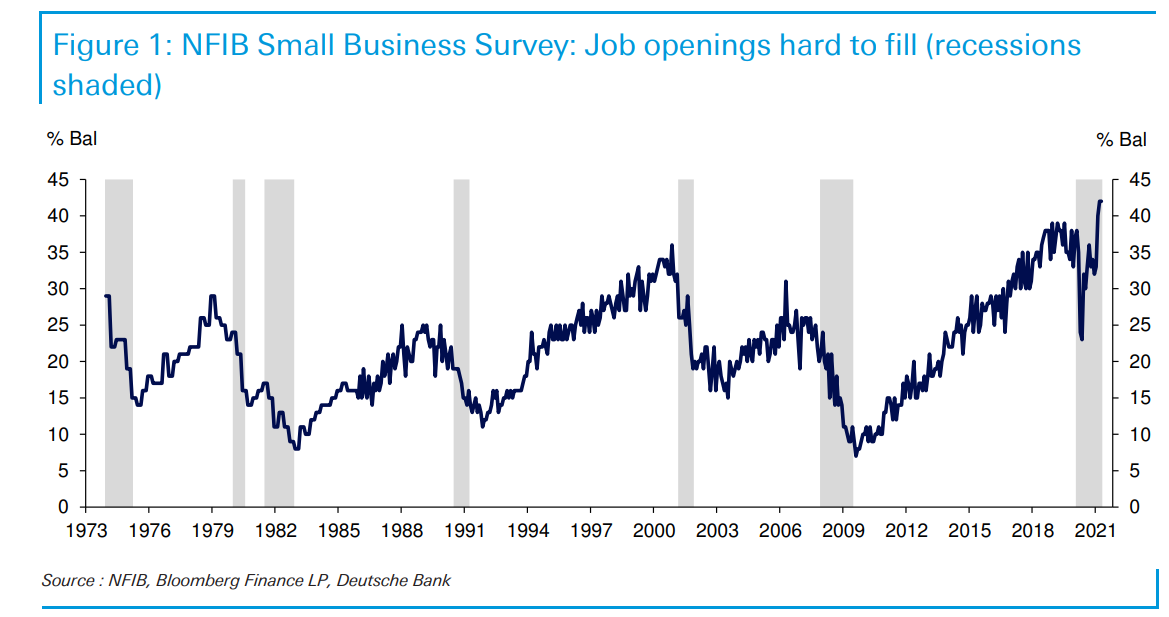

Start with the chart above via Jim Reid of Deutsche Bank: “Small Business job openings hard to fill” index of the NFIB is at record highs.1 Literally, since this survey/sentiment series began almost 50 years ago, it has never been at these high levels. Reid adds “This is at a level much higher than normally seen at the end of a cycle let alone at the start.”

Which leads to the obvious question “Why are Job Openings so hard to fill?”

Start with the pandemic externality making this a rather unusual cycle. But it is a lot more than that: On the high end of technical + technology workers, we have a shortage of people with the right skills and education for those jobs. At the low end you have wages that have simply lagged for decades, and reached the point where they are too low for most Americans. These used to be filled regularly by immigrants and non-citizens, but their numbers have fallen over the past few years. You can’t blame all of this on Trump — it goes back further than that as deportations peaked under Obama in 2013. The mix of restricted immigration and increased deportations has created shortages at the lower end of the labor market.

If the Demand for workers is there, why hasn’t the supply caught up yet? The short answer is Price. Employers have been reluctant to raise wages. This is classic problem where buyers and sellers get anchored on some past level, failing to keep up with the realities of markets.2

The old trader cliché “More Buyers than Sellers” often omits the phrase “at this price level.” 3 For any trade to occur there must always be at least one seller for each buyer (and vice versa); once there are no more sellers at a specific price level, if you want to find more stock for sale, you must look at higher price levels.

After several decades of lagging prices for low wage labor, I believe what we are witnessing is something very similar. THERE IS NO MORE LABOR FOR SALE AT $7/HOUR; so the price moves up. Once it moves up high enough so that supply matches with demand, you get a stabilization at that level.

In this morning’s reads was this Pittsburgh Business Times on a few stores that cracked the code for finding workers: The TL:DR was they doubled their starting wages from $7.25 an hour to $15 an hour. Instead of getting a few applicants per position, half of whom wouldn’t show for the interview, they got 1,000s: “It was instant, overnight. We got thousands of applications that poured in. [And, it led to getting] quality work from people when they know that they are going to make a good paycheck.”

This was obvious 5 years ago — see Can’t Find Qualified Applicants? Raise Your Pay!, — and even further back if you looked in the right places. Indeed, it was what I was referencing last month when I discussed the Shifting Balance of Power. My experience is that People want to work. They want to have a job where they feel they are doing something meaningful, are appreciated, and are appropriately compensated for their time and labors.

In the immediate aftermath of World War 2, there was such overwhelming demand for goods and services and workers, that good jobs at good wages were plentiful. Everybody worked, consumer demand was met, stocks went higher, everybody won.4

Capitalism is an excellent system for creating wealth and getting products and services to where they are most wanted/needed; however, in its unfettered form, it also gave us child labor and slavery. Hence, this is not a market failure, but rather, what we are witnessing is the failure of the political and regulatory systems to create the appropriate minimum wage. Once they do, Capital will become more efficient, Businesses will innovate, automate, and find ways to make higher wages work. So too will Labor adapt — becoming more productive, better educated and more skillful over time.

It has taken a while for this to reach a point where all of these forces have made their way down the economic strata to the minimum wage cohort. That is what is going on right now. $7 an hour is so yesterday; $10 hour seems cheap but its actually expensive once you factor in poor candidates and high turnover rates.

Wages have lagged just about every measure over the past 40 years: CPI Inflation, Health care and education costs, productivity, corporate profits, C Suite compensation, even the number of billionaires seems to be growing faster than wages.

Want to hire qualified candidates who will fill jobs, generate revenue, create profits, and lower your overall cost structure? Perhaps you should consider offering higher starting wages.

Next time out: What might this mean for inflation?

Previously:

Wages in America

Can’t Find Qualified Applicants? Raise Your Pay! (September 8, 2016)

Wal-Mart’s Minimum Wage Breakdown (Feb 23, 2015)

The Minimum Wage and McDonald’s Welfare (Dec 17, 2013)

________

1. I wrote rather disapprovingly about the NFIB surveys as mostly Noisy, Unhelpful in February 2018.

2. I vividly recall House sellers post-2005-06 stuck on 2003-04 prices. If you wanted to sell your home at those prices, you needed a time machine.

3. My frame of reference for this was my Nasdaq Level 3 quote box, showing all of the market makers who had stock for sale at various price points.

4. Saving the digression of Cold War threats of nuclear annihilation and systemic racism for another post…