Welcome to November (how did that happen?) My back to work morning train WFH reads:

• Deflating Your Inflation Fears: Rising prices eat away at the purchasing power of your assets. But taking on more risk to fight inflation can do more harm than good. (Wall Street Journal)

• Wall Street Starts to Doubt Facebook, Its Longtime Darling The company has lagged rivals on a key measure of investor confidence. (Businessweek) see also The Real Reason Facebook Changed Its Name Mark Zuckerberg wants to be the hero of the metaverse because he knows Facebook is boring. (The Atlantic)

• Women May Be Better Investors Than Men. Let Me Mansplain Why. Overconfidence is bad, and women are less likely to fall victim to it. (New York Times)

• 2022 Lucid Air: At Last, a Worthy Tesla Opponent With industry-leading range and a dual-motor array maxing out at 1,111 hp, the Lucid Air Dream Edition Performance marks the arrival of another serious contender in the electric luxury-sedan market (Wall Street Journal)

• The Disrespect. You’re surrounded by other investors. They see things differently than you. They are operating differently than you might be. That’s okay. It’s supposed to be that way. A total and complete stranger doesn’t have to share your investment beliefs. Doesn’t have to agree with your opinions about the right way to trade or the right investments to hold. (Reformed Broker)

• Richard Thaler: ‘I became an academic because I’m not good at taking orders’: John Morgan meets the Nobel prizewinning father of nudge economics, who believes that the dismal science can only be improved by taking account of people’s ‘predictable mistakes’ (Times Higher Education)

• Is there any truth to viral TikTok and Twitter claims that cities have made allergies worse by planting mostly male trees? Short answer: No; Longer answer: “Botanical Sexism” is complicated (Slate)

• What is actually in the Biden legislative plan that is likely to pass? As it turns out, a great many things: $400 billion for child care, universal pre-K programs for 3- and 4-year-olds one-year extension to the child tax credit, premium subsidies for buyers of health plans, and immigration reform. (LA Times) see also The Billionaires Tax Isn’t New: Taxing billionaires on their wealth may sound novel, but the ideas behind it are already frequently used in the tax code. (ProPublica)

• The Jan. 6 siege of the U.S. Capitol was neither a spontaneous act nor an isolated event. The consequences of that day are still coming into focus, but what is already clear is that the insurrection was not a spontaneous act nor an isolated event. It was a battle in a broader war over the truth and over the future of American democracy. (Washington Post)

• The NBA’s Most Surprisingly Valuable Player: Suns backup Cameron Payne was out of the league. Now he’s a star in his role on a nearly $20 million contract. Even he can’t believe it. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Lisa Jones, CEO of Amundi U.S., the $100 billion arm of the French asset management giant. Amundi has over $2 trillion (€1.729) in AUM via 100 million clients from 36 countries, making it the second-largest asset manager in Europe and one of the world’s top 10 asset managers.

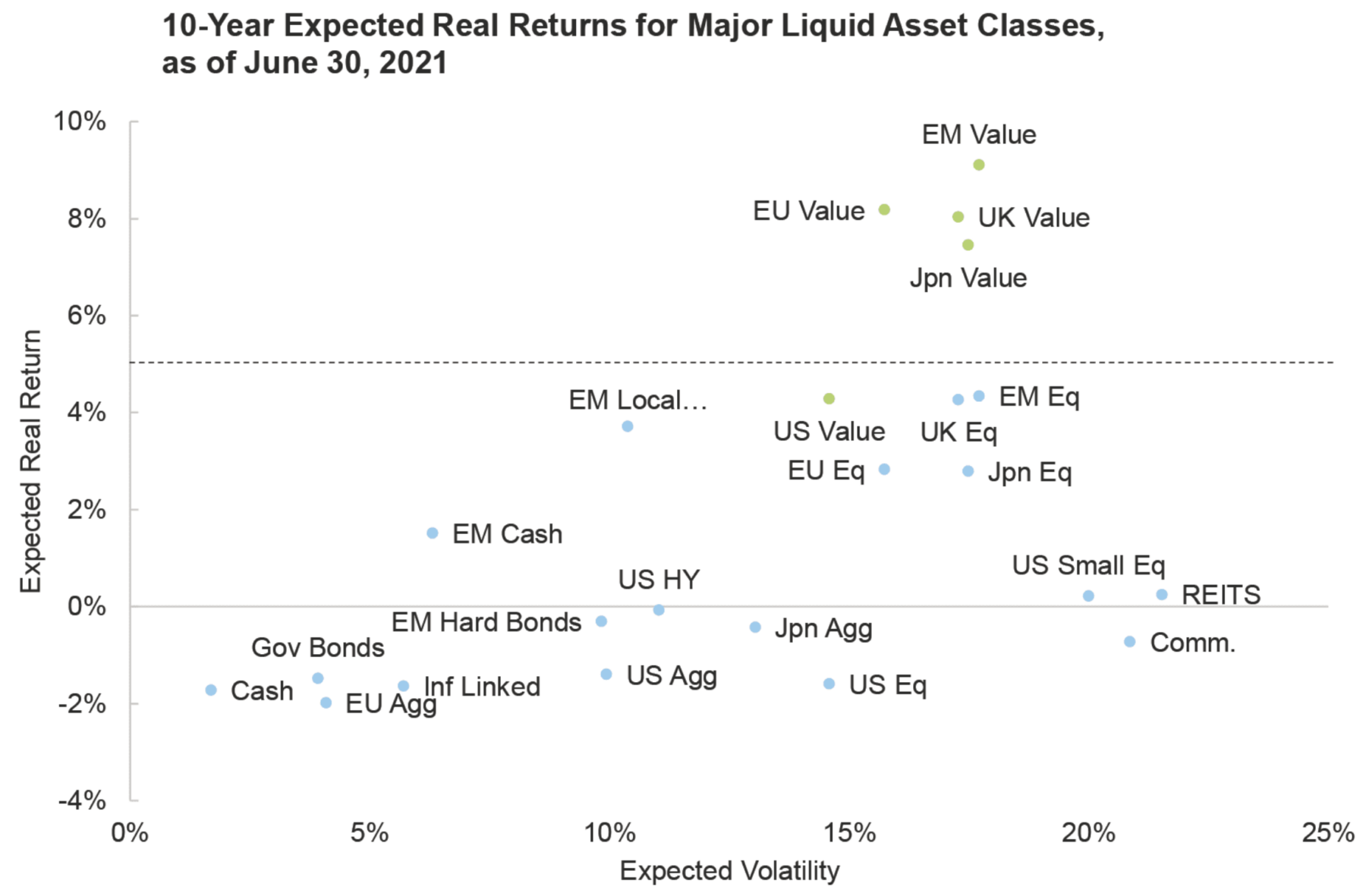

Expected Returns Relative to Volatility

Source: Research Affiliates

Sign up for our reads-only mailing list here.