My end of week morning train WFH reads:

• How post-pandemic inflation ended last time Your great great grandparents weren’t reading articles about the CPI every day because the CPI didn’t even exist until the early 20’s. And if it was published anywhere, it was for government officials and economists, not Fox News hosts. And then, in 1920-1921, there was an 18 month recession that popped the bubble in rising prices and restored inflation to a more moderate pace. This moderation would set the table for one of the most important decades of innovation and economic progress ever. (Reformed Broker)

• Cities with empty offices see new room to expand housing: After Covid, New York and other cities are weighing whether to convert empty office buildings into affordable housing. (Politico) see also Visions of a U.S. Computer Chip Boom Have Cities Hustling Many local governments see a silver lining in the shortage of semiconductor chips that has contributed to a slowdown in the global economy. (New York Times)

• Inflation Tarnation! Inside the Supply-Chain Snafu That Could Wreck Your Holiday Plans How the wild details of the most memed shipping crisis perfectly illustrate our global trade dilemma. (Vanity Fair)

• What’s Wrong With ESG Investing as Explained Through the Medium of Ohio No matter how much you or I might abhor companies that pollute the planet, gouge the sick with criminally high pharmaceutical prices, produce dangerous weapons for public purchase, or poison our democracy with dangerous conspiracy theories, we can’t make the shares of those companies disappear; someone will own them. (Bloomberg)

• The Golden Age of Grift We are in the middle of a trillion dollar game of musical chairs. Except some people think their chair can’t disappear, other people sit in a chair before the music actually stops, and a few players just pick up a chair and leave the room altogether. The only losers are the people actually following the rules. (Young Money)

• Supply-Chain Snarls Deliver Windfalls to Wall Street Hedge funds cash in via appreciating stakes in container-ship companies, sales of vessels (Wall Street Journal)

• Why There Hasn’t Been A Mass Exodus Of Teachers The most recent statistics suggest that while some districts are reporting significant faculty shortages, the country overall is not facing a sudden teacher shortage. Any staffing shortages for full-time K-12 teachers appear far less severe and widespread than those for support staff like substitute teachers, bus drivers and paraprofessionals, who are paid less and encounter more job instability. (FiveThirtyEight)

• Where Are Young People Most Optimistic? In Poorer Nations. More than half of Americans, young and old, say children today will be less economically successful than their parents, a global survey shows. (New York Times)

• Pop psychology has killed the villain: Profit is more important than the menace of evil We are all shaped by our experiences, good and bad, but rarely in a clear or simple way. Psychotherapists don’t identify one essential turning point in a client’s life (“Hmm, Dalmatians, you say?”) and then close the case. Sometimes, one can know every factor and still encounter a terrifying, unilluminable void at the heart of a personality. In real life, not everybody who does appalling things is misunderstood. (UnHerd)

• Know How the Beatles Ended? Peter Jackson May Change Your Mind. The director’s three-part documentary “Get Back” explores the most contested period in the band’s history and reveals there’s still plenty to debate. (New York Times)

Be sure to check out our Masters in Business this week with Edwin Conway, Global Head of BlackRock Alternative Investors (BAI), which runs over $300 billion in total assets. BlackRock’s global alternatives business includes Real Estate, Infrastructure, Hedge Funds, Private Equity, and Credit, and is one of the fastest-growing parts of the investment giant.

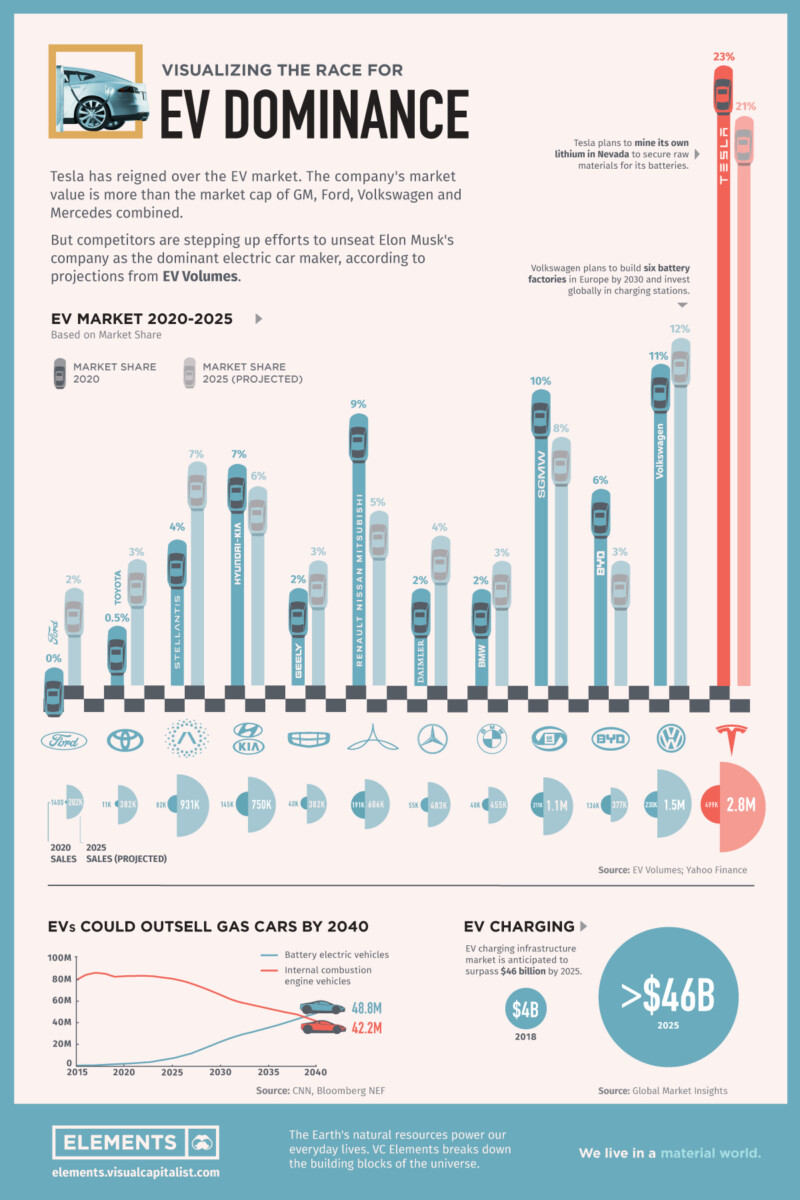

Electric Vehicle Market Share

Source: Visual Capitalist

Sign up for our reads-only mailing list here.