My mid-week morning train WFH reads:

• ‘The End of the GE We Knew’: Breakup Turns a Page in Modern Business History CEO Larry Culp resisted splitting up the company that began the 21st century as the most valuable conglomerate in America (Wall Street Journal) see also Charting GE’s Historic Rise and Tortured Downfall General Electric Co. has unraveled. The onetime icon of American industry suffered its biggest annual stock decline of the modern era as it was booted from the Dow Jones Industrial Average. (Bloomberg)

• How JPMorgan Is Helping Washington Make Sense of the Pandemic Economy The JPMorgan Institute uses account data to parse consumer financial behavior. It also is trying to influence economic policy. (Wall Street Journal)

• Reddit’s Latest Money-Making Obsession Is an Obscure Fed Facility Huge, oft-misunderstood program turns into another avenue for GameStop daydreams (Bloomberg)

• Will the Guitar Boom Outlast COVID? Stay at home orders drove record guitar sales, but what happens when the pandemic subsides and life returns to normal? (Music Trades)

• The Chip That Could Transform Computing The M1 chips make laptops as powerful as some of the fastest desktops on the market yet so efficient that their battery life beats that of just about any other laptop. The chips portend a future absolutely saturated with computing power — with extremely powerful processors not just in traditional computers and smartphones but also in cars, drones, virtual-reality machines and pretty much everything else that runs on electricity. (New York Times)

• Meet the VC trying to reintroduce the Pentagon to Silicon Valley: Lux Capital’s Josh Wolfe and others believe the DoD must give up its tight embrace of traditional contractors who lack the agility to develop high-tech defenses against future threats. (Fast Company)

• Zillow’s Algorithm-Fueled Buying Spree Doomed Its Home-Flipping Experiment How the real estate company’s innovation became a $569 million cautionary tale. (Businessweek) see also Some Lessons About the Housing Market From Zillow’s Blunder Buying and selling homes in the short term with the goal of turning a quick profit may sound intriguing. And there are certainly people out there who can flip homes for a profit. But it is not easy, and it is not guaranteed. (A Wealth of Common Sense)

• Facebook Allows Stolen Content to Flourish, Its Researchers Warned About 40% of traffic to pages in 2018 went to those with content that was plagiarized or recycled, and Facebook has been slow to crack down on copyright infringement (Wall Street Journal)

• We Already Have the Tools We Need to Beat Climate Change The challenge is not identifying the solutions, but rolling them out with great speed. (Slate)

• We Need to Talk About Nate (Spoilers!) Nate’s arc, slowly deployed by the writers throughout the season, was a master stroke. The very end of the Ted Lasso season-two finale reveals that Nate Shelley, the shy former kit man turned assistant coach, has fully moved to the dark side. (Vulture)

Be sure to check out our Masters in Business interview this weekend with Tom Gayner, Markel Corporation’s co-president and chief investment officer of the financial-holding company He has been dubbed the “next Warren Buffett.” From 2000 to 2015 Gayner returned an average of 11.3% annually, while the S&P 500 index of big U.S. stocks returned 4.2%, (including dividends).

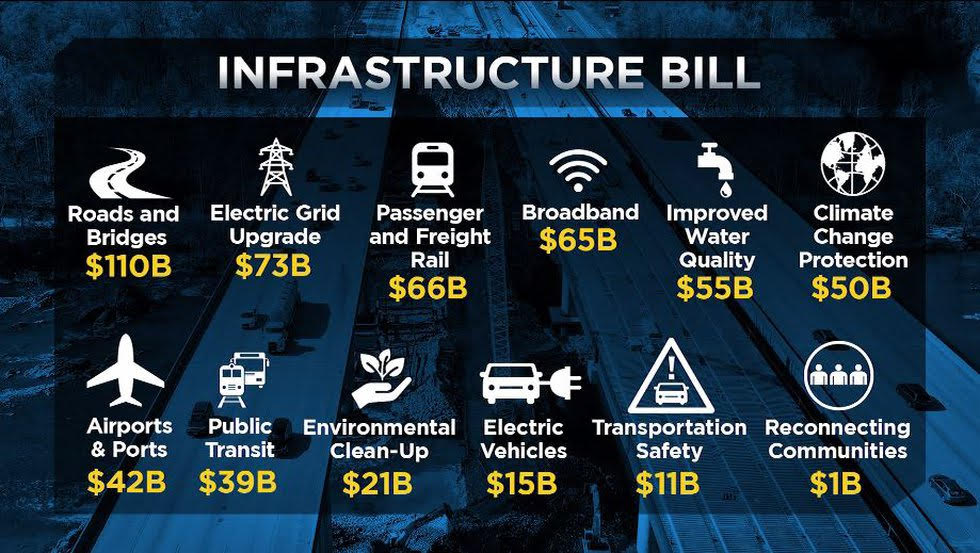

Roads, transit, internet: What’s in the infrastructure bill

Source: Cleveland 19 News

Sign up for our reads-only mailing list here.