A friend accidentally sent me an invite to a metals and mining conference. She knows I was bullish on Gold in the mid-2000s but have been mostly skeptical since. I respect her as an investor, but she is bullish on gold for the decades I know her and has been for many decades before that. Our emails back and forth were pretty amusing, with me challenging her current premise for owning Gold, and she defending her lifelong attraction to the yellow metal as an investment vehicle.

Our conversation almost always begins the same way: “Look how the dollar has depreciated over the past century.”

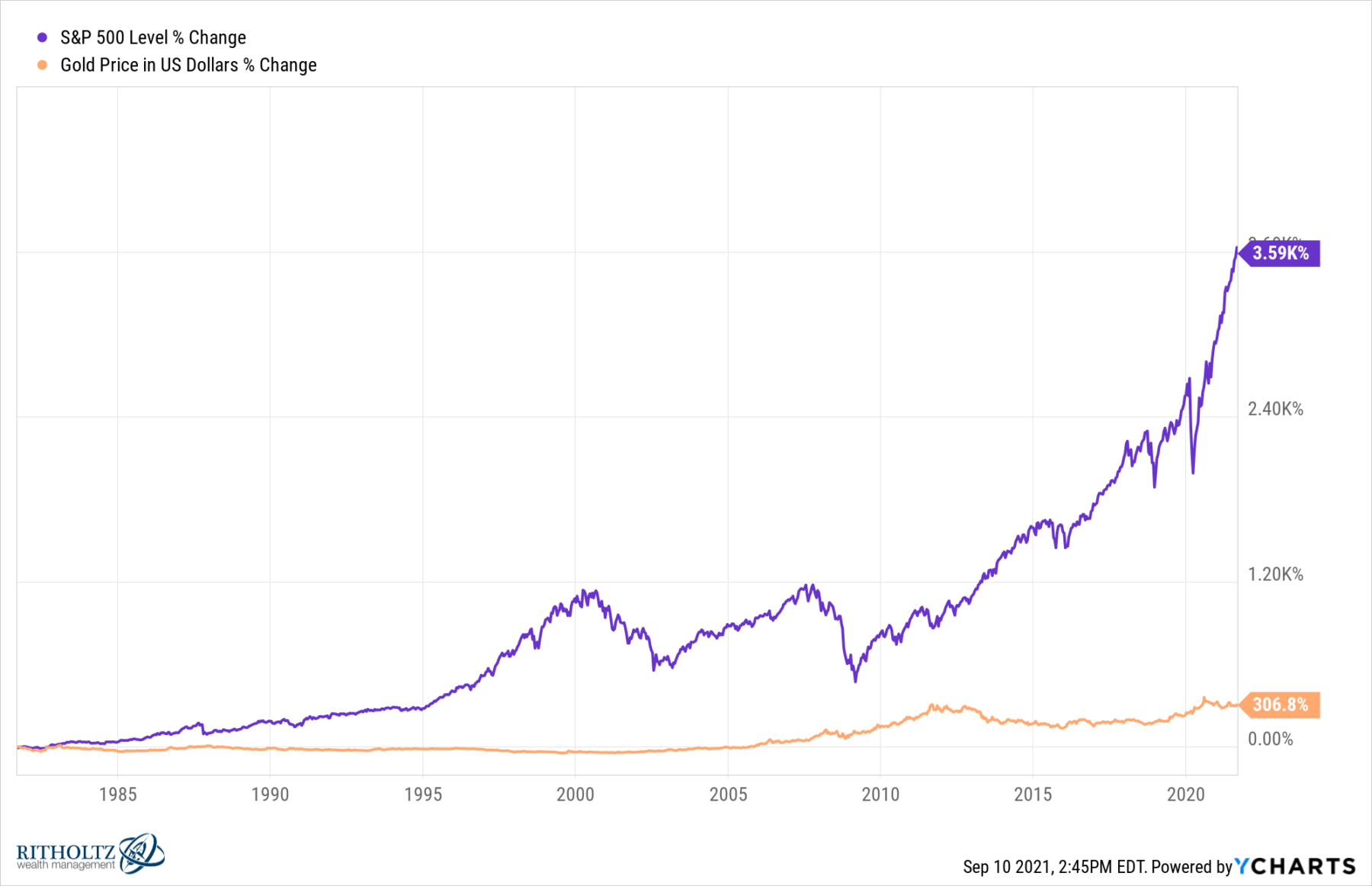

My response: “Why would any portfolio have sat in dollars for a century? Don’t tell me how gold has done versus the dollar, tell me how gold has done versus WHERE MY DOLLARS ARE INVESTED: Stocks, bonds, real estate, my own business, and start-ups — all of which beat gold in any timeframe you care to choose.”

My modest caveat: “A dollar has to maintain its value from the time I get paid until whenever I invest it, spend it or pay my taxes with it.”

Thus began our back and forth emails.

We agreed Gold’s performance in 2021 disappointed: Gold had a fantastic window to prove itself as an effective hedge in the first quarter of 2021; There was the anticipation of Covid vaccines leading to a massive re-opening surge, with big spending and temporary inflation. This was the perfect environment for gold to surge through $2,000 and begin its long-promised march towards $10,000.

That thesis looked right for all of 10 minutes.

When it failed to move higher off of every possible supportive condition, the professional Gold traders admitted their error and dumped it. But the Gold Bugs are a religious sort, who continue to believe despite the persistent disappointments of the atomic number 79.

My favorite line of hers was a quote by Don Coxe1: “Those who know it best love it least for they have been disappointed the most.” She added, “I guess I am one of these people but I will still keep buying and believing.”

My friend reminded me I had liked the ETF GLD when it was ~$400 on CNBC pre-GFC (I was laughed at by the anchors, which turns out to be a great indicator).

My friend reminded me I had liked the ETF GLD when it was ~$400 on CNBC pre-GFC (I was laughed at by the anchors, which turns out to be a great indicator).

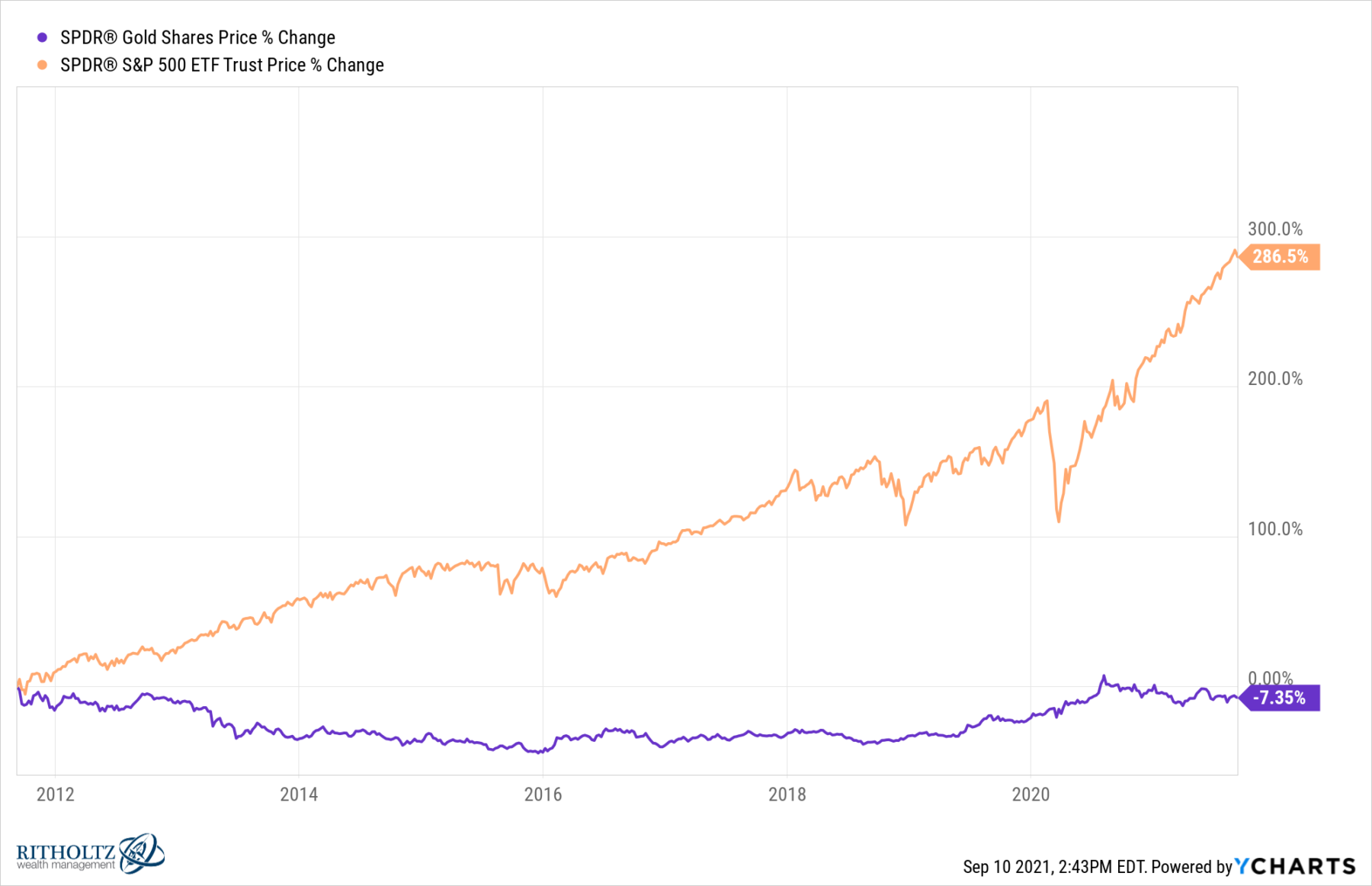

My response was those were very different conditions, Gold went up 5X since then, and other, more attractive opportunities had presented themselves. The marketers seem to have gotten used to QE/ZIRP, and Gold has not responded much to those inputs. Indeed, over the past decade, Gold has done a whole lot of nothing. This failure in 2021 was probably the last straw for gold for not just me, but lots of others: Libertarians, hard money zealots, even some former goldbugs had migrated to Crypto. Gold was so last century.

Then she said this, that rocked me back on my heels:

“I like having assets out of the banking system + out of government hands.”

This is utterly false, a premise that is so wrong as to be hallucinatory. It is a narrow and artificial claim that is not reality-based.

Everything you own — EVERYTHING — depends upon the government to enforce your contractual property rights: The title to your home is enforced by the town property and tax registry, and if you have an issue, the government courts are where it gets resolved. You own title to your car because it is registered with your state’s DMV; that little DMV paper is how you transfer ownership to a third party. Ownership of any stock or bond you believe you own is tracked by custodians, the Depository Trust Company (DTC), and numerous other entities, all regulated by the U.S. Securities and Exchange Commission (SEC).

Ownership of any asset requires a central authority to enforce rules about that ownership. Unless you live in the badlands, where it is you, your trusty horse, and your rifle as the only law in town (Shane! Come back!). But, if you live in civilization — in any town, village, or city where people congregate — there will be some form of government hands involved in your business, and with a banking system tasking a vig as well. This is the promise of DeFi, to get these entrenched players out of your pocket. Good luck getting them to go quietly, if at all.

The pushback to this was “Not true not if you vault your gold outside the country and not in a safety deposit box.”

Again, I had to point out this was wrong:

1. Outside this country means inside another country — you are relying on the same thing from that government — but who do you trust? China? Russia? Israel? Switzerland? None are trustworthy.2

2. Worse, you are vaulting your gold, so now it has a cost of carry not accounted for in the spot price — so the performance is even worse.

I was shocked but I should not have been.

I told her the only positive thing I could say about Gold is that the moment I post on it, it will mark the beginning of a glorious and embarrassing run higher. Thus, she should thank me for her coming hard metal portfolio gains. Mark the date.

~~~

What are your thoughts on Gold? Share them here…

Previously:

12 Rules of Goldbuggery (April 16, 2013)

Bitten by the gold bug? You’ll do well to heed the past (January 12, 2014)

Once Again, the Gold Narrative Fails (December 2, 2014)

10 Lessons Learned from Gold’s Epic Rise & Fall (January 8, 2014)

________

1. The full Don Coxe quote actually means the opposite: “The most exciting returns are to be had from an asset class where those who know it best, love it least, because they have been hurt the most.”

2. Not even the Swiss, who notoriously were happy to take Nazi Gold, even if it was formerly in the teeth of people murdered in Auschwitz. Hard pass on the Swiss.

GLD Spdr, 2011-2021

GLD ns SPY, 2011-2021

SPX vs Gold Index, 1981 – 2021