My Two-for-Tuesday morning train WFH reads:

• How The Big Short Turned Into The Big Long. It was the biggest recession in a generation. We had two 50% crashes within the span of a decade. This triggers the recency bias (giving greater importance to more recent events) and the availability bias (overestimating an event that had a profound impact on us). Many households and companies were ruined by the financial crisis. Those scars run deep. (A Wealth of Common Sense)

• Why You Might Not Be Returning to the Office Until Next Year After the Delta variant disrupted plans to reopen after Labor Day, many businesses pushed their targets further out or left them open-ended. (New York Times) see also How Office Culture Changed in the Pandemic—From Workers Who Went Back Ages Ago Some employees have been toiling in cubicles for months while private offices sit empty; shifting rules and surprise doughnuts (Wall Street Journal)

• Private Equity’s Potential Payday From Build Back Better Hundreds of billions of dollars are scheduled for industries private equity dominates. Advocates want to make sure workers and families benefit, not financiers. (American Prospect)

• Gensler’s brewing battle with Robinhood could prove bloody In directing those trades to Citadel and Virtu, Robinhood is incentivized to overlook any scammy stuff because of the fees it receives. The firms can hide all this allegedly nefarious trading activity in various “dark pools” or private markets that exist all over Wall Street. (New York Post) see also What Gary Gensler Really Meant With His Order Flow Remarks The SEC chair is taking aim at market makers like Citadel and Virtu, not Robinhood and other brokers. (Bloomberg)

• For many workers, raises today don’t make up for years of wage stagnation Even as retail and hospitality workers see pay hikes, they’re often not enough to offset rising prices and years of low pay. (Fast Company)

• All the Biggest Environmental Risks Facing the World’s Biggest Cities From landslides and extreme heat to insect infestations and airborne diseases, these are the most worrying hazards in urban areas with more than 1 million people. (BusinessWeek) see also Wall Street Can’t Get Enough Fixer-Upper Houses High-interest loans to house flippers are a hot commodity on Wall Street, but inventory is scarce (Wall Street Journal)

• The Other Sara Morrisons are ruining my inbox Email is an awful online ID that we use for almost everything. (Recode)

• In Florida, a summer of death and resistance as the coronavirus rampaged. Florida provided ideal conditions for the virus to flourish: Businesses have largely reopened. Gov. Ron DeSantis (R) has waged high-profile fights to stop mask mandates at schools and to shield businesses from fines for allowing unvaccinated and unmasked patrons. (Washington Post) see also How Florida’s massive Covid-19 spike got so bad The Florida surge is a microcosm of a summer gone wrong. (Vox)

• The 7 Worst Habits for Your Brain Bad choices and everyday missteps could harm your cognition. Here’s how to combat several of them. (AARP)

• The Ted Lasso backlash was inevitable The soccer comedy is its folksy, charming self in season two. That might be why some people are so mad at it. (Vox) see also How Did ‘Ted Lasso’ Become Such a Lightning Rod? For a show that’s all but synonymous with positivity, the Apple TV+ hit has bizarrely become the subject of intense criticism in its second season. (The Ringer)

Be sure to check out our Masters in Business interview this weekend with Robert Hormats, Managing Director at Tiedemann Advisors. Previously, he spent 25 years at Goldman Sachs (International), rising to Vice Chairman. Hormats has served five U.S. presidential administrations, most recently as Under Secretary of State for Economic Growth, Energy, and the Environment from 2009 through 2013.

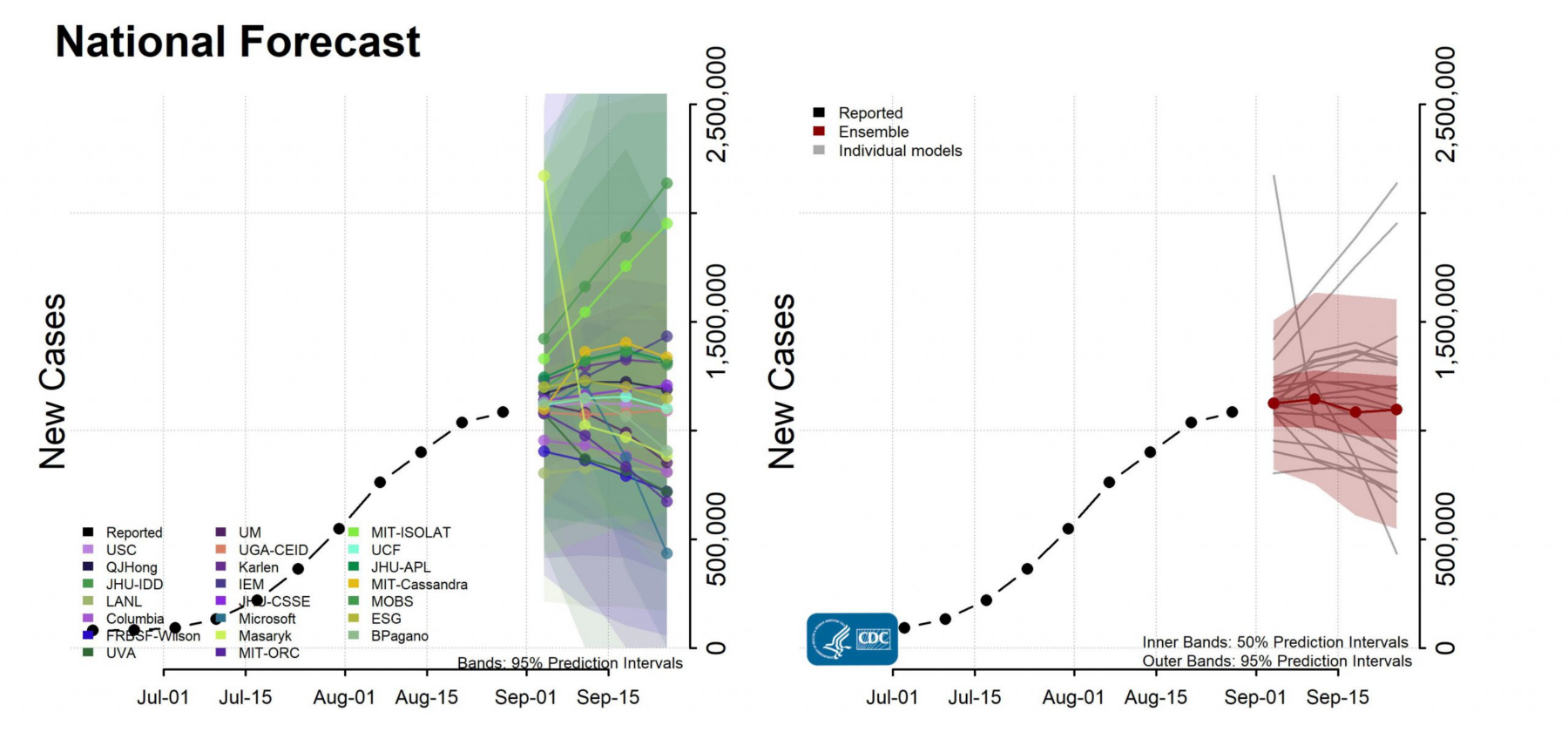

COVID-19 Forecasts: Cases

Source: CDC