My back to work morning train WFH reads:

• The Man Who Lost $20 Billion in Two Days Is Lying Low in New Jersey About 15 miles from midtown Manhattan, the head of Archegos is groping for answers in the wake of one of the biggest debacles in Wall Street history. (Bloomberg Wealth)

• No, Really, TikToks and Tweets Could Make You a Smarter Investor How Lily Francus, Kyla Scanlon, and other breakout stars of financial social media are cutting through the noise. (Businessweek)

• The Global Asset Management Industry Thrived During the Pandemic — And Not Just Because of the Bull Market Although long-term challenges remain, asset managers have exploited new opportunities in product development, ESG, and emerging markets to produce solid growth in assets. (Institutional Investor)

• Say Goodbye to the 1% Investment-Adviser Fee? Investors who don’t want to pay the traditional 1% of assets for financial advice have an increasing number of alternatives. (Wall Street Journal)

• Will Remote Workers Get Left Behind in the Hybrid Office? The benefits of working from anywhere can also come with bias against those who aren’t seen around the hallways. (New York Times) see also The feds won’t make you get a vaccine. But your boss will. Only private businesses can end the pandemic now. They just might do it. (Washington Post)

• Simple Explanations For Complex Topics. One of the biggest residential real estate brands in the world is getting hammered in the midst of one of the biggest housing booms we’ve ever seen? What gives? I posed this question on Twitter this past week… (Wealth of Common Sense)

• Amid the Labor Shortage, Robots Step in to Make the French Fries Fast-food chains are working with a host of startups to bring automation to their kitchens. (Wall Street Journal)

• The mRNA Vaccines Are Extraordinary, but Novavax Is Even Better Persistent hype around mRNA vaccine technology is now distracting us from other ways to end the pandemic. (The Atlantic)

• Climate Scientists Reach ‘Unequivocal’ Consensus on Human-Made Warming in Landmark Report The first major assessment from the UN-backed Intergovernmental Panel on Climate Change in nearly a decade sees no end to rising temperatures before 2050. (Green)

• What’s Rarer Than Gold? Making It Onto A Wheaties Box. The Wheaties box endures as a symbol of athletic achievement for the same reason it continues to be a successful marketing strategy for the brand: Wheaties has been doing this for a very long time, and it has been incredibly discerning in who graces its cardboard. If 100 athletes were on the box every year, it wouldn’t be nearly as prestigious. (FiveThirtyEight)

Be sure to check out our Masters in Business interview this weekend with Sandy Rattray, Chief Investment Officer of Man Group and a member of the Man Group Executive Committee. Man provides a range of funds for institutional and private investors globally and is the world’s largest publicly traded hedge fund company, with about $125 billion in funds under management.

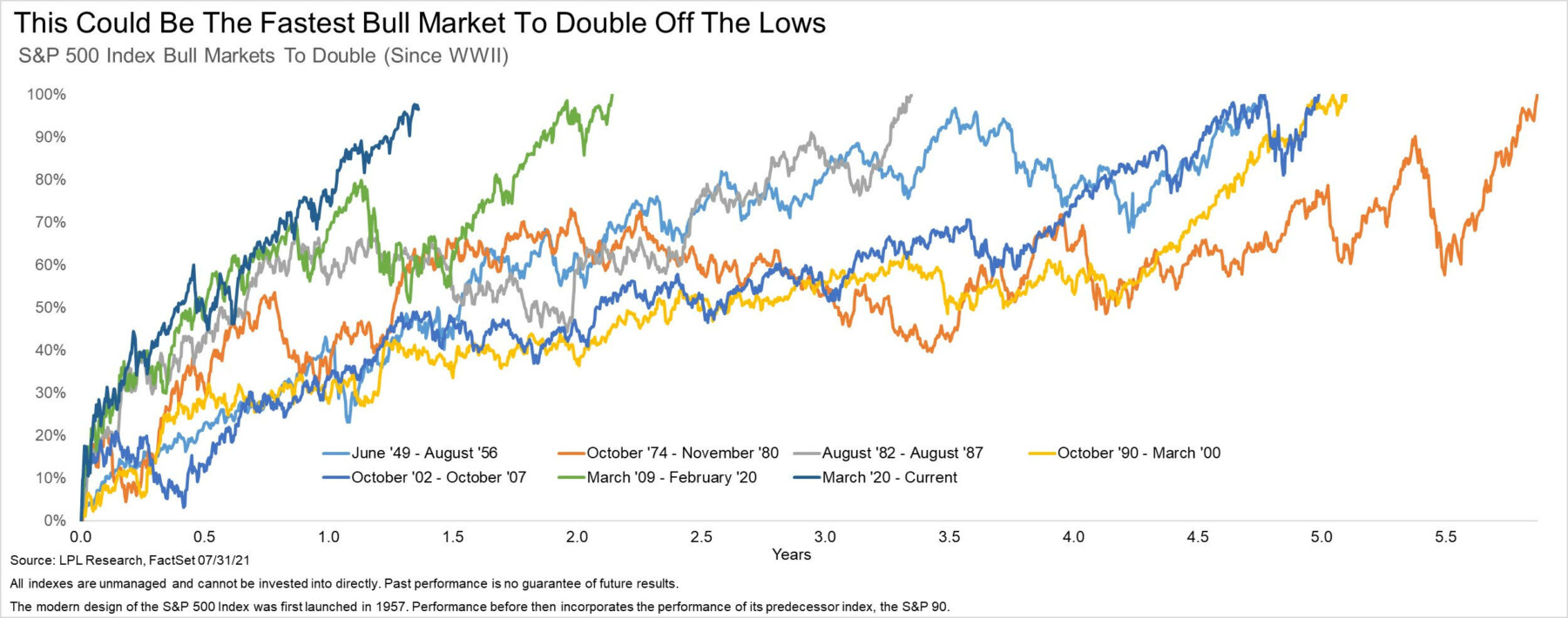

This could very well could be the fastest bull market ever to double.

Source: @RyanDetrick

Sign up for our reads-only mailing list here.