My back to work Tuesday morning train WFH reads:

• New York is back, just ask Jerry Seinfeld Restaurants are crowded, flights are packed, Yankee Stadium is at full capacity and corporate America is calling its workers back. All signs point to a sharp recovery in New York’s prime housing market, according to Liam Bailey, Knight Frank’s global head of research. (Knight Frank) see also Let’s Face It, Most Bankers Are Going Back to the Office Despite the press releases, very few companies have actually committed to new, more flexible ways of working. Credit Suisse is a case in point. (Bloomberg)

• When a 59% Annual Return Just Isn’t Enough: Investors appear to be growing more and more optimistic about how their portfolios will perform in the years to come. Disappointment is bound to follow. (Wall Street Journal)

• Why fragility is the new reality for the stock market An imbalance has developed between the supply of and demand for liquidity, and as a result we’ve seen a significant increase in the potential for the public equity market to jump from a state of calm to one of chaos. Consequently, we tend to distrust situations where stability has become the consensus, as we believe any change in the narrative is apt to bring surprisingly drastic changes in the equilibrium. (Wellington Management) see also Record Stock Sales From Money-Losing Firms Ring the Alarm Bells If you think a rush by companies to sell their shares is a bad omen for the market, imagine a scenario where most of the sales come from firms that don’t make money. It’s happening now. Since the end of March, almost 100 unprofitable U.S. companies, including GameStop Corp. and AMC Entertainment Holdings Inc., have raised money through secondary offerings, twice as many as coming from profitable firms. (Bloomberg)

• Designing a Portfolio With Crypto, Cannabis, and Value in Mind With the stock market at record highs and inflation heating up, how to preserve and grow capital while managing encroaching risks has been top of mind for many investors. Meb Faber, co-founder and chief investment officer of Cambria Investment Management, has made that question his No. 1 mission since founding his firm in 2006. Cambria manages $1.1 billion in a dozen exchange-traded funds. All of its funds are actively managed, and many are driven by quantitative factors like value, momentum, and shareholder yield (Barron’s)

• Shrinkflation Is an Economic Monster Worth Watching When inflation strikes, retailers have a proven strategy to pass the costs on to consumers. (Bloomberg) see also On Low Treasury Yields Today, the 10-year Treasury yields a paltry 1.5%. With real rates negative, the near-consensus view is that rising inflation will end the 35-year Treasury bull market. And commentators are arguing that Treasurys at 1.5% have far less upside than they did at 6.4%. (Verdad)

• What’s the Impact of Early Retirements on Plans? More than a year into the pandemic, some pension funds are reporting a jump in workers leaving. (Chief Investment Officer)

• No, it doesn’t need to be a Zoom: We’re wasting hours of our lives on inefficient video calls. Here’s how to decide when you should jump on a Zoom – and when not to (Wired)

• Business Lessons from Reed Hastings/Netflix Part 1 “We’re figuring out every year how to use the Internet to make a great consumer experience. Every year is an experiment.” (25iq) see also Business Lessons from Reed Hastings/Netflix Part 2 “Prices are relative to value. We’re continuing to increase the content offering and we’re seeing that reflected in viewing around the world. So we try to maintain that feeling that consumers have that were a great value in terms of the amount of the content we have relative to the prices.” (25iq)

• Trump’s company cloaked him in gilded fame. Now it faces felony charges, debt and a tainted brand. The Trump Organization, even if it avoids a conviction, is at its lowest point in decades (Washington Post)

• Caroline Shaw Is Making Classical Cool Can Classical Music Make a Comeback? Caroline Shaw is often cited as proof that the genre has an exciting future. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Steve Romick, Managing Partner at FPA, which manages $26 billion in equity, fixed income, and alternative strategies. Romick manages the $11 billion FPA Crescent Fund since its 1993 inception and was named Morningstar’s U.S. Allocation Fund Manager of the Year.

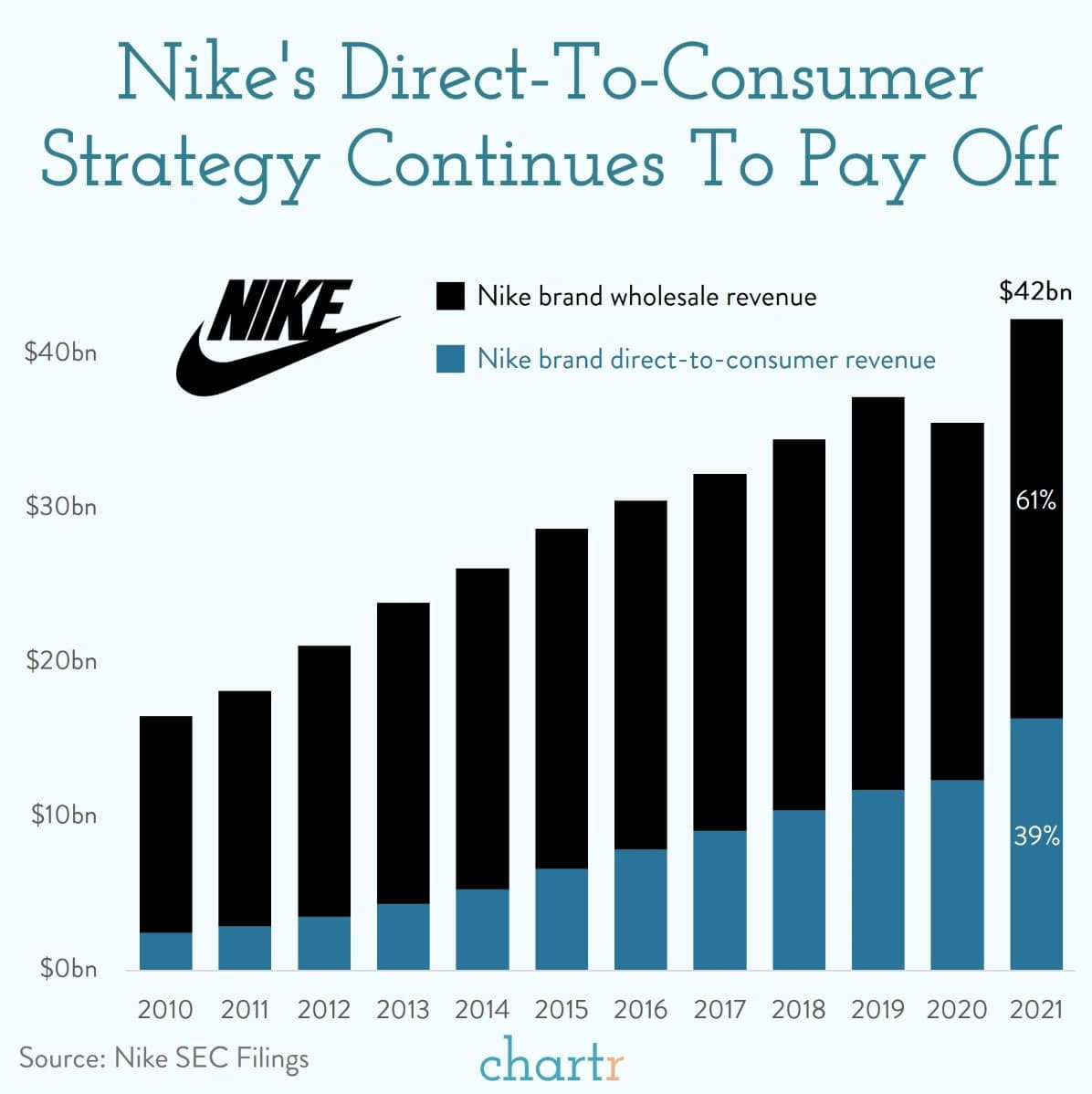

Nike’s Direct-To-Consumer Strategy Continues To Pay Off

Source: Chartr