The weekend is here! Pour yourself a mug of Danish Blend coffee, grab a seat by the leaves, and get ready for our longer-form weekend reads:

• How to Dabble Safely in the Bubble of Cryptos, NFTs, and Meme Stocks. This isn’t a valuation screed—not solely, at least. The world doesn’t need another asset-allocation traditionalist carrying on about Bitcoin not having cash flows. This is a hopeful note for ordinary savers and investors who no longer recognize their surroundings—who see abstract things selling for startling prices and wonder, on one hand, whether that’s dangerous for stocks, bonds, and traditional money, and, on the other, whether it’s too late to grab a stake in some new, fun, potential moon rocket. (Barron’s)

• Rivian: The Most Remarkable Adventure: A Deep Dive Into the 12-year-old, Amazon-backed, EV Adventure Company Rivian’s IPO will be one of the biggest and most hotly-anticipated of the year. SoFi will have no trouble finding buyers to fill its allocation. But this is the very early innings of a transition in which retail investors will hopefully get more and more access to IPO shares in the best deals. Companies are often nervous about retail investors, though. They’re worried we’re less likely to hold shares and more likely to sell on a pop. In order for retail to get more direct access, we need to not fuck it up. That means understanding what we’re buying, or not, and why. Knowledge makes the diamond hands. (Not Boring)

• How Patrick Soon-Shiong Made His Fortune Before Buying the L.A. Times The billionaire doctor has become one of Los Angeles’s most prominent civic leaders, after a boundary-pushing ascent in medicine.(New Yorker)

• Moderna: A Company “In Need Of A Hail Mary” Before COVID-19, Moderna was in danger of hemorrhaging investors, as persistent safety concerns and other doubts about its mRNA delivery system threatened its entire product pipeline. Fear caused by the pandemic crisis made those concerns largely evaporate, even though there is no proof that they were ever resolved. (Unlimited Hangout)

• All Those 23andMe Spit Tests Were Part of a Bigger Plan CEO Anne Wojcicki wants to make drugs using insights from millions of customer DNA samples, and doesn’t think that should bother anyone. (Businessweek)

• The Company Man. “Tse Chi Lop, the suspected ringleader of a $21-billion crime syndicate, may be the world’s most innovative drug lord.” (Toronto Life)

• Service workers are getting paid more than ever. It’s not enough. Why hospitality employees won’t go back to work. Restaurants and hotels are closing or unable to operate at full capacity, which is forcing companies to either change their working conditions or their business models to survive. The reasons it’s currently tough to hire in the sector are myriad and range from the romantic, like a push for worker empowerment and reevaluating the meaning of life, to the quotidian, like a lack of child care and opportunities for advancement. (Vox)

• Big Hires, Big Money and a D.C. Blitz: A Bold Plan to Dominate Crypto The Silicon Valley firm Andreessen Horowitz, whose founders played big roles in the development of the internet, aims to own a huge part of the digital currency world — and set the rules for it, too. (New York Times)

• God And Guns How religious leaders have responded to mass shootings in places of worship. The relationship between religion and guns is often obscured by the horror and tragedy of mass shootings like those that terrorized the Charleston and Sutherland Springs congregations. However, activists, scholars and pastors now point to a shift in the relationship between religion and guns, with more people of faith realizing that despite a range of views on the proliferation and use of guns, they have a theological and moral imperative to speak out on the issue. (FiveThirtyEight)

• How the Maestro Got His Hands Back A lifetime of brutal injuries and misfortune robbed the world-renowned pianist João Carlos Martins of the ability to play his instrument. And then along came an eccentric designer and his bionic gloves. (GQ)

Be sure to check out our Masters in Business interview this weekend with Tom Gayner, Markel Corporation’s co-president and chief investment officer of the financial-holding company He has been dubbed the “next Warren Buffett.” From 2000 to 2015 Gayner returned an average of 11.3% annually, while the S&P 500 index of big U.S. stocks returned 4.2%, (including dividends).

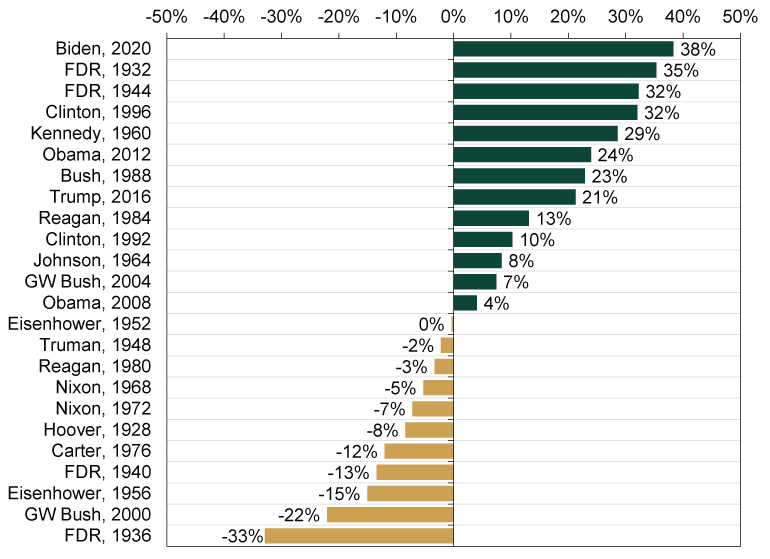

S&P 500 Returns One Year After Presidential Elections

Source: Fisher Investments

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.