My Two-for-Tuesday morning train WFH reads:

• Condos Are in Uncharted Territory: The first generation of American condominiums is reaching old age. Are homeowner boards up to the task? (Slate) see also What the condo collapse means for agents, sellers and buyers in South Florida “The condo market was on fire. There is no question that the condo market is going to take a hit because of the fear factor. I’ve already seen it in closings.” (South Florida Agent Magazine)

• An Investing Truth: Roughly 80% of Stocks Are “Duds” Whether you’re measuring 19th-century whaling, early stage startups, or large stocks, you can’t escape this investing truth. Lots of losers and a few big winners. (Risk Hedge)

• Beware the IP-Ohs One should raise money when it is available rather than when it is needed. This is the reason most companies come out with their IPOs during rising or bull markets when money is aplenty. Unfortunately, most investors in these IPOs come out on the losing end of the equation (Safal Niveshak) see also The Rebirth of the IPO 2020 was a banner year for initial public offerings. Even though capital markets more or less shut down in March and April of last year and companies couldn’t go on their standard roadshows to sell their stock, IPOs were up 36% from 2019. (Wealth of Common Sense)

• Is Moderna’s Vaccine Breakthrough Really Worth $100 Billion? The company’s hugely successful Covid shot sent the stock sky-high, but its hefty valuation comes with some big risks. (Bloomberg)

• Covid Didn’t Kill Cities. Why Was That Prophecy So Alluring? A distrust of urban life has persisted in America, finding expression in different ways over time. (New York Times) but see “I Don’t Think I’ll Ever Go Back”: Return-to-Office Agita Is Sweeping Silicon Valley As more of America gets vaccinated, executives—especially in tech—are facing a conundrum: a scattered workforce, employees enchanted by the WFH lifestyle, and million-dollar campuses standing vacant. (Vanity Fair)

• Your NFT Sold for $69 Million—Now What? Beeple Turns to a New Project, and Old Masters. Mr. Winkelmann’s blistering rise and bumpy aftermath echoes the entire NFT art phenomenon, which started gaining traction last fall as digital artists realized they could attach data already being used to track cryptocurrency onto their own pixelated images and sell one-of-a-kind work the way painters sell original canvases. (Wall Street Journal)

• Fintech, NeoBanks and the Unbanked: 25% of U.S. households are either unbanked or underbanked. Half of the nation’s unbanked households say they don’t have enough money to meet the minimum balance requirements. 34% say fees are too high. And, if you’re trying to get a mortgage, you’d better hope the house isn’t cheap. (No Mercy No Malice) see also Introducing Not Boring Capital: Behind-the-Scenes of Raising a Fund to Invest in Companies with Stories to Tell (Not Boring)

• The lie of “expired” food and the disastrous truth of America’s food waste problem Stop throwing your food away (Vox)

• There’s A Stark Red-Blue Divide When It Comes To States’ Vaccination Rates But surveys have shown Trump supporters are the least likely to say they have been vaccinated or plan to be. Remember, Trump got vaccinated before leaving the White House, but that was reported months later. Unlike other public officials who were trying to encourage people to get the shot, Trump did it in private. (NPR) see also Least Vaccinated U.S. Counties Have Something in Common: Trump Voters The disparity in vaccination rates has so far mainly broken down along political lines. For nearly every U.S. county, both the willingness to receive a vaccine and actual vaccination rates to date were lower, on average, in counties where a majority of residents voted to re-elect former President Donald J. Trump in 2020. (New York Times)

• Angels Star Shohei Ohtani Isn’t the Best Two-Way Player Since Babe Ruth. He’s Better. The MLB All-Star has been heralded as the ‘Japanese Babe Ruth’ because of his abilities as a hitter and a pitcher. But he’s doing something Ruth never did. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Christine Hurtsellers, CEO of Voya Investment Management. The firm manages over $245 billion in assets. Hurtsellers was recently named to Barrons’s top 10 most influential women in wealth management.

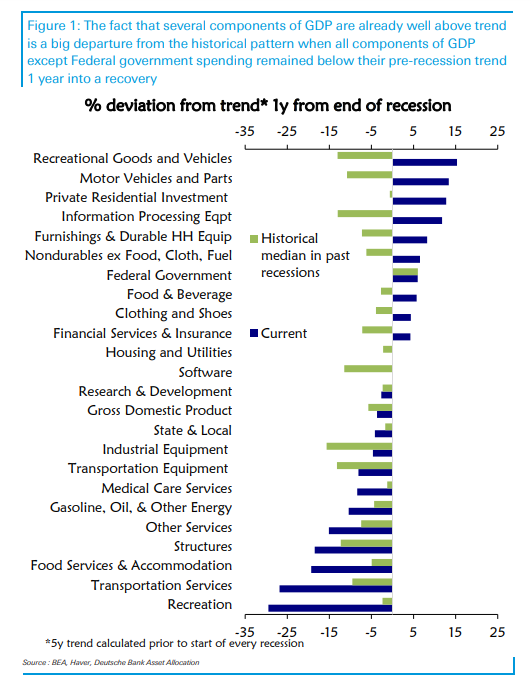

Lots of US economy already late cycle?

Source: Deutsche Bank