Your end of Q3 morning train WFH reads:

• ‘Most Americans Today Believe the Stock Market Is Rigged, and They’re Right’ New research shows insider trading is everywhere + so far, no one seems to care. It’s not just those at the top of the rankings who constantly beat the market; purchases made by U.S. executives outperformed the S&P 500 over the ensuing 12 months by an average of 5% points between 2015 and 2020. The gap might seem scandalous to those with only a passing acquaintance with U.S. insider trading rules, which make it illegal for insiders to trade using material—or financially significant—nonpublic information. And yet on Wall Street it’s long been an open secret that insiders trade on what they know. (Businessweek)

• Dimension Studio: How fashion is being brought to the metaverse Everyone in this world appears to be reporting exceptional demand. Cathy Hackl, a futurist and metaverse expert who consults for brands, notes a surge in work for her consultancy business. “I think that the opportunity could be life-changing for startups that really present a value proposition; that are really doing things that have never been done before” (Vogue Business)

• University Endowments Mint Billions in Golden Era of Venture Capital Some schools, including Washington University in St. Louis and Duke University, gained more than 50% (Wall Street Journal)

• The Diversity Premium: More Women, Higher Returns. “The higher the female representation across the companies we cover the better share price returns we have observed since 2010,” said Eugène Klerk, Credit Suisse’s head of global ESG research. (Institutional Investor)

• One Big Reason Canadian Plans Are So Well Off: International Investing Their overseas exposure is expanding, while US funds stay mostly at home. (Chief Investment Officer)

• Robinhood Hits Campus, Where Credit Card Companies Fear to Tread The company plans to hit up college coffee shops to spread the word about its services. When credit card companies did it a generation ago, Congress got involved. (New York Times)

• Is It Ever OK to Get Stoned With a Client? And Other Questions as Pot Comes to Work As more young professionals use legal weed with work friends, companies grapple with setting boundaries on a new kind of bonding (Wall Street Journal)

• College “Move-In Day”–Army Style Whereas America’s colleges and universities take America’s best and brightest and turn them into whining and sniveling wokesters, the armed forces take America’s teenage dead-enders and produce the best amongst us. RESPECT! (Redneck Intellectual)

• How America Dropped to No. 36 The U.S. has fallen far behind in distributing the vaccines that it pioneered. (The Atlantic) see also No, Vaccinated People Are Not ‘Just as Likely’ to Spread the Coronavirus as Unvaccinated People This has become a common refrain among the cautious—and it’s wrong. (The Atlantic)

• Jon Stewart Has a New Talk Show, but He Plans to do More Listening “The Problem With Jon Stewart” will examine social issues through the personal stories of those most affected. “It feels more cathartic than just yelling at the screen,” he said. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Jack Schwager, author of various Market Wizard books. He is also the founder of Fund Seeder, a platform designed to match undiscovered trading talent with capital worldwide. His latest book is “Unknown Market Wizards: The best traders you’ve never heard of.”

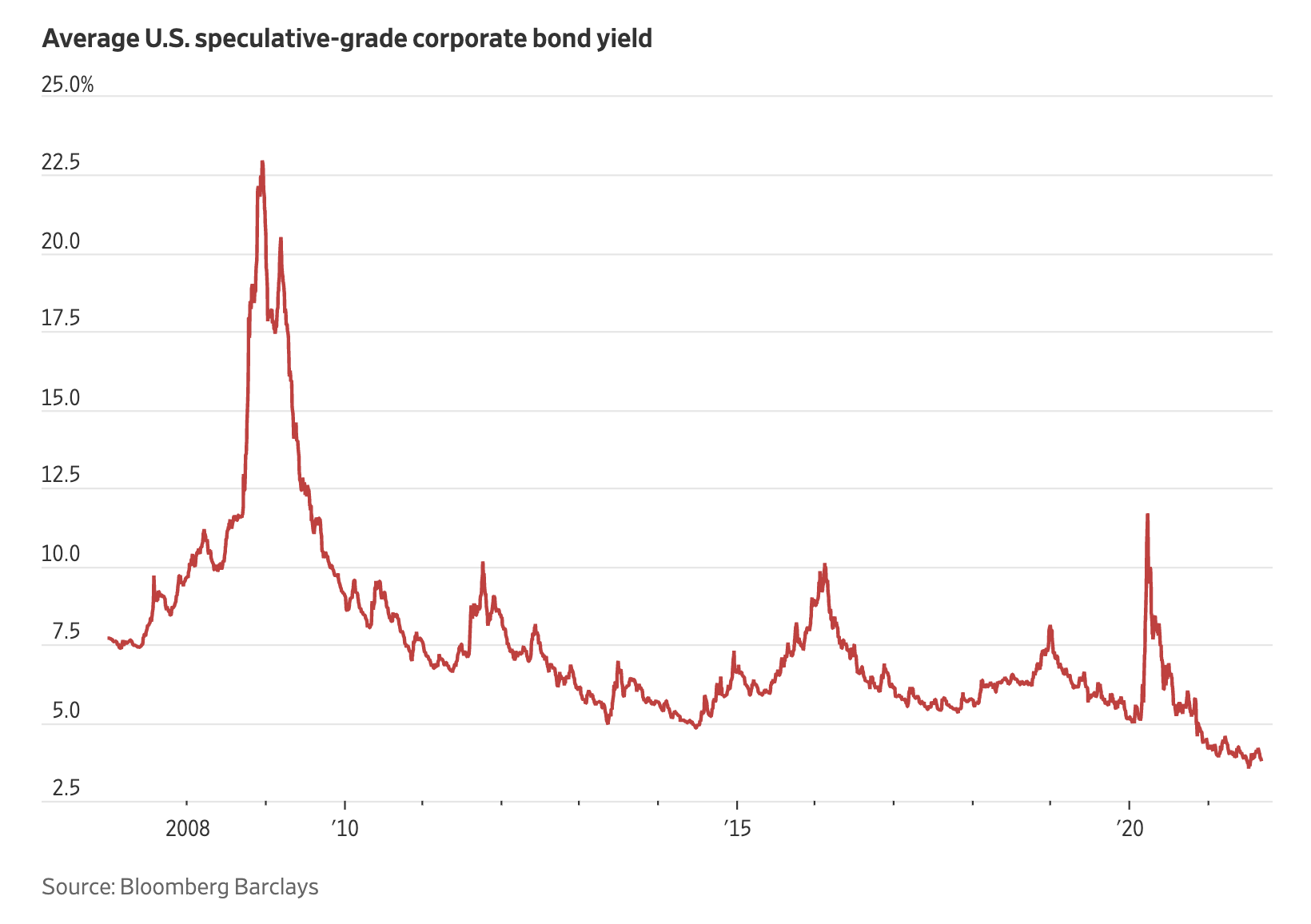

Search for Yield Leads Bond Buyers to Unrated Debt

Source: Wall Street Journal

Sign up for our reads-only mailing list here.