My morning train WFH reads:

• Wall Street During the Pandemic: The Impossible Is Now Commonplace One lesson from the market’s relentless climb is that sometimes the rules don’t matter. (Businessweek)

• Are We in a Melt-Up? “Of all the things that you should do during a melt-up, the most important is to get invested. Do not sit in cash. Why? Because even if the market does eventually return to its prior levels, sitting in cash will destroy you psychologically.” (Of Dollars And Data)

• In This Housing Boom, Mortgages Are for Losers To boost entry-level homeownership for lower-income buyers, the government needs to make the market less appealing to the cash-rich Wall Street investors who have taken over. (Bloomberg)

• The High Priest of Cryptopia Regrets Nothing Ian Freeman could have been a bitcoin billionaire. Instead he could go to prison for the rest of his life. (New York Magazine)

• Companies Are Hoarding Record Cash Amid Delta Fears Cash and short-term investments on corporate balance sheets rose in the second quarter (Wall Street Journal)

• The new threat to China’s luxury boom: What to know Luxury stocks tumbled last week as the Chinese government announced a crackdown on wealth inequality. Here’s what that means for the industry. (Vogue)

• Inflation for Whom? There’s another reason the “falling real wage” claim is misleading. When price increases are concentrated in a few areas, the inflation rate facing people who are buying stuff in those areas will be very different from the rate facing those who are not. Most Americans do buy a car every few years, but relatively few need to buy a car right now.1 And even averaged over time, different groups of people spend more or less on cars relative to other things. (J. W. Mason)

• How Facebook, Twitter, and YouTube are handling the Taliban The world might accept the Taliban as a legitimate government. Will social media companies? (Vox)

• Nursing Homes Keep Losing Workers Employment has continued to fall as job losses in other sectors reverse; low wages, burnout and fear of Covid-19 keep staff away (Wall Street Journal)

• Charlie Watts, the Unlikely Soul of the Rolling Stones In a band that defined debauched rock ’n’ roll, he was a quiet, dapper jazz fan. But their unusual chemistry defined the rhythm of the Stones, and of rock. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Joan Solotar, Blackstone’s Global Head of Private Wealth Solutions. PWS manages over 100 billion dollars of the private equity giant’s $684 billion in assets. She has been named to Barron’s 100 Most Influential Women in US Finance list.

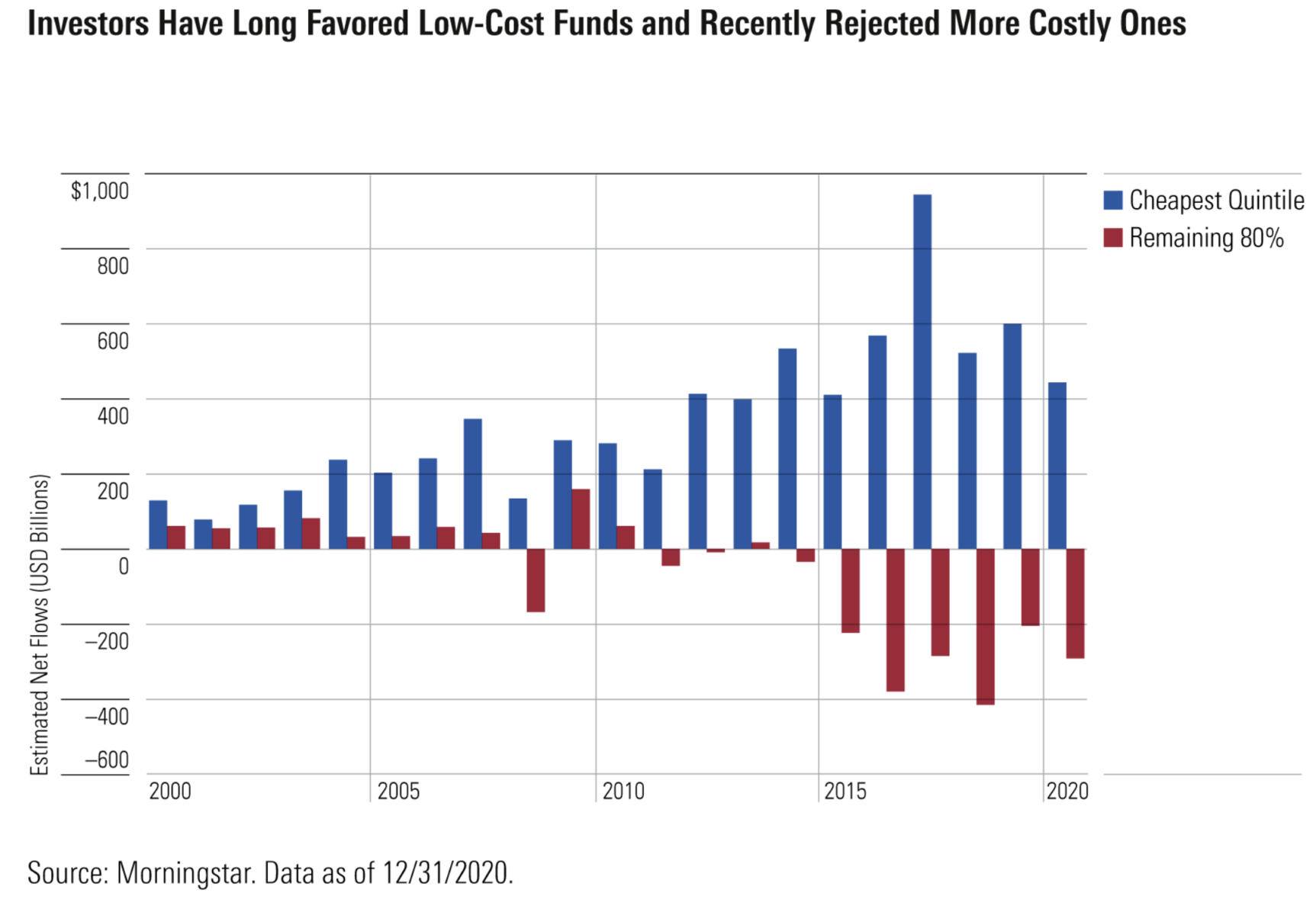

How Low Can Fund Fees Go?

Source: Morningstar

Sign up for our reads-only mailing list here.