Where did June go? My end of first half morning train WFH reads:

• Seven Reasons to Be Extremely Optimistic About the Economy Right Now The U.S. economy is in the middle of an awkward transition. Like a groggy bear roused from hibernation, the country is no longer dormant due to the pandemic but isn’t quite back in full form either. Millions remain unemployed, businesses are having trouble hiring, workers are still avoiding the office, and shortages of everything from lumber to computer chips have helped push up consumer prices. (Slate)

• Inside The Reddit Forum That Wants To See Bitcoin Die Crypto has legions of devoted fans but also an army of critics. Cryptocurrency haters have found a home—and common cause—trashing the volatile asset class and wishing for its demise. (Forbes)

• Commodity Traders Harvest Billions While Prices Rise for Everyone Else From oil to steel, raw material prices are surging. As the world economy recovers, how much further does the boom have to run? (Bloomberg)

• Why Aren’t Interest Rates Higher? We may not get 4-5% sustained inflation but we could see 2-3% which would be a step up from the 1-2% post-2008 recovery. And we may not see 6-7% real GDP growth continue but it’s certainly possible for 3-4% for a few years as opposed to the 2% or so we’ve become accustomed to. Yet interest rates remain stubbornly low. (A Wealth of Common Sense)

• Rising Inflation Looks Less Severe Using Pre-Pandemic Comparisons Annual inflation hit a 13-year high in May, but annualized price growth from 2019 was more modest. (Wall Street Journal)

• The Pandemic Changed How Musicians and Investors See Royalties When live performances stopped, artists looked for ways to take control of their music, and more investors got interested in a new type of asset. (New York Times)

• The Art — and Imperfection — of Due Diligence: When investors evaluate managers, they need to balance the pros and cons of key-person risk versus an investment committee — without sacrificing returns. (Institutional Investor)

• SEC’s Gensler aims to be ‘transformational’ Wall Street cop Sen. Elizabeth Warren and SEC Chair Gensler have developed close relationship sources say (Fox Business)

• There could be many more Earth-sized planets than previously thought Exoplanet searches could be missing nearly half of the Earth-sized planets around other stars. Earth-sized worlds could be lurking undiscovered in binary star systems, hidden in the glare of their parent stars. As roughly half of all stars are in binary systems, this means that astronomers could be missing many Earth-sized worlds. (Phys)

• Jeremy Clarkson Bought a Farm 11 Years Ago. Now He Has to Run It Clarkson, the “polarizing car fetishist” is as salt-and-vinegary as ever. The charismatic star’s particular form of zest is simply directed at different targets than the sports cars he used to accost. But what makes Clarkson’s Farm such fun to watch is that while Clarkson reigned supreme in his Top Gear role as master of the car guy universe, his knowledge and capability levels hover around zero on these grounds. (Bloomberg)

Be sure to check out our Masters in Business interview this past weekend with Joe Moglia, who is the former chairman and CEO of TD Ameritrade (now part of Schwab) and former Head Coach of the football team at Coastal Carolina University.

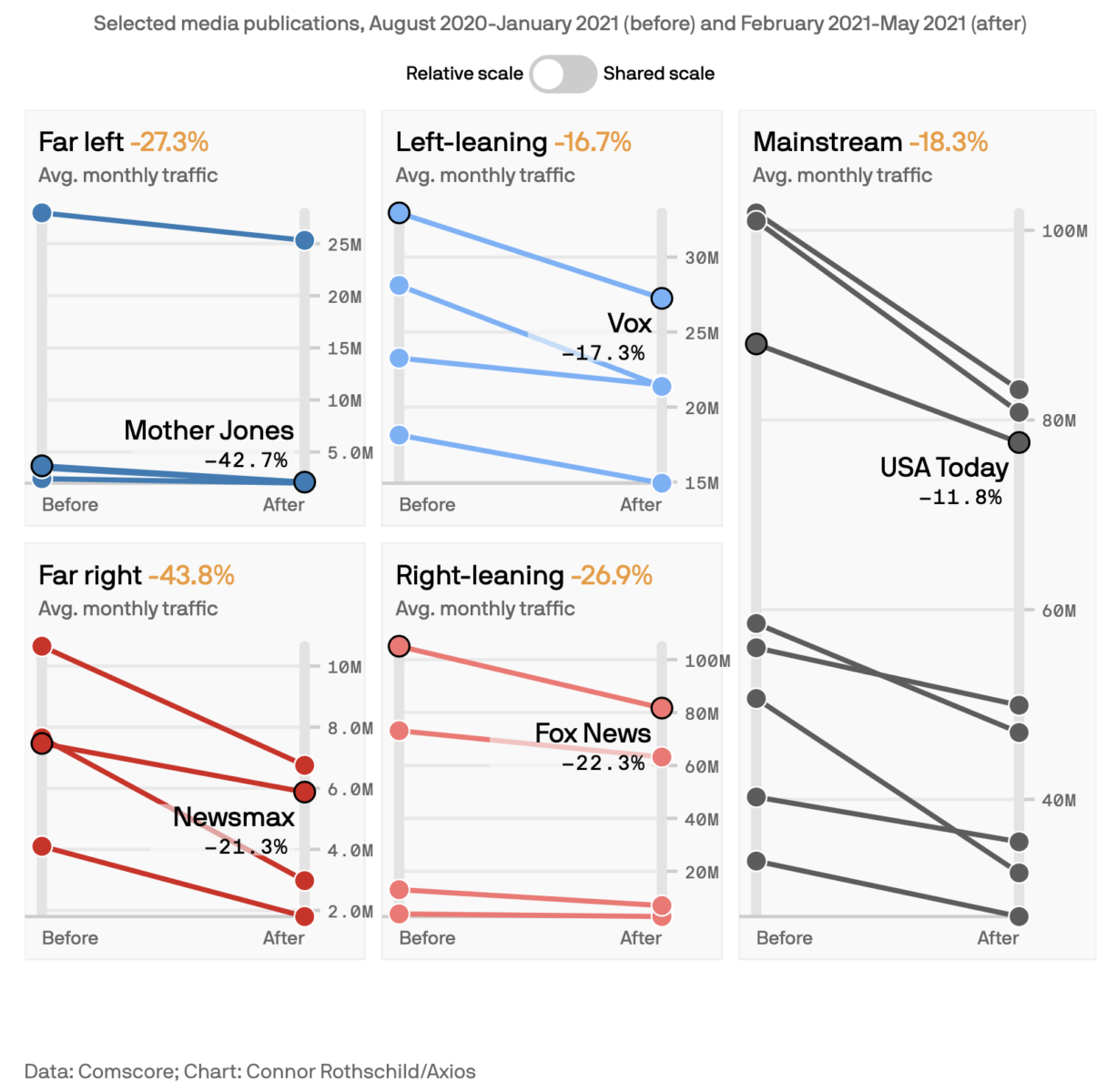

Boring news cycle deals blow to partisan media

Source: Axios

Sign up for our reads-only mailing list here.