My morning train WFH reads:

• The World’s Financial Centers Struggle Back to the Office: The journey back to your desk is shaping up to be slow and indirect. Roughly 15 months after locking down to ward off Covid-19, several of the globe’s key financial centers are struggling to get employees back to their offices. (Citylab)

• Maria Bartiromo’s top 10 fails: After six years of protracted network sycophancy, there should be little that’s shocking about a top Fox Newser laying out the welcome mat for Trump’s mendacity. Yet somehow there is. (Washington Post)

• Why Wall Street Is Afraid of a Digital Dollar The idea of a government-backed virtual currency has support in policy circles, but Wall Street sees a threat to its consumer-finance dominion. (Businessweek)

• Why Remote Work Might Not Revolutionize Where We Work Even with the pandemic giving a boost to remote work, most companies aren’t seriously considering an officeless future. New full-time remote jobs has tripled, but the overall percentage remains incredibly low. Before the pandemic, it was about 2% of all new office jobs, and now it’s only about 6 to 7% of new office jobs. (NPR)

• The Stock Market is Outperforming Most Stocks Right now the market is being led higher by the big five, which are flirting with new highs as a percent of the overall index. They’re masking some of the weaknesses in other areas. (Irrelevant Investor) see also Investors, Don’t Depend on Stocks and Bonds to Hedge Each Other The negative correlation between their monthly returns is no sure thing. (Businessweek)

• When the Next Animal Plague Hits, Can This Lab Stop It? A new federal facility in Kansas will house the deadliest agricultural pathogens in the world—and researchers working tirelessly to contain them. (Wired)

• Why Cuba is having an economic crisis Three crises and a whole lot of bad policy decisions have driven hungry Cubans into the streets (Noahpinion)

• Biden’s plan to make stuff cheaper The president’s big antitrust push could impact how much you pay for plane tickets and prescription drugs. (Vox)

• More Power Lines or Rooftop Solar Panels: The Fight Over Energy’s Future The president and energy companies want new transmission lines to carry electricity from solar and wind farms. Some environmentalists and homeowners are pushing for smaller, more local systems. (New York Times) see also The U.S. Is Rapidly Running Low on Water There’s a gross way to fix this. (Slate)

• Three years after the suicide of Anthony Bourdain, a documentary tries to make sense of it all There are many revealing moments embedded in director Morgan Neville’s nervy, impressionistic film, which over the course of two hours quietly peels back the layers of an onion that sweetened almost everything it touched and left many of us with tears in our eyes. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Matt Ishbia, CEO of United Wholesale Mortgage. UWM is the number 1 wholesale lender and the number 2 overall mortgage lender in the nation. The firm went public in the biggest SPAC ever (UWMC) this year. Ishbia is also the author of “Running the Corporate Offense: Lessons in Effective Leadership from the Bench to the Boardroom.”

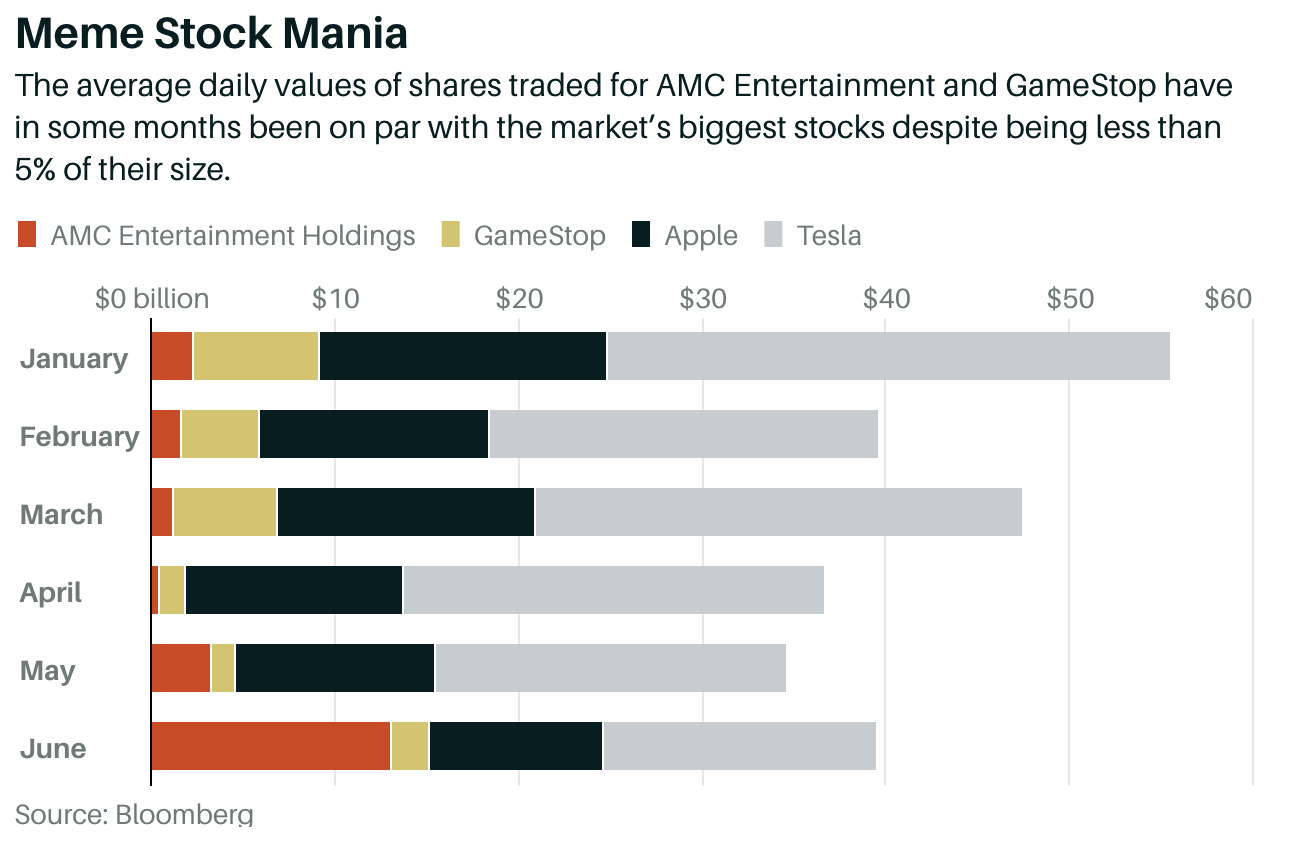

The Meme Stock Trade Is Far From Over. What Investors Need to Know

Source: Barron’s

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.