Are Houses Less Affordable Than They Were in Past Decades?

Source: Simplifying the Market

I have been fascinated by Residential Real Estate for as long as I can remember. Mom was a Real Estate agent, and Housing and mortgages and transactions were dinner table conversations ever since I was a little kid.

That experience certainly helped me notice what was going on in Real Estate in the 2000s and provided lots of clues as to what was coming. It also has been useful to see the response to the recent real estate boomlet — really a supply/demand imbalance revealed in part by the pandemic lockdown; it is actually a structural problem that was decades in the making.

And one of the things that many people miss is that purchasing a house is a function of two main things: The home’s cost, and how you finance the purchase. As my colleague, Ben Carlson noted, “While prices were far lower in the past, borrowing rates were much higher.”

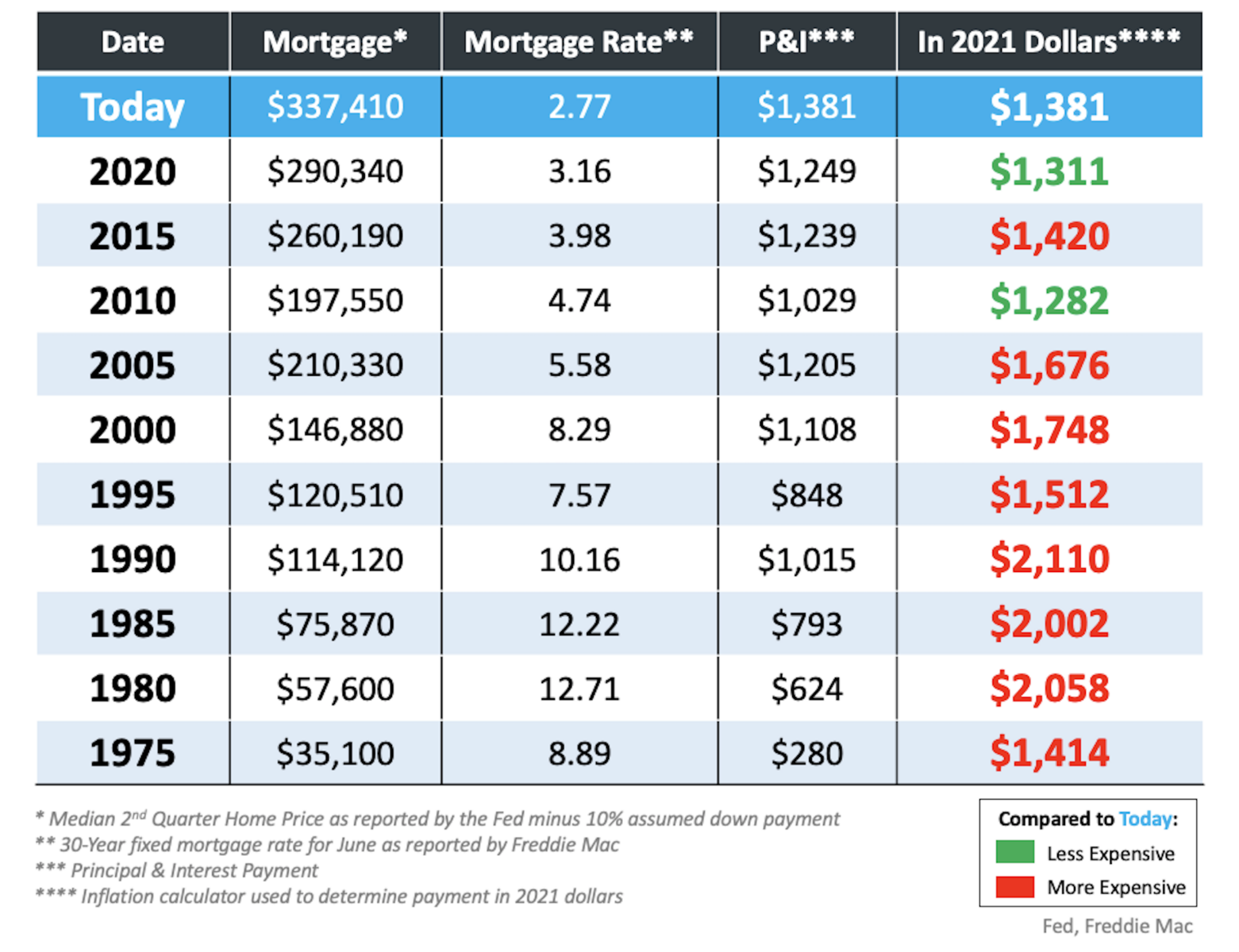

Don’t take our word for it, look at the table above: It shows the cost of purchasing a “median home” using the prevailing fixed 30-year mortgage rate. And despite the recent rise in prices, the current low rates are near ll time records.

That table shows it was cheaper to buy the median house with a standard mortgage 10 years ago, it was more expensive 20, 30, and 40 years ago.

This is food for thought — not only about home prices but also the challenge facing the Fed as it begins contemplating tapering QE and ending ZIRP.

Previously:

How Everybody Miscalculated Housing Demand (July 29, 2021)

Not a Housing Bubble (March 30, 2021)

Mortgage Debt Hits Record: So What? (September 4, 2019)

See also:

Has There Ever Been a Worse Time to Be a Homebuyer? (May 28, 2021)