My Two-for-Tuesday morning train WFH reads:

• Taliban seize power amid chaos in Afghanistan All U.S. Embassy staff in Kabul, including the mission’s top diplomat, were being evacuated. (Politico) see also ‘A Total and Unmitigated Defeat’ We have an obligation to begin thinking about how to mitigate the horrors that will take place within Afghanistan. (The Bulwark)

• Actually, it doesn’t matter who runs the Fed Edward Price argues central bank independence is too theoretical for any appointment to make a difference. (Financial Times)

• The Great Game on the Anniversary of the End of Bretton Woods aaaa less than a decade after Nixon’s decision, a new era opened, characterized in many respects by turning Bretton Woods on its head. Currencies floated against the dollar. Capital was liberated, purposely freed from restrictions on its mobility in several dimensions. Resistance to new forms of protections, such as Voluntary Export Restrictions and Orderly Market Agreements, ultimately necessitated replacing the General Agreement on Trade and Tariffs (GATT) with the World Trade Organization. (Marc-to-market) see also 50 Years After Nixon Ended the Gold Standard, Dollar’s Dominance Faces Threat The dollar nonetheless remains the primary legal tender used internationally for trade, finance, and as a store of value, which has conferred upon the U.S. enormous advantages. Whether that will continue for the next half-century is far from certain. (Barron’s)

• One Number to Gauge Where the Economy Is Headed The yield on the 10-year Treasury note is often a reliable indicator of how Wall Street views the prospects of economic growth — especially when other data points send confusing signals. (New York Times)

• Delta Variant Hasn’t Yet Changed Many Return-to-Office Plans A recent survey finds most people report they are already back at their workplace or will be soon. (New York Times) see also The Delta Variant Is Already Leaving Its Mark on Business The Covid-19 variant is damping demand and raising costs after a spring and summer that seemed to promise a rapid recovery (Wall Street Journal)

• Congress’s Financial Conflicts Go Beyond Rand Paul’s Wife A simple fix: Politicians, their staffers and their spouses shouldn’t trade stocks. (Bloomberg)

• What Marc Maron’s Learned From Hosting Over 1,200 Episodes of His Podcast He’s a podcast pioneer, who’s been hosting his weekly WTF With Marc Maron show since 2009; he’s released over 1,200 episodes, with recent guests including Rick Rubin, Quentin Tarantino and Eddie Murphy. He still gets nervous before almost every interview he does. (Wall Street Journal) see also Amazon’s Move Into Podcasts Was a Big Advertising Play All Along With revenue in the growing segment expected to top $1 billion this year, the e-commerce giant wants a larger slice of the pie. (Businessweek)

• 12 Ways to Break the USA: The European bigot’s guide to the social and geographic complexity of the US (Atlas of Prejudice)

• Delta Is Bad News for Kids More children are falling ill because more are being infected. More children are falling ill because more are being infected. (The Atlantic) see also Reopening Plans for the 100 Biggest School Districts Are Changing Fast Masks optional or enforced? Must adults be vaccinated? District policies vary widely, and some are being adjusted on the fly. (New York Times)

• ‘South Park’ Co-Creator Matt Stone on his $900 Million Deal Moments after Stone signed his new deal with ViacomCBS, we spoke for about an hour about his plans for “South Park,” his disdain for “Space Jam 2” and what it means to have his biggest payday yet. (Bloomberg)

Be sure to check out our Masters in Business interview this weekend with Greg Becker, CEO of Silicon Valley Bank. The bank has helped fund more than 30,000 start-ups, 50% of venture-backed tech and life science companies in the US, and 69% of U.S. VC-backed tech + life science companies with an IPO banked with SVB.

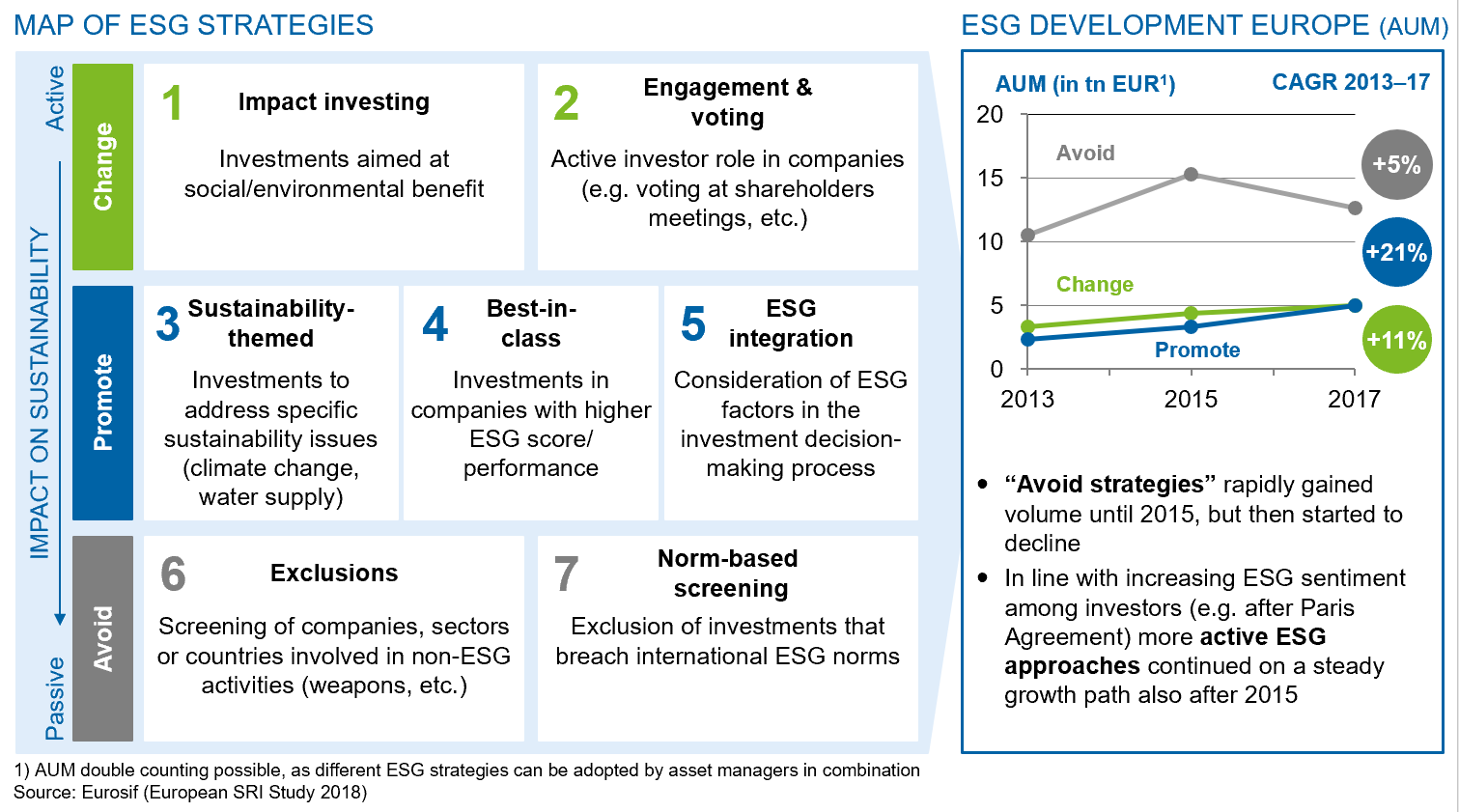

ESG investing: the rise of a new standard

Source: Banking Hub