My end of week morning train WFH reads:

• Zillow Torched $381 Million Overpaying for Houses. Spectacular. Zillow is easy to mock here. Losing almost $400 million in three months when you could’ve done almost anything else is extremely make-fun-able, not to mention retrospectively wasteful. It’s also possible that the machines will never be good enough to do this on their own in a way that works for both sellers and the companies trying to buy their houses. (Slate)

• Going back in time and telling a Tesla bull the company is worth $1tn When u think about it, it makes perfect sense. (Financial Times) see also The All-Electric Porsche Taycan Is an Amazing Car. But Tesla Has Little to Worry About. The fit and finish are great. The handling and breaking are great. The exterior and interior styling are great. The ride is quiet. Even with the Taycan doing well, matching the Model S, it’s hard to call it an existential threat to Tesla. It’s expensive, as is a Model S, and both cars represent a small portion of the overall auto market. (Barron’s)

• The Rep If you’re an established fintech player providing software to us, we will make you a better company. We have improved the products and services of numerous companies in the wealthtech / fintech space through this sort of collaboration. All of our most crucial providers are better companies for having dealt with us. If you can keep up with us, servicing a typical RIA becomes a piece of cake. (Reformed Broker)

• Papa John Is Still Obsessed With Papa John’s John Schnatter stepped down as the pizza chain’s chairman following revelations he’d uttered a racist slur. Now he’s cashed out over $500 million in stock and wants to clear his name. (Businessweek)

• I Was the Only Female Partner at My Hedge Fund. Here’s What Needs to Change. In an excerpt from her book, former Canyon Partners portfolio manager Dominique Mielle reflects on the scarcity of women in senior roles — and the obstacles that stand in their way. (Institutional Investor)

• The last great mystery of the mind: meet the people who have unusual – or non-existent – inner voices Most of us have an inner voice: that constant presence that tells you to “Watch out” or “Buy shampoo” or “Urgh, this guy’s a creep”. For many of us, this voice sounds much like our own, or at least how we think we sound. But for some people, their inner voice isn’t a straightforward monologue that reproaches, counsels and reminds. Their inner voice is a squabbling Italian couple, say, or a calm-faced interviewer with their hands folded on their lap. Or it’s a taste, feeling, sensation or colour. In some cases, there isn’t a voice at all, just silence. (The Guardian)

• Elon Musk Is Building a Sci-Fi World, and the Rest of Us Are Trapped in It The metaverse is at once an illustration of and a distraction from a broader and more troubling turn in the history of capitalism. The world’s techno-billionaires are forging a new kind of capitalism: Muskism. Mr. Musk, who likes to troll his rivals, mocked Mr. Zuckerberg’s metaverse. But from missions to Mars and the moon to the metaverse, it’s all Muskism: extreme, extraterrestrial capitalism, where stock prices are driven less by earnings than by fantasies from science fiction. (New York Times)

• The Booming Underground Market for Bots That Steal Your 2FA Codes The bots convincingly and effortlessly help hackers break into Coinbase, Amazon, PayPal, and bank accounts. (Vice)

• Soccer Looks Different When You Can’t See Who’s Playing Broadcast tracking technology captures how players move their limbs by reproducing filmed action displayed as stick-figure skeletons in a two-dimensional render. Show the same clips to different viewers as either a video or an anonymized animation, they could measure how attitudes toward race and gender affect how we see soccer. (FiveThirtyEight)

• ‘Awards Chatter’ Podcast: ‘Sopranos’ Creator David Chase Finally Reveals What Happened to Tony Chase opens up about what inspired that series and its new prequel, how his feelings about film versus TV have evolved over the years and, in a major disclosure, what really happened to Tony Soprano at the end of the series finale. (Hollywood Reporter)

Be sure to check out our Masters in Business interview this weekend with Tom Gayner, Markel Corporation’s co-president and chief investment officer of the financial-holding company He has been dubbed the “next Warren Buffett.” From 2000 to 2015 Gayner returned an average of 11.3% annually, while the S&P 500 index of big U.S. stocks returned 4.2%, (including dividends).

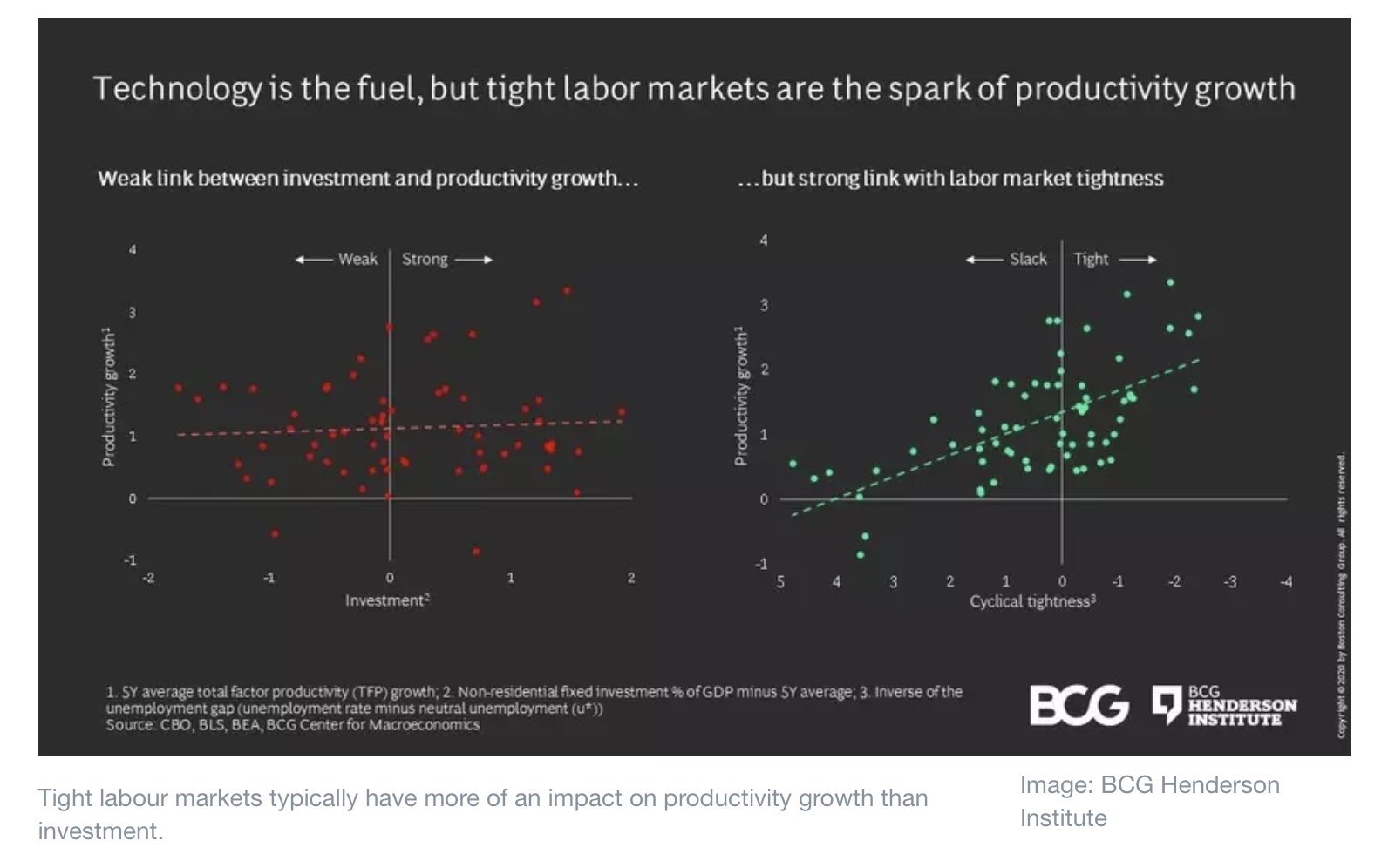

How Productivity Grows

Source: @PlanMaestro

Sign up for our reads-only mailing list here.