My mid-week morning train WFH reads:

• The Pret Index: Wall Street Latte Sales Approaching Bear Market Sales of cappuccinos and tuna baguettes are close to entering a bear market in downtown Manhattan, in London’s business district and in Paris. The setback comes as major financial services firms push back return-to-office plans, with the delta variant having driven the average number of new Covid-19 cases in New York City up to almost 2,000 a day—a level not seen since April. (Bloomberg)

• Gold as an Inflation Hedge: What the Past 50 Years Teaches Us On the anniversary of the metal’s unleashing by Nixon, gold’s believers may be disappointed by the record (Wall Street Journal)

• American CEOs make 351 times more than workers. In 1965 it was 15 to one Rather than address stagnant wages for hourly workers and yawning inequality, corporations are blaming a ‘labor shortage’ (The Guardian)

• The Lionel Messi saga is a lesson in how not to handle a prize asset Barcelona and other football clubs could learn from how Silicon Valley treats valued performers (Financial Times)

• Are You a Hedgehog or a Fox? Whether you believe you’ve already discovered a system that will work for you or are struggling to improve, the rewards you seek as an investor require greater self-knowledge. (American Consequences)

• These People Who Work From Home Have a Secret: They Have Two Jobs When the pandemic freed employees from having to report to the office, some saw an opportunity to double their salary on the sly. Why be good at one job, they thought, when they could be mediocre at two? (Wall Street Journal)

• An Audacious Case for an Ancient Building Style: The Courtyard The idea of arranging housing around enclosed central spaces could find fresh applications in crowded urban areas like Manhattan, designers say. (CityLab)

• Texas GOP’s All-In Focus on Culture War Spurs Corporate Backlash Dell, Facebook, Apple and IBM have objected to proposed bills Employers say conservative social agenda hurts recruiting. (Bloomberg)

• Why Afghan Forces So Quickly Laid Down Their Arms Opposing Afghan factions have long negotiated arrangements to stop fighting — something the U.S. either failed to understand or chose to ignore. (Politico) see also Billions spent on Afghan army ultimately benefited Taliban Built and trained at a two-decade cost of $83 billion, Afghan security forces collapsed so quickly and completely — in some cases without a shot fired — that the ultimate beneficiary of the American investment turned out to be the Taliban. They grabbed not only political power but also U.S.-supplied firepower — guns, ammunition, helicopters and more. (AP)

• Murray Bartlett On Letting Loose As Armond in The White Lotus The veteran actor talks sex scenes, being out in Hollywood, and his memorable Sex and the City appearance. (GQ)

Be sure to check out our Masters in Business interview this weekend Fran Kinniry, Global Head of Private Investments at investing giant Vanguard Group. He is the leader of Vanguard’s initiative to offer private equity investing to individual investors.

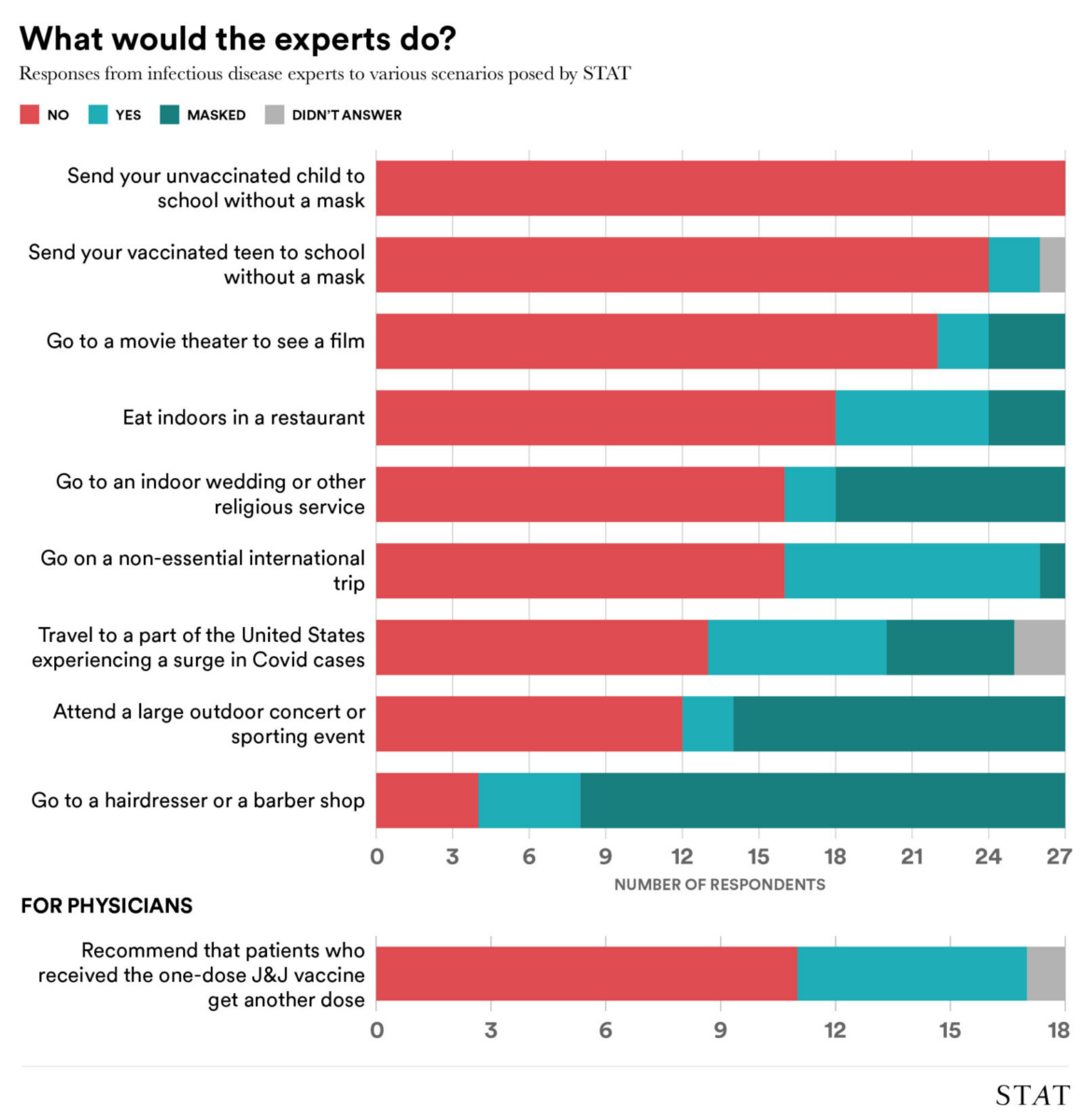

What’s safe to do during summer’s Covid surge? STAT asked public health experts about their own plans

Source: Stat

Sign up for our reads-only mailing list here.