One of the neat things about being a fast-growing firm is that we embrace innovative, new ways of doing our jobs.

Case in point: O’Shaughnessy Asset Management’s direct indexing tool, Canvas. The entire company was just acquired by investing giant Franklin Templeton. There is $1.8 billion in Canvas (RWM is part of that). Kudos to the entire OSAM team for how they created an excellent, indeed, indispensable, software tool for managing client dollars.

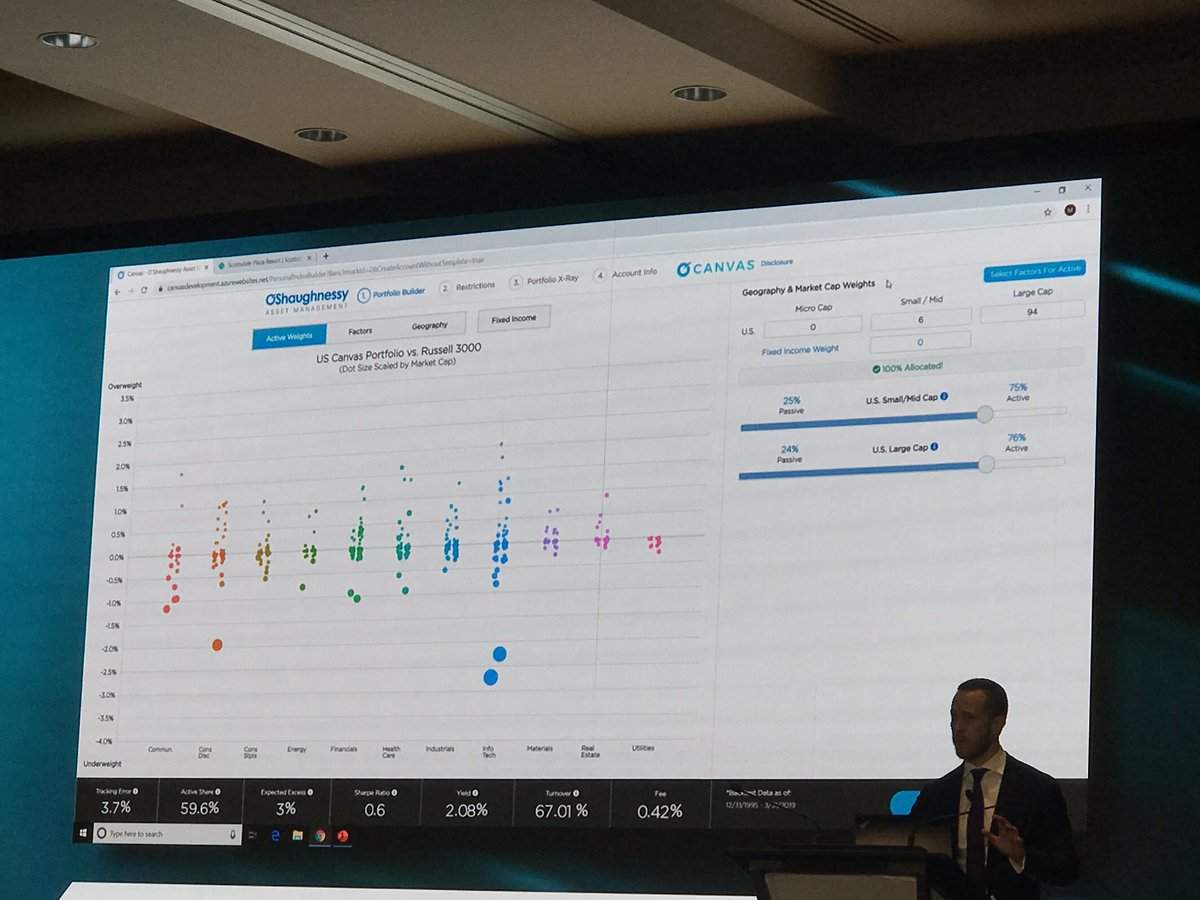

RWM was fortunate not only to be a beta tester of Canvas, but we hosted team OSAM’s unveil of their product at our 2019 conference (That’s Patrick O’Shaughnessy in the pic above barely 2 years ago). Michael, Ben, and the rest of our team had major input, sharing a practitioner’s perspective. It’s great that the program is now affiliated with a big shop (AUM = $1.5 trillion), which will allow even further development of Canvas in the coming years.

I previously discussed how Canvas allowed us to harvest an extraordinary amount of tax losses during the pandemic crash and recovery in 2020. Direct Indexing is a great concept, but the way OSAM executed it – the user interface, features, tools, dashboard, etc. – really made it a unique and amazing product for RWM’s clients.

Paul Volcker once quipped “The only thing useful banks have invented in 20 years is the ATM,” but I have to disagree with Tall Paul’s assessment.1 We live in a golden age of innovation for investors, banking, and financial transactions. Of course, it’s not remotely perfect, but financial technologies have made things so much better today than they were 50 years ago. Hell, it’s 10X better than it was a decade ago.

A few examples:

Investing

1. Index funds allow purchases of entire markets or sectors

2. ETFs allow funds to be purchased intraday, and to operate without unintentional cap gains tax

3. Expense ratios have plummeted

4. Investor behavior has become much better understood

5. More market data is broadly available than ever before

6. Factors that drive returns are well catalogued

7. Roboadvisors allow professional account management regardless of account size.

8. Tax loss harvesting increases net returns for investors

9. ESG allows portfolios to reflect investor’s values

10. Direct indexing gives investors enormous flexibilityTrading

1. Costs have dropped to zero.

2. Trades clear and settle much faster, on the way to T-0

3. Apps allow access to markets via mobile devices

4. Analytic tools are ubiquitous

5. Market & company information travels instantaneouslyBanking

1. Apps (Venmo) allow individuals to send cash as easy as texting

2. Square allows vendors of any size to process credit card transactions

3. Deposit checks into your bank account via your phone camera

4. Sending money internationally is easy (GlobalRemit & Remittly)

5. Oh, and yes, ATMs are convenient for those who still use cash

I am going to stop at 20 but there are endless other ways technology has made finance better.

A great joy of running an innovative firm is that we get an early look at all of the crazy cool FinTech tools before most of the world knows about them. We love when entrepreneurs share ways of doing our jobs better/faster/smarter/cheaper for our clients. Sometimes we become these start-ups’ clients, sometimes we become investors, but we always share our feedback with founders as to how we imagine using their products on behalf of investors.

Congratulations to OSAM on a great product, and a smart partnership with $BEN. We are excited to continue working with Team OSAM on the future of Canvas.

Previously:

Accessing Losses via Direct Indexing (April 14, 2021)

Masters in Business: James O’Shaughnessy (September 2, 2014)

MiB: Campbell Harvey on DeFi (September 18, 2021)

_________

1. I met ‘Tall Paul’ at a party hosted by Chris Whalen in 2012 and told him a finance joke that cracked him up. It was a career highlight!