My back to work morning train WFH reads:

• Yes, Real Estate Prices Are Soaring, and No, It’s Not a Bubble The parallels are hard to ignore: the record prices, the bidding wars, the subdivisions that fill up as soon as they’re built, the resourceful buyer who clinched a deal by dropping off cupcakes that matched the home’s interior paint colors. Today’s real estate market feels a lot like the bubble market circa 2006. There’s one very big difference between then and now, though: Mortgage loans are much harder to get. (Businessweek)

• You Can’t Invest Without Trading. You Can Trade Without Investing.

Understanding the difference between speculation and investing is essential to avoiding reckless risk (Wall Street Journal)• The Recession Isn’t Over Till They Say It’s Over. (But Who Are They?) The contraction in the U.S. seemed to end quickly in April 2020, but the committee charged with determining an endpoint has been quiet. (Upshot)

• Why I’m Not Worried U.S. Household Debt Is At Record Highs For once it’s not just the top 10% or even the top 1% who are better off. Wealth for the bottom 50% is at an all-time high:; The same is true for the 50th to 90th percentile. (Wealth of Common Sense)

• World’s Richest Face Tax Squeeze After 40% Run-Up in Fortunes The world’s wealthiest 500 individuals are now worth $8.4 trillion, up more than 40% in the year and a half since the global pandemic began its devastation. Meanwhile, the economy’s biggest winners, the tech corporations that created many of these vast fortunes, pay lower tax rates than grocery clerks, and their mega-wealthy founders can exploit legal loopholes to pass huge windfalls onto heirs largely tax-free. (Bloomberg)

• Fake Reviews and Inflated Ratings Are Still a Problem for Amazon Sellers are taking advantage of the online-shopping frenzy, using old and new methods to boost ratings on products (Wall Street Journal)

• King of Cards: As a new generation gets into sports memorabilia, Ken Goldin — market maker, evangelist, therapist — is cashing in on priceless pieces of cardboard. (Businessweek)

• Why Is Growing Pot So Energy-Intensive? Federal regulations, budtender preferences, and a weird trick with carbon dioxide. (Slate)

• The Human Faces of Data: Data alone won’t reveal the context and causes of racial disparities in transportation, policing and many other municipal services. (CityLab)

• Biden in the UK: “A commitment by the American people” to the world, Jill’s jacket, Joe goes for a pint (sort of), Donald who? — and the Kremlin casts a shadow over it all (Great Power)

• ‘These new vaccine mutants are extremely disappointing,’ by Magneto I am Magneto, and I would like to register a complaint. Frankly, all of these new mutants are terrible. I was thrilled when I heard that there was a whole class of people who had been recently endowed, they thought, by the coronavirus vaccine with magnetic powers they could not explain. Things stuck to them, they claimed, that had not stuck to them previously. Coins. Silverware. Even the occasional key — which was so encouraging to me because keys are made of brass, and thus suggested a level of power and control that went beyond simple magnetism. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Brad Stone, BusinessWeek Technology editor, and author of the new book, Amazon Unbound: Jeff Bezos and the Invention of a Global Empire.

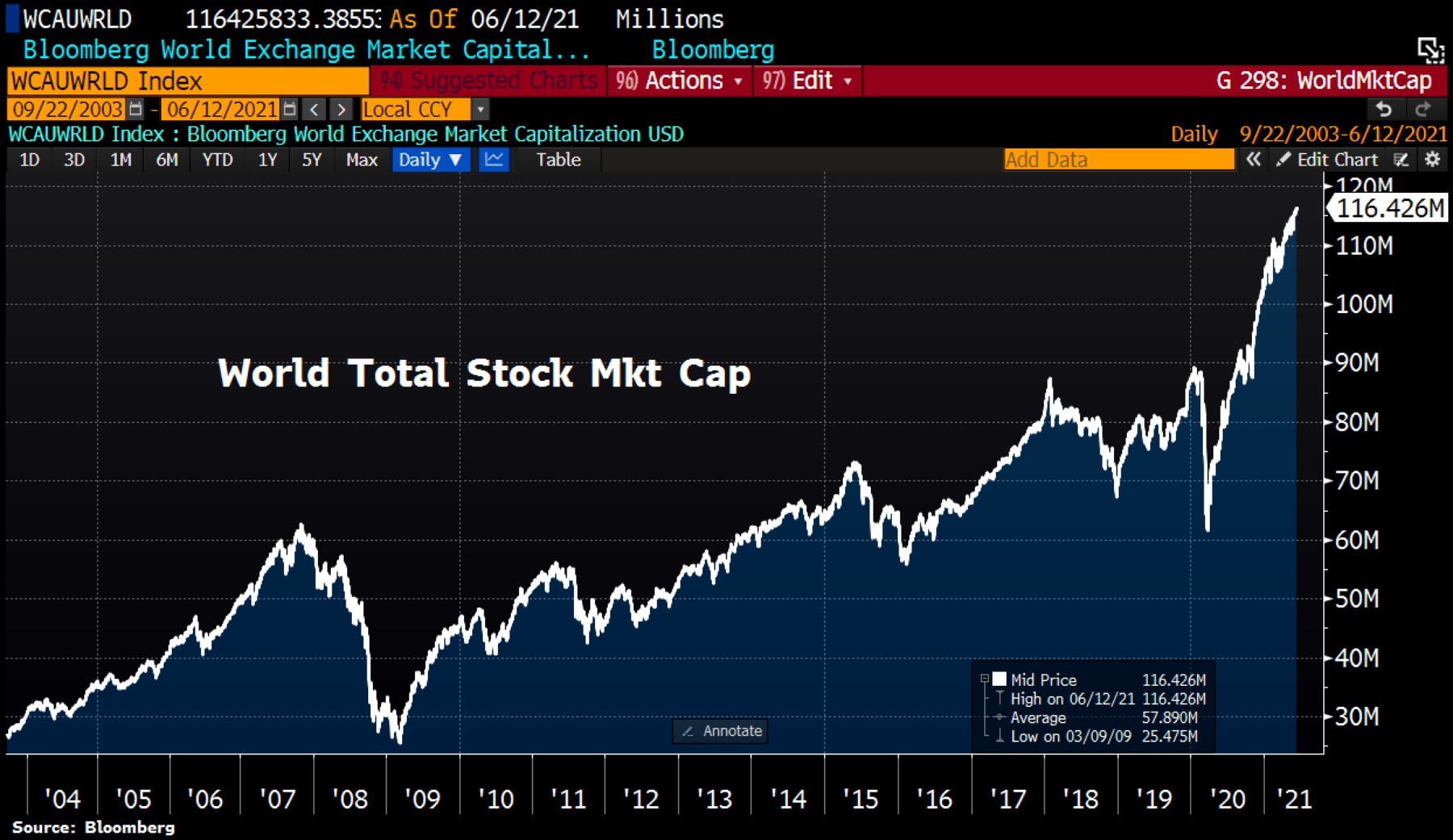

Global stocks are now worth a record $116.4tn, equal to 132.7% of global GDP.

Source: @Schuldensuehner

Sign up for our reads-only mailing list here.