I spent the past 5 days hanging out in the woods of Maine — fishing, drinking, eating but mostly talking with asset managers and economists about . . . everything. The collective AUM of the group (minus the Fed folks) was estimated at about $1 trillion dollars. These were not casual conversations, but deep, thoughtful discussions about the state of the world.

A number of themes emerged over the weekend about everything from Inflation (Modest annual increases but from higher levels) to crypto (new tech yet to be exploited) to Behavioral (more cognitive issues than psychological), the Delta Variant (dangerous economically, but especially punishing in Florida). There was not a lot of consensus but a broad variance of ideas as to what the current state of the economy is and where markets might go.

The one concept that caught my attention in many conversations was simply the sheer volume of Capital sloshing around. Not just on the deck off of the dining room, or even the US system, but throughout the entire global financial system.

The world is awash in capital, in so much cash, that it is a little difficult to comprehend. Not only are equities priced higher, but every asset class you can think of is being driven up as faithful money seeks a dry, safe and happy home.

If capital is the fuel that drives the economic engine, we are not just topped off, but the supplemental tanks are filled to the brim as well. Consider a few asset classes/styles/pools that are being driven higher by all this cash:

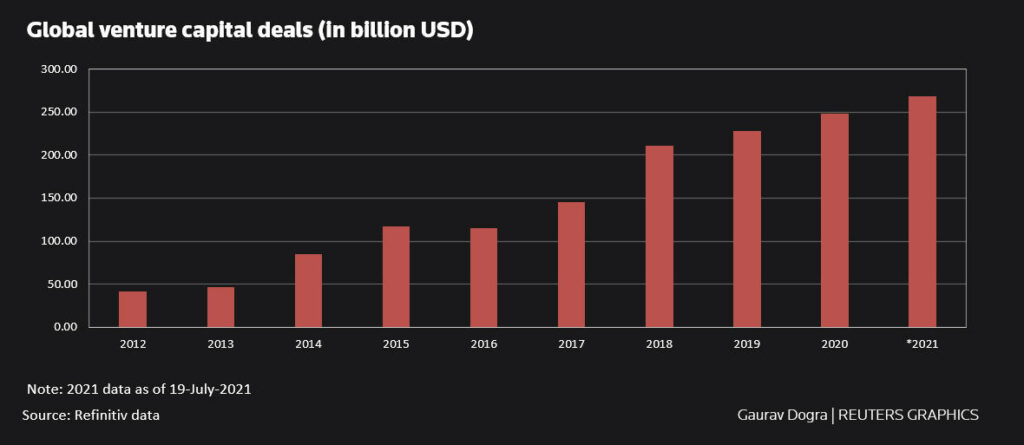

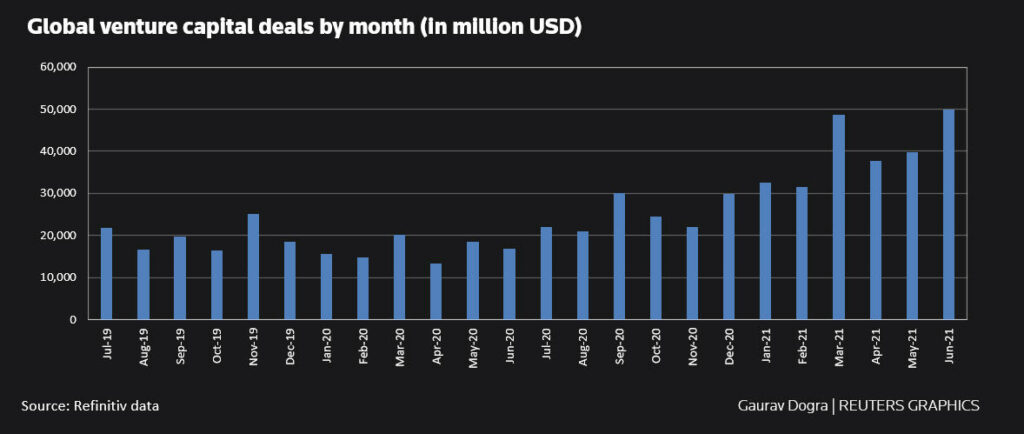

-Venture Capital

-Angel Investing

-Private Equity

-Public stocks

-Farmland

-Crypto / Blockchain

-Rare Earth Metals

-Climate Change Adaptive Tech

-Corporate Bonds (Investment grade)

-Treasuries, TIPS

-Munis

-Structured Notes

-Option writing strategies

-Direct Indexing

-ESG investing

-PE for the mass affluent

Etc.

There are surely many negatives to this, ranging from valuations pushed from fully valued towards pricey, to making the already massive wealth gap even larger.

But there are so many positives in this massive pool of capital that are also worth exploring. New ideas are getting funded, new businesses starting up to monetize all of the energy and innovation and technology. From apps to pure science R&D and all in between, there is a Cambrian explosion of value creation coming from this massive pile of capital, the results of which may be hard to see from here, other than to note its speed and size.

Take billions of dollars, put them in the hands of wealthy institutions and sophisticated UHNW individuals. They will seek to generate a return on capital that is attractive, but in the process, move forward a raft of sectors via technology and ingenuity.

Take a moment to contemplate the net results this massive influx of cash, innovation, and labor is in the midst of producing. It’s enough to turn a curmudgeon into a capitalist.

Source:

Global venture capital investments hit record high.

Gaurav Dogra, Patturaja Murugaboopathy

Reuters, July 21, 2021.

https://www.reuters.com/business/finance/global-venture-capital-investments-hit-record-high-2021-07-21/

Previously:

The Great Reset (June 2, 2021).

What If EVERYTHING Is Narrative? (June 21, 2021)

The Economic Risks from Anti-Vaxxers (July 15, 2021)