My mid-week morning train WFH reads:

• Fear and Loathing in Cryptoland I see far too many parallels between the DotCom bubble and crypto. There is so much outrageous behavior in these markets that it is hard for me not to see it this way. On the other hand, I also say this as a partial compliment. (Of Dollars And Data)

• How Car Shortages Are Putting the World’s Economy at Risk Because so many jobs depend on automaking, the industry’s production problems are causing the pain to ripple. (New York Times) see also Introducing the Chokepoint Economy, When Shortages Start to Matter Everywhere you look, there are shortages and bottlenecks. Containers for shipping are in short supply and ports are struggling to keep up with demand. Semiconductors — a crucial component in everything from cars to iPhones — have been so scant that they’re impacting production of cars and GDP. There are shortages of lumber and pallets. (Bloomberg)

• Why Advisors Are Embracing Alternative Investments Inflation-adjusted yields on cash are negative. Bonds are being squashed by interest-rate fears. And stocks are historically expensive. To meet investors’ needs, financial advisors are increasingly turning to alternative investments such as real estate and private equity. (Barron’s)

• Wall Street Lunch Hour Dogged by Bread Supply Crisis “Suppliers are struggling to get ingredients in because they’re stuck at ports and there isn’t enough staff to move the containers around,” Christou said. “There have been some days when our fridges have been pretty depleted in the U.S. because of that.” (Businessweek)

• Farewell Offshoring, Outsourcing. Pandemic Rewrites CEO Playbook. Uncertainty in the global supply chain is driving executives to seek operations away from cheaper countries to locales affording greater control (Wall Street Journal)

• Texas Belies `Best for Business’ by Trailing Major States Low taxes and few regulations have failed to propel the economy anywhere near the top of the national rankings. (Bloomberg)

• Hot Streaks in Your Career Don’t Happen by Accident First explore. Then exploit. Researchers found clusters of highly successful work, as determined by higher-than-average art-auction prices, IMDb film ratings, or scientific-journal citations. Bursts of high-impact works [are] remarkably universal across diverse domains. Just about everybody has a period in their life when they produce at their best — Special bursts of creativity , or “hot streaks,” special creativity clusters. (The Atlantic)

• How does a pandemic start winding down? You are looking at it. Coronavirus infections are down, hopes are up, but uncertain forecasts put the Biden administration in a pandemic messaging bind (Washington Post) see also The Unvaccinated May Not Be Who You Think 95% of those over 65 in the US have received at least one dose — a remarkable number, given that this age group is prone to online misinformation, is heavily represented among Fox News viewers and is more likely to vote Republican. Clearly, misinformation is not destiny. (New York Times)

• What’s the deal with Amazon trucks’ weird-ass backup sound? We’re used to ‘beep-beep,’ but we’re getting harsh, staticky noise. It’s super-annoying — and safer for us. (Input)

• The unmaking of a Beatle: George Harrison’s widow and son on the legacy of ‘All Things Must Pass’ All things must pass, but George Harrison is forever. The late singer-songwriter released his three-LP solo album, an explosion of pent-up musical energy after the dissolution of the Beatles, 50 years ago. A vast new box set celebrating the album’s anniversary only proves that the quietest Beatle arguably had the most to say. (Los Angeles Times)

Be sure to check out our Masters in Business interview this weekend with Lisa Jones, CEO of Amundi U.S., the $100 billion arm of the French asset management giant. Amundi has over $2 trillion (€1.729) in AUM via 100 million clients from 36 countries, making it the second-largest asset manager in Europe and one of the world’s top 10 asset managers.

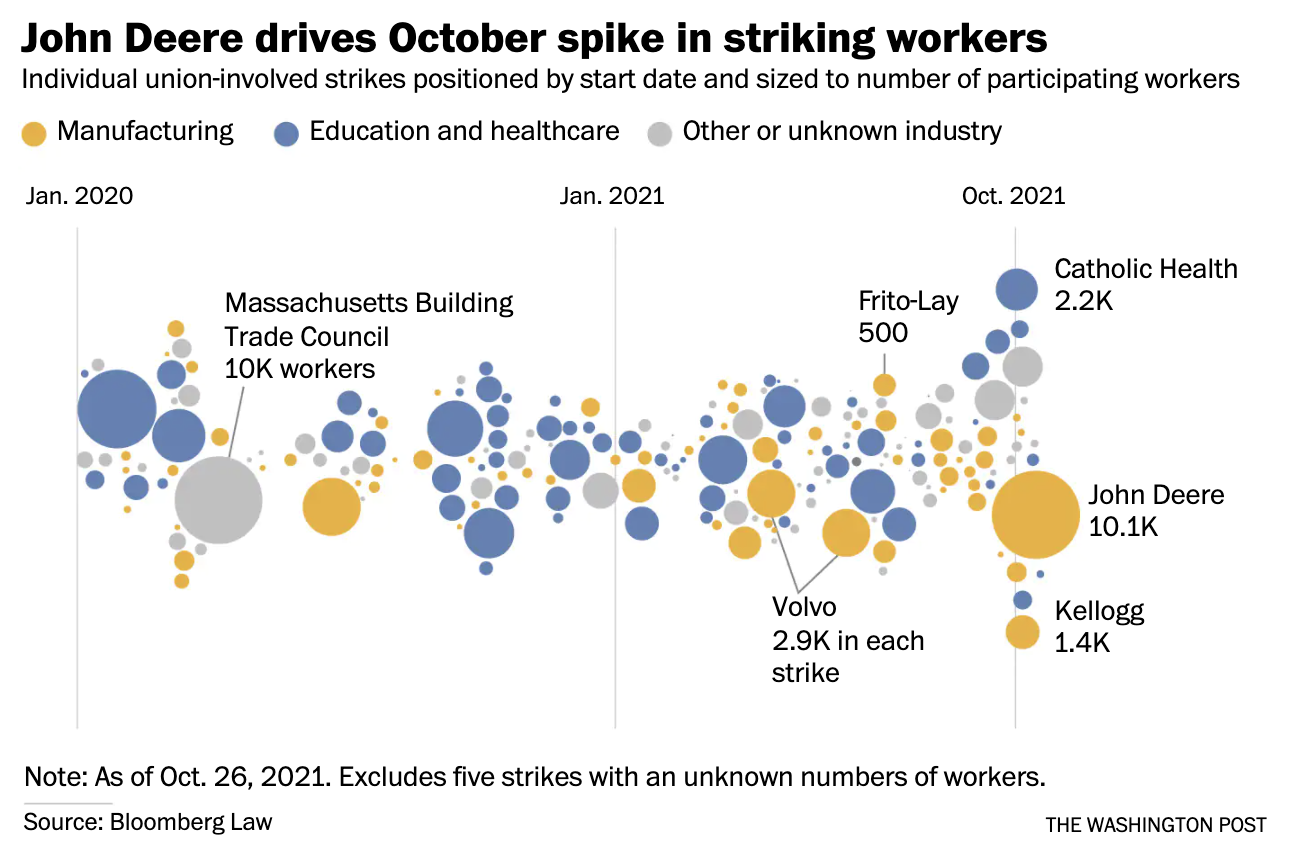

Workplace strikes are surging. Here’s why they won’t stop anytime soon

Source: Washington Post

Sign up for our reads-only mailing list here.