The weekend is here! Pour yourself a mug of Maxwell House pre-ground coffee (?!), grab a seat by the lake, and get ready for our longer-form weekend reads:

• Going for Broke in Cryptoland It’s hard to think of another financial craze in which so many people poured so much into entities with so little intrinsic value. Few hype coins have any utility as currency. Good luck buying lunch with one. Many are minted in numbers rarely seen outside astronomy books — trillions, quadrillions — which dooms them to vanishingly tiny prices. Some hype coins mint instant millionaires. Others go bust. Why not take a chance? (New York Times)

• The Pandemic Business Boom COVID-19 killed countless businesses. Surprisingly, it also launched a whole bunch of new ones. (The Atlantic)

• Blackstone’s Moment Blackstone is the largest alternative asset manager in the world, which means it traffics in the kinds of investments that don’t fall into the conventional buckets of stocks, bonds and cash. There are around $250 trillion of securities in conventional stock and bond markets around the world; Blackstone is focused on the $14 trillion market of investable assets that sits outside them. It currently manages in excess of $650 billion of assets and targets a trillion. (Net Interest)

• ‘Green Bitcoin Mining’: The Big Profits In Clean Crypto Bitcoin is infamous for wasting enough electricity to add 40 million tons of carbon dioxide to the atmosphere a year—but now, a growing cadre of U.S. miners are developing green, and lucrative, new strategies worth a fortune all their own. (Forbes)

• Compounding Crazy: Everything is moving so fast out there. What if it’s just getting started? Craziness and high valuations invite snark. It’s how people respond to unfamiliar things, and it’s exceedingly easy to dismiss everything as a bubble, or as temporary froth, or as COVID-boredom-induced-adventure-seeking, or as a ponzi waiting to collapse. Being skeptical makes you look smart and responsible. A surefire way to get grown-up bonus points is to make fun of people who believe “this time is different.” (Not Boring)

• The $5,000 quest for the perfect butt How the Brazilian butt lift, one of the world’s most dangerous plastic surgery procedures, went mainstream. (Vox)

• “This Is Going to Change the World” As the new millennium dawned, a mysterious invention from a charismatic millionaire became a viral sensation—then went down in flames. Ever since, I’ve wondered: Was it all my fault? A look at the Segway, 20 years later (Slate)

• Gorillas: The new WeWork? What does the future hold for on-demand grocery startup Gorillas? (Sifted)

• A non-Standard model: Most cosmologists say dark matter must exist. So far, it’s nowhere to be found. A widely scorned rival theory explains why (Aeon)

• How Dua Lipa Shut Down the Trolls and Conquered International Pop Before she rocketed into the pop stratosphere, before she delivered a record of club catharsis to a world stuck dancing in its bedroom, before she broke the billion-stream barrier, before the Grammys…Dua Lipa had to learn to believe in her own powers. (Vanity Fair)

Be sure to check out our Masters in Business interview this weekend with Sandy Rattray, Chief Investment Officer of Man Group and a member of the Man Group Executive Committee. Man provides a range of funds for institutional and private investors globally and is the world’s largest publicly traded hedge fund company, with about $125 billion in funds under management.

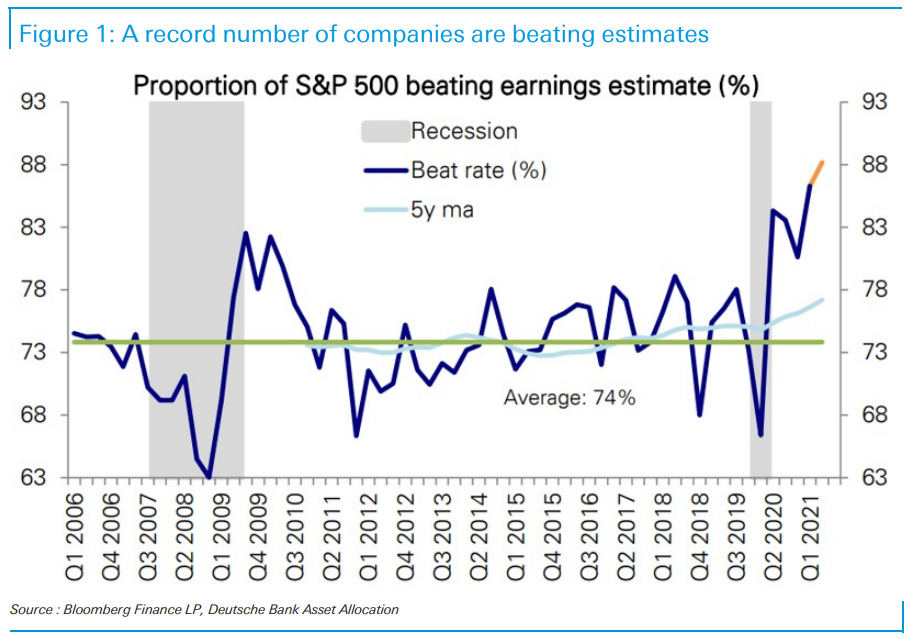

Q2 US earnings season has been spectacular so far

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.