The Consequences of Physical Climate Risk for Banks

Source: Ceres

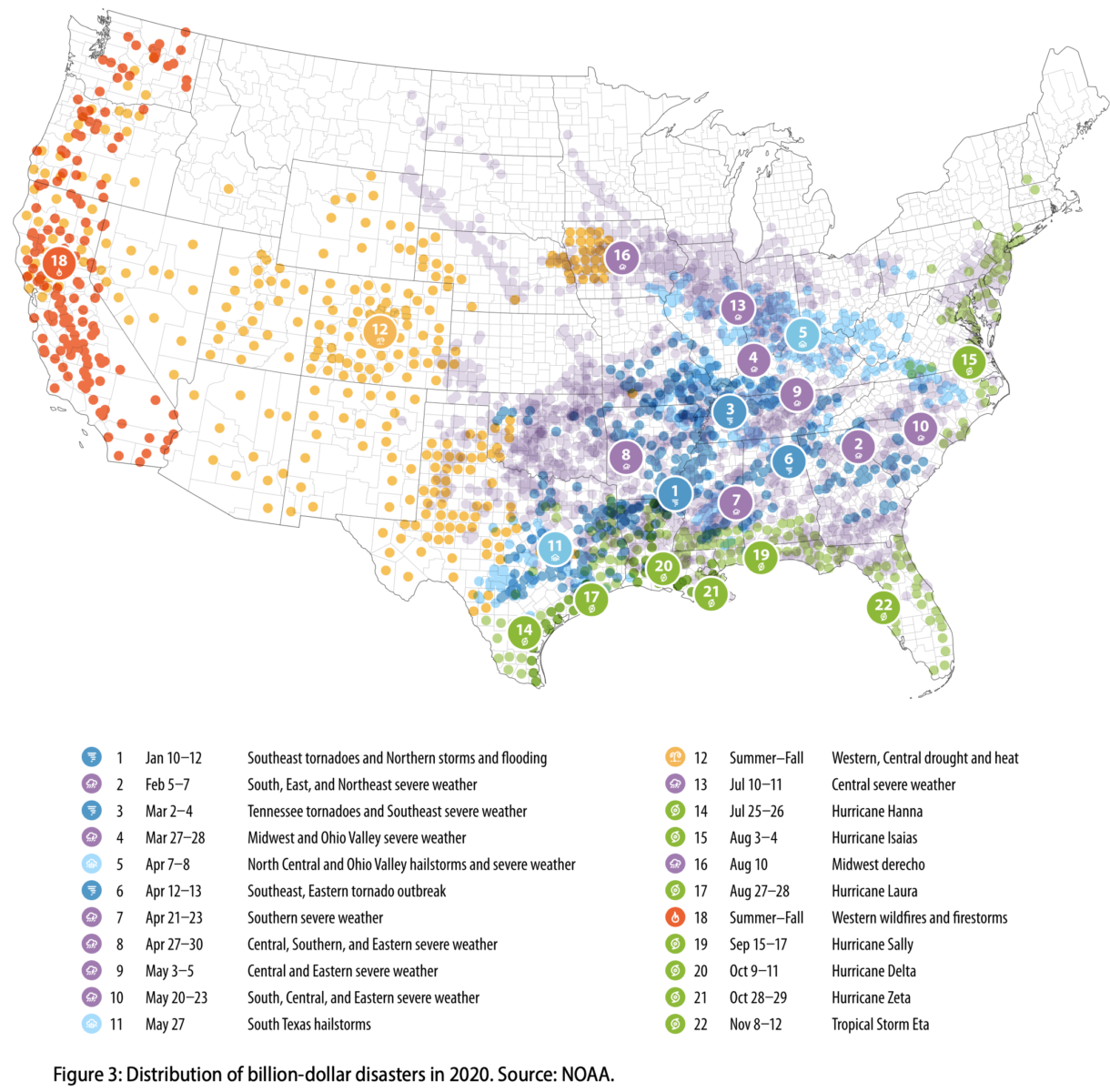

It is not that often that a dry financial research report gets me to stop what I am doing and take notice of a massive risk that may be getting too little attention. It happened today: You can see those risks detailed on the map above from a report (boringly titled) Financing a Net Zero Economy: The Consequences of Physical Climate Risk for Banks.

Cut to the chase: 28 of the largest U.S. banks hold $2.2 trillion of syndicated loan exposure. The impact of climate change on that portfolio could approach 10% or more, suggesting a risk of $200-250 billion.

Those are just the loans; consider the risks to a wide range of investments, from Private Equity to businesses to public equity to real estate — from flooding, storms, drought, supply chain disruptions, reduced productivity, and work interruption by extreme weather. Some worst-case scenarios suggest a few trillion dollars in losses are possible. That is some genuine capital at risk.

I don’t have a whole lot of insight into this area but I am becoming increasingly interested in it.

More to come . . .

Source:

Financing a Net Zero Economy: The Consequences of Physical Climate Risk for Banks

September 8, 2021

https://bit.ly/3CNTCmv