To hear an audio spoken word version of this post, click here.

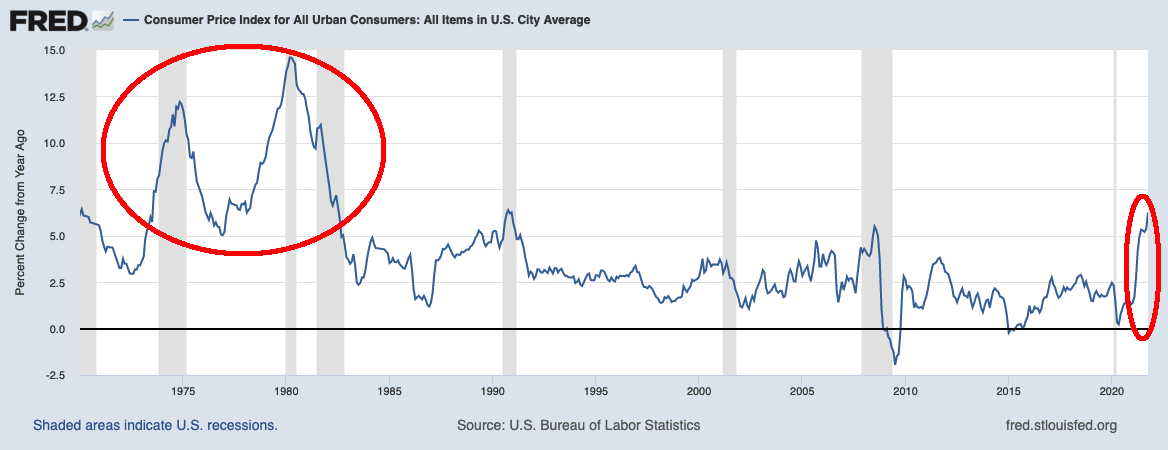

The Consumer Price Index print today of 6.2% is the highest print we have seen this year. I wouldn’t be surprised if this was the highest print we see for this entire cycle. There has been enough ink spilled on this that I don’t want to add to the noise1, or repeat myself. Instead, I want to discuss a few reasons why we seem to have such difficulties with the concept of “transitory.”

We may understand it intellectually, but we find it more difficult to manage emotionally. The French mathematician and philosopher Blaise Pascal summed up our circumstances by observing: “All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

It is even worse in the modern era. The forces behind our “inability to sit quietly” include, the 24/7 news cycle, Recency Effects, Social Media, even FOMO. Perhaps most significant of all is the concept of Time; more specifically, the way we experience time in the modern era.

There is the Here & Now — that’s pretty much it.2 Our memories are fallible, nostalgia-tinged recollections, error-prone, and self-edited to make ourselves look and feel better. The future is unknown and unknowable, mostly wishful thinking that too often fails to anticipate the (in hindsight) obvious, while always completely missing the unexpected.

And, we just barely exist within those parameters. We are hardly present, easily bored, always looking for a distraction. And the “right now” is the best we can hope for.

Is it any surprise we have a hard time with the concept of transitory?

Our time experiences were not always this way. In his book, Four Thousand Weeks,3 Oliver Burkeman explains that the very concept of time was unknown by most people a mere few centuries ago. Medieval farmers didn’t experience time as “an abstract entity — as a thing,” instead they followed the rhythms of Nature. There were seasons, governed by the movement of planets and stars, or the Gods, depending upon your schooling. Day and night, Winter and Summer. There was no sense something might be amiss, but not to worry, it might soon pass after some duration (or not), and then we can get back to normal. The world just was.

That is not how we operate today.

Today, we form an idea that something like inflation might be transitory, could well last 6 or 9 or 12 months, then fade away. We understand the concept of disrupted supply chains and pandemic re-opening. We place this idea within a broader intellectual framework, imagining how it will impact Global Trade and the Federal Reserve and the Bond Market, and even the White House. We read up on it, research it, crunch the numbers, do the historical comparisons. We fully grasp the idea and file it away in our own memories.

All of that took place on a random Monday in March.

The next day brought other data consistent with it. Then the next day, some data was higher; the next day lower. The markets jinked and turned, the newsflow accelerated. Every day after, there was some new hot take, another meme, a fresh Twitter thread. Home price bidding wars! Used car prices! Quarterly earnings saw CEOs mention inflation. Google Trends saw a big uptick in inflation searches. Lumber prices rose (then fell), as did Coal and Steel and Oil. Meat prices rose just in time for Thanksgiving. Endless anecdotes of rising prices. Do you know what it costs to buy 12 gallons of milk a week? No, why the hell should anyone know that?

Day after day, an endless firehose of news and punditry and data and noise.

All of which, not coincidentally, actually confirm the original thesis that inflation caused by disrupted supply chains and vaccinated post-pandemic reopening would send prices spiking before they fell back to normal.

Here we sit, in the Here & Now, with the most recent CPI data out, and at 30-year highs, there is nothing in the data that does not also confirm that thesis. We understand all of this, and yet we still — STILL — lack the ability to sit quietly in a room alone.

Previously:

Return of the Inflationistas (May 14, 2020)

The Inflation Reset (June 1, 2021)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)

_________

1. We have repeatedly discussed why I think the inflationistas are wrong, that they misunderstand the general state of inflation, and that some of them are motivated by partisanship.

2. David Nadig makes the case that we experience the world on a 200-millisecond delay, as that is how long it takes for sensory inputs to traverse the distance of our nerves and be received and processed by the brain. This makes the Here & Now actually the Here & 200 MS ago, but for the purposes of this essay, we shall stick with “Now.”

3. Assuming you live to be 80, you have just over four thousand weeks in your lifespan.

click for audio