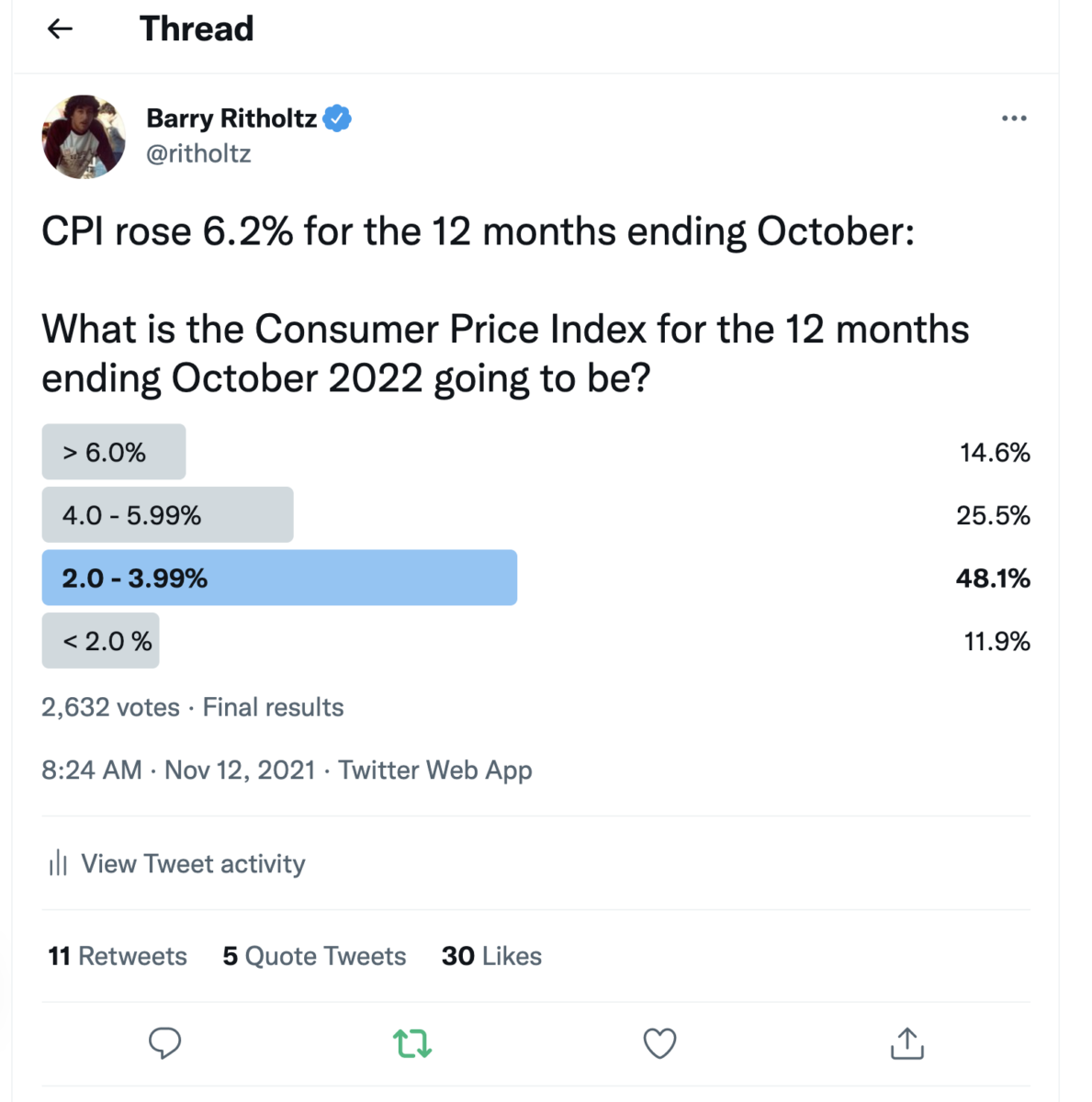

Getting bored with the ideological aspects of the inflation debate, I asked the Twitter crowd for their opinion:

“What is the Consumer Price Index for the 12 months ending October 2022 going to be?“

The point of reference was the current measure of CPI for the 12 months ending October 2021 at +6.2%. 1

I was curious if the answers would reflect a “wisdom of crowds” or be more of a study into crowd psychology, perhaps showing some Recency Effects, Dunning-Kruger, Tribalism, and the ever present “talking your own book/portfolio bias.”

Let’s consider each poll option to see if there is anything we might discern.

1. >6.0% To select this option, you must believe the recent “highest in 30 years” print of inflation will continue on its record-breaking run for the next 12 months. My view is this is unlikely; more than 85% of the 2,632 respondents felt similarly. Still, 14.6% selected this outcome, a not-insignificant percentage. This assumes that essentially nothing gets better.

Asset Class Beneficiary: Equities, Gold.

2. 4.0 – 5.99% The second most popular choice, registered by a quarter (25.5%) of the survey takers. These folks are in the “inflation will stay very elevated, and come off of recent highs” camp. I assume Recency Effect impacts this choice (See How We Experience Time for the contra-Recency argument). A modest increase in commodity supplies and improvement in supply chain gets the economy to this level.

Asset Class Beneficiary: Equities, Gold, Real Estate (Price).

3. 2.0 – 3.99% The most popular selection: Nearly half (48.1%) of all poll participants chose modestly elevated inflation but at substantially lower — one to two-thirds lower — levels less than at present. For this to occur, supply chain snags need to mostly resolve, commodity availability improves, as do supplies of automobiles and homes/rentals for sale.

Asset Class Beneficiary: Equities, Real Estate (more volume than price)

4. <2.0% Very low inflation was the least popular choice at only 11.9%. But this outlier could occur, partly via the base rate2 effect: this time next year, the 6 months of 2021’s elevated monthly numbers — March to October — will drop off, replaced with lower 2022 numbers. If inflation moderates even a bit, this would make the trailing 12 months much lower on a relative basis.

Asset Class Beneficiary: Real Estate (volume), Bonds

I wonder if an option specifically detailing negative inflation (Deflation) would have moved some more folk would have selected this choice.

The two answers at the extremes of below 2% and over 6% are significant because each embodies the potential to surprise the most people.

For inflation, we could see any one of a variety of outcomes, with all sorts of variations caused by many different inputs: Supply chain, semiconductors, even vaccination rates for children. Each permutation will impact various asset classes quite differently. Each asset class beneficiary might turn out quite differently if some unusual variations show up.

I always want to be conscious of my own bias: Are my inflation assumptions simply me talking my own book, my own portfolio?

_______

1. Twitter only allows four options, otherwise, I could have been even more granular, replacing fourth option with 0 – 1.99%, and adding a fifth choice for below zero (negative number).

2. Dartmouth prof Danny Blanchflower explains “How CPI inflation changes each month are actually highly predictable.” It is simply the sum of twelve successive monthly changes. Each month CPI reports the changes for this month.

Example. The CPI for December 2020 was simply the sum of the twelve monthly changes from January -December 2020. Next month, January 2021 eleven of the changes to be used in the calculation are already known, that is February through December. We get a new number for January 2021 which replaces January 2020.

Hence, as these one-off big numbers drop out next year and get replaced with smaller ones, inflation falls. It is hard to imagine these jumps repeat themselves next year which is what would be required for this inflation to not be temporary. What we are going to see over the next few months is the big numbers will drop out and likely will be replaced with smaller ones, so inflation will fall.